Here in South Florida, we are inching toward hurricane season.

Areas around the U.S. have already seen dangerous tornados and storms.

We were all in the office last week wondering if we’d need a rowboat to get home. A flash storm ended up dumping 25 inches on Ft. Lauderdale just 30 minutes south of us.

Homeowners are beefing up their houses and condos with impact-resistant doors and windows in response.

It’s also a perfect time for people building new homes to add these features to construction budgets.

Studies show we’re spending more on these improvements … and will continue to do so in the coming years.

Today, I want to share that data and show how I used our proprietary Stock Power Ratings system to find a stock that’s a leader in this industry.

Home Construction and Improvement Rising

With fewer existing homes on the market, more Americans are building their dream homes from scratch.

I mentioned this trend in an essay I wrote earlier this month.

Diving deeper into home construction data, I found something equally revealing: Americans are spending more to improve the homes they’re already in.

This chart shows the value of new residential construction and home improvements in the U.S.

From 2019 to 2026, FMI Corporation expects new construction value to rise 89.8%, and home improvement value to jump 81.2%!

It means the demand for quality doors, windows and other building products will go up too.

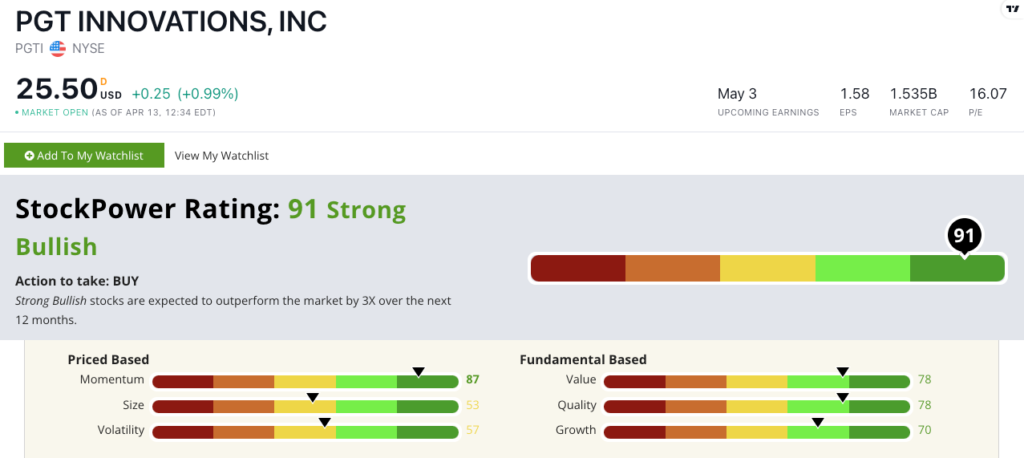

I used our Stock Power Ratings system to find a stock that can best capitalize on this trend … and it scores 91 out of 100, making it a great potential investment.

PGTI Products Help Protect Against Mother Nature

Living in an area prone to tornadoes and hurricanes means you have to make sure your doors and windows can protect you and your home.

Strong winds and heavy rains can decimate property in a flash.

I’ve seen it firsthand growing up in Kansas’ Tornado Alley, and now living in hurricane-prone South Florida.

But today’s Power Stock is here to help.

PGT Innovations Inc. (NYSE: PGTI) is a market leader in this field. It manufactures storm-resistant windows and doors along with other custom home products, like moving glass walls, impact-resistant garage doors and patio windows.

Its 91 out of 100 score on our Stock Power Ratings system means we are “Strong Bullish” on the stock and expect it to outperform the market by 3X over the next 12 months.

PGTI stock has strong fundamentals and even stronger momentum (I’ll get to that in a sec).

The stock scores a “Bullish” 70 on our growth factor and its recent 2022 annual report provides insight into why:

- The company notched net income of $98 million for the year … a 180% increase over its 2021 benchmark.

- Its operational cash flow — the cash generated from normal business — was $196 million … a 208% jump from the year before!

PGTI is also a solid value stock — scoring a 78 on that factor.

Its price-to-sales and price-to-cash flow ratios are all lower than the construction materials industry averages.

Now, let’s address that incredible momentum:

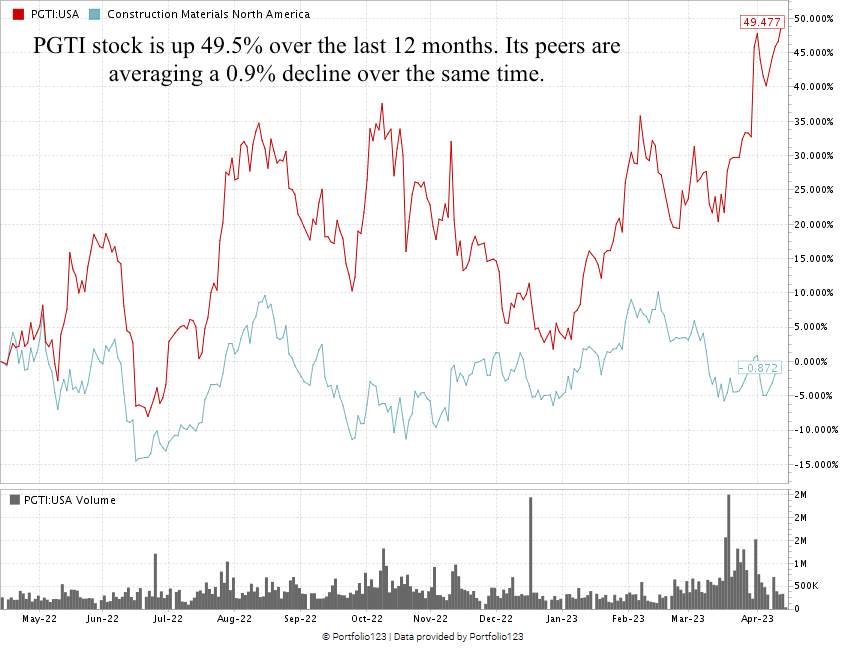

Created in April 2023.

Over the last 12 months, PGTI is up 49.5% while its construction materials peers have averaged a 0.9% loss over the same time.

The stock has been in a consistent uptrend since its December 2022 low.

It’s showing the “maximum momentum” we want to see in stocks.

The stock scores a 91 overall on our proprietary Stock Power Ratings system. That means we are “Strong Bullish” and expect it to beat the broader market by 3X over the next 12 months.

Bottom line: Storm season is upon us.

Whether you’re building a new home or looking to remodel your current one, you want to make sure your home can resist the fury of Mother Nature.

As a leader in producing impact-resistant doors and windows, PGTI stock should be considered for your portfolio.

Stay Tuned: How Small Caps Outperform Post-Recession

Tomorrow, Adam O’Dell is going to show you why small-cap stocks are where you want to be when economies come out of downturns.

Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets