Thanks to all of our YouTube viewers! In this week’s Marijuana Market Update, I’m addressing a company that one of you, Paul, has asked about several times.

He wrote in his most recent comment:

Hope you have some info on SCNA.

Paul is referring to Smart Cannabis Corp. (OTC: SCNA).

About Smart Cannabis Corp.

Smart Cannabis Corp. is a California-based cannabis company that provides automated and commercial greenhouse systems for both the cannabis and organic food industries.

Its systems help conserve water and increase growing capacity.

Smart Cannabis expanded into the retail sales sector for cannabis when it acquired Budding Botanicals, a California company specializing in CBD tinctures, capsules, hard candies and pet treats:

Now, a quick note: SCNA is not the same as Smart Cannabis, which bases in Portland, Oregon. That company doesn’t trade publicly.

I dug into the company as much as I could, but we don’t know a whole lot about Smart Cannabis Corp.

About SCNA Stock

I can tell you that its market value is around $31 million, and it has more than 4.9 billion shares outstanding.

It trades over the counter (OTC) on the Pink Sheets, so its account reporting is different than a traditional company that trades on the Nasdaq or the New York Stock Exchange.

The most recent quarterly financial report I found was from September 2019.

At that time, the company reported revenues of $443,000 for the nine months ending September 30, 2019. That was more than $200,000 less than the revenue it reported for the same period the year prior.

Smart Cannabis reported a net loss of $3.2 million for the nine months in 2019, compared to a gain of $134,000 the year before. A bulk of that was due to a massive increase in general and administrative costs in 2019 — from $140,000 in 2018 to $1.4 million in 2019.

After trading flat for most of 2019, the company’s share price spiked. It jumped from around $0.05 to $0.17 per share in February 2020.

SCNA stock dipped in March 2020, as most other companies did during the coronavirus crash, but that drop continued into November.

SCNA: 82% Drop; 166% Rally

Its share price dropped about 82% from its February high to its November low.

In a massive rally in December, the stock jumped 166% in just a few days, when cannabis stocks rose after the 2020 election.

Later in the month, the stock hit a golden cross. Its 50-day moving average (in green in the chart above) crossed above its 200-day moving average (yellow).

A golden cross indicates a potential upswing.

However, my research tells me there are still some red flags.

Watch the video now for the full story on Smart Cannabis Corp.!

Update: Cannabis Watchlist

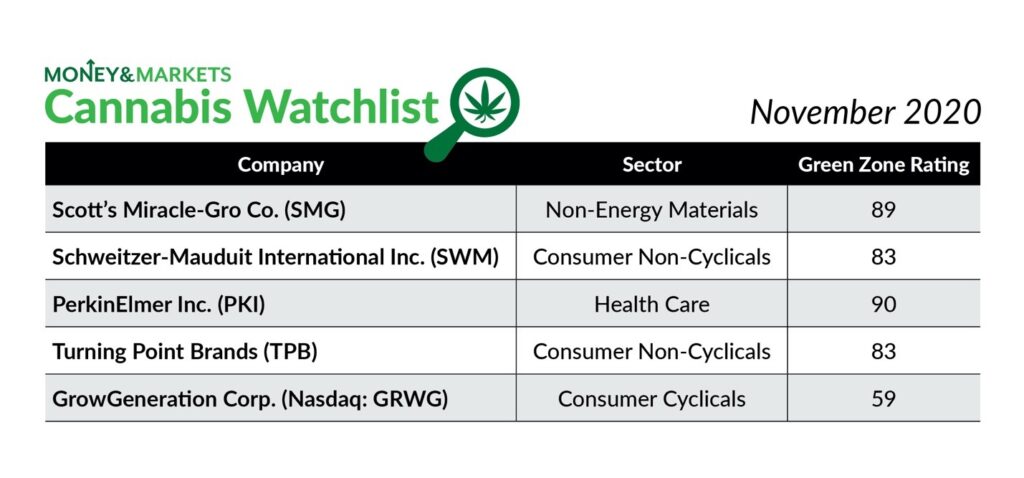

Our Cannabis Watchlist has entered the new year on a hot streak. (Stay tuned next week to see what stock we’re adding for January!)

Every one of our watchlist positions shows double-digit gains.

The total average gain of our five positions is 33%. We’re crushing the broad stock market.

The iShares Core S&P 500 ETF (NYSE: IVV) is only up 5% since I put the first three cannabis stocks on our Watchlist in September.

Here’s a deeper look:

- Schweitzer-Mauduit International Inc. (NYSE: SWM) — This traditional tobacco company has been consistently in the black since I put it on the watchlist in September. It’s showing a 34.4% gain since then.

- PerkinElmer Inc. (NYSE: PKI) — The company that tests cannabis strains has been a consistent winner since I added it in September. JPMorgan Chase & Co. recently increased its stake in PKI. The stock is up more than 23% since I added it in September.

- Turning Point Brands Inc. (NYSE: TPB) — This is another traditional tobacco company making a run into the cannabis market. Turning Point is up nearly 44% since I put it on the list in October.

- GrowGeneration Corp. (Nasdaq: GRWG) — This cannabis company is selling more stock in hopes of raising an additional $125 million in public money. Since I added it to the watchlist in November, it’s up more than 45% and still has room to grow.

- Scotts Miracle-Gro Co. (NYSE: SMG) — This has been our weakest performer thanks to an early snow in the north. Despite being down as much as 10% early in October, the stock has rebounded and is now up nearly 20%.

If you invested when I made those recommendations, congratulations on your gains!

As always, my team and I love the feedback we’re getting on our YouTube channel and through email.

Feel free to send comments, questions and stocks you want us to examine to feedback@moneyandmarkets.com — or leave a comment on YouTube!

Where to Find Us

To watch the Marijuana Market Update before anyone else, just subscribe to our YouTube channel, and get an alert when we release a new update.

Coming up this week, we’ll have more on The Bull & The Bear podcast and our Money & Markets Week Ahead, so stay tuned.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

P.S. Next week, Chief Investment Strategist Adam O’Dell and Editor Charles Sizemore are hosting a rare event where they will share the details on a strategy that Adam guarantees will make you 100% profits every single month!

Just click here now to sign up for this once-in-a-lifetime event.

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.