In the 1800s, Charles Dow realized that stock prices could forecast economic trends. With this insight, he developed the Dow Jones Industrial Average.

Soon, he was running the financial news powerhouse Dow Jones. It still turns a profit today.

To Dow, and thousands of researchers who followed, the link was obvious.

Smart money buys stocks when the economic news is bad but ready to change for the better. Then they make money selling to excited investors when the news is good.

Dow’s theory makes sense.

Smart money in the 1800s included Wall Street bankers. They knew everything about clients. Strong sales resulted in higher checking balances. Loan demand told them about expansion plans or financial distress.

Back then, bankers had inside information. And it was legal to use the information. So, Wall Street bought as business was turning up and sold ahead of economic contractions.

Now, laws prevent banks from profiting like that. Banks don’t move the market anymore.

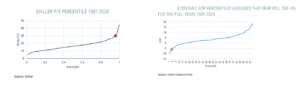

But the charts below show that someone is buying at a time when the economy has rarely been this bad.

The Terrible Economy Isn’t Scaring Buyers

Source: GMO

The left side of the chart shows the Shiller P/E ratio. This is a price-to-earnings ratio adjusted for inflation. It’s calculated with 10 years of earnings data to smooth the impacts of sudden changes — such as the recession that began when the economy was shut down earlier this year.

The chart shows that the current reading of the ratio, the red diamond, is in the 95th percentile. In other words, the market is one of the most expensive in history based on valuation.

On the right side, the red diamond shows where the economy is, based on history. It is at the 4th percentile, among the worst readings in history.

What “Smart Money” Tells Us

That assumes there is a rapid recovery in the second half of the year. If the economy stalls, that reading will get worse.

Under Dow’s logic, this relationship makes sense. Smart money should be buying stocks if the economy is as bad as it will get.

Unfortunately, smart money isn’t pushing stock prices up. Individual investors trading momentum stocks are fueling recent gains instead.

And the economy is showing signs of stalling rather than turning up. Risks of a second shutdown are rising in many parts of the country.

The economy may get worse before it fully recovers. That means stocks are ahead of the economy and likely to sell off again in the next few weeks.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.