This week confirmed that inflation is making a comeback.

Official data showed the consumer price index (CPI) rose 0.6% in July. It increased by the same amount in June. CPI measures what consumers pay for everyday items including food, gas, clothing and electricity.

An economist quoted in The Wall Street Journal noted:

There’s nothing to fear about inflation getting out of hand.

But if we dig deeper into the numbers, there are reasons to fear.

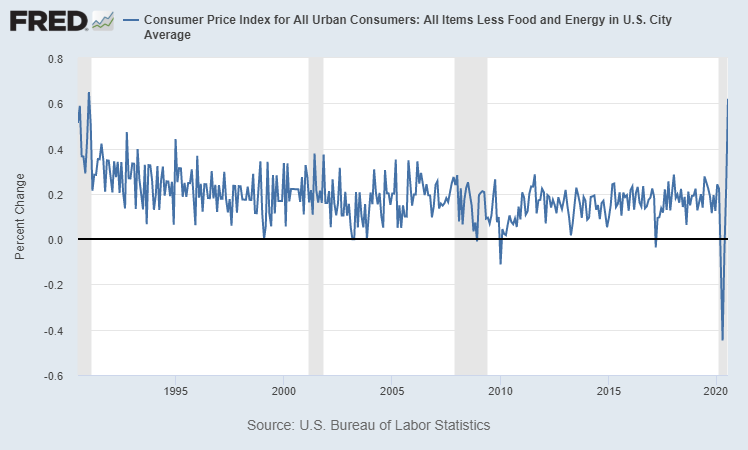

Economists analyzing the data often exclude food and energy because these prices are volatile. This is known as the core CPI, which also rose 0.6%. It was the biggest monthly gain since January 1991.

Core CPI Surged Higher in July

Source: Federal Reserve

The idea that there’s nothing to fear about inflation also ignores history. It gets out of hand suddenly and unexpectedly. Once it gets out of hand, it’s difficult to control.

Inflation Is Rising Around the World

Globally, there are already signs of rampant inflation.

Right now, 12 countries in the world experience inflation of over 33% per year. That’s more than 6% of the world’s countries.

And the count is rising with countries in the Middle East, Latin America, Africa and Europe.

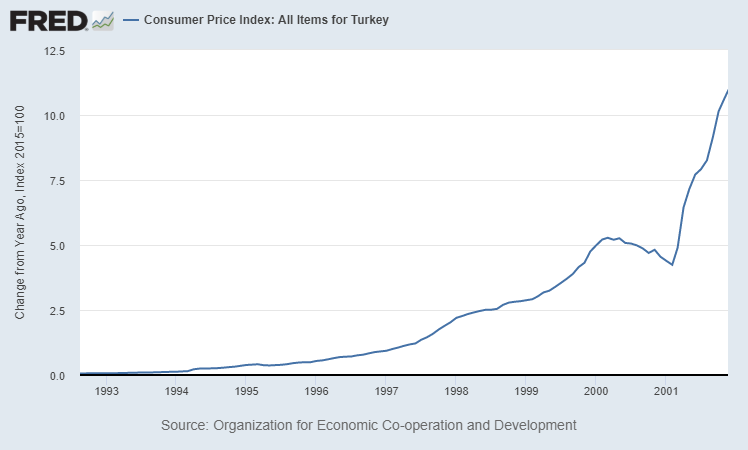

The most recent country to join that group is Turkey, a NATO ally.

Turkey is an example of how quickly it can get out of hand.

Federal Reserve data for the country begins in 1961. Inflation topped 1% in 1997. Within three years, 5% was considered normal. It topped 10% less than two years after that.

Turkey’s Inflation Is Out of Control

Source: Federal Reserve

Of course, the U.S. might not follow the same path as Turkey.

But it’s happened before.

In 1974, U.S. inflation topped 12%, a 300% increase in just two years. Inflation then affected business decisions and interest rate policy for the next two decades.

There are many other examples of rapid inflation. And there are also examples of Inflation’s lasting impact even after it subsides.

When it comes to inflation, the only thing we have to fear is the belief that there is nothing to fear.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.