The smart money is screaming that another decline is likely. Smart investors will heed that message.

Every week, a government office few investors are aware of tells us what the “smart money” is doing in the stock market.

The Commodity Futures Trading Commission (CFTC) issues an obscure report called the Commitment of Traders (COT), which tells us who is buying and selling in the futures market.

CFTC officials ensure all traders are treated fairly in futures markets. These markets include agricultural products like soybeans, energy markets like oil and stock markets like the S&P 500. They play a role similar to that of the Securities and Exchange Commission in the stock market.

To keep markets fair, large traders must report what they buy and sell every week. This prevents them from moving prices like they did in the 1920s, before governments regulated markets.

Prior to regulation, big investors often built large positions, fed false rumors to individual traders and then unloaded their positions at a gain. Now, all traders report large positions so this behavior isn’t possible.

COT Reports Show Wrong Investors Pushing Rally

These reports are available in the stock market on Form 13f. In futures markets, the COT reports are even more comprehensive.

In COT reports, all positions are assigned to one of three groups. This data tells us exactly who expects prices to rise and who believes a decline is near.

Analysts call one group “smart money.” This group is right about major trends more often than not. They’re large speculators in the COT report, including hedge fund managers that control hundreds of billions of dollars.

The weekly report of traders’ positions also shows what individual traders are doing. This group, known as small speculators, is often wrong.

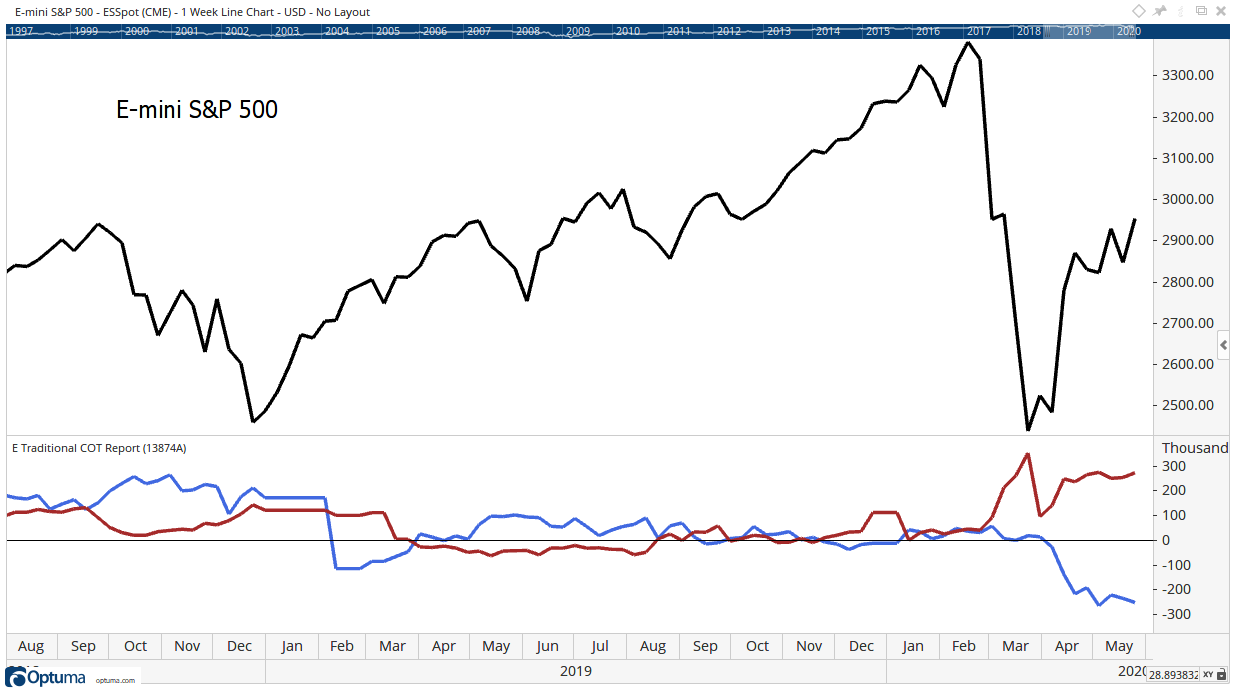

The chart below shows positions of these two groups at the bottom of the chart. The price of the S&P 500 is at the top. The red line shows positions of small speculators. Large speculator positions are shown in the blue line.

Source: Optuma

In futures markets, traders are either long or short. Long positions benefit from price increases. In the chart, the thin grey line separates longs from shorts.

Small speculators built large long positions as prices were falling. Large speculators were taking short positions, which benefit from price declines.

Both groups are positioned to benefit from a large price move. One group has a history of success in the market while the other group has a reputation for being wrong.

The smart money is screaming that another decline is likely. Smart investors will heed that message.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru