The amount of data collected and processed today is massive.

And it’s only growing.

International Data Corporation projects the annual amount of data consumed worldwide will reach 181 zettabytes by 2025.

For reference: A zettabyte is 1 trillion gigabytes.

Data companies are looking for new ways to process massive amounts of data closer to home.

This is called edge computing.

Edge computing allows companies to process data much faster than if they have to access data from remote locations such as data centers.

Some of you may know it as “the cloud”.

The chart above shows the growth of the edge computing market from 2021 to 2030.

In 2021, estimates placed the market value at $40.5 billion.

By 2030, Precedence Research expects it to increase by 187.7%!

Today’s Power Stock creates the hardware that optimizes edge computing: Super Micro Computer Inc. (Nasdaq: SMCI).

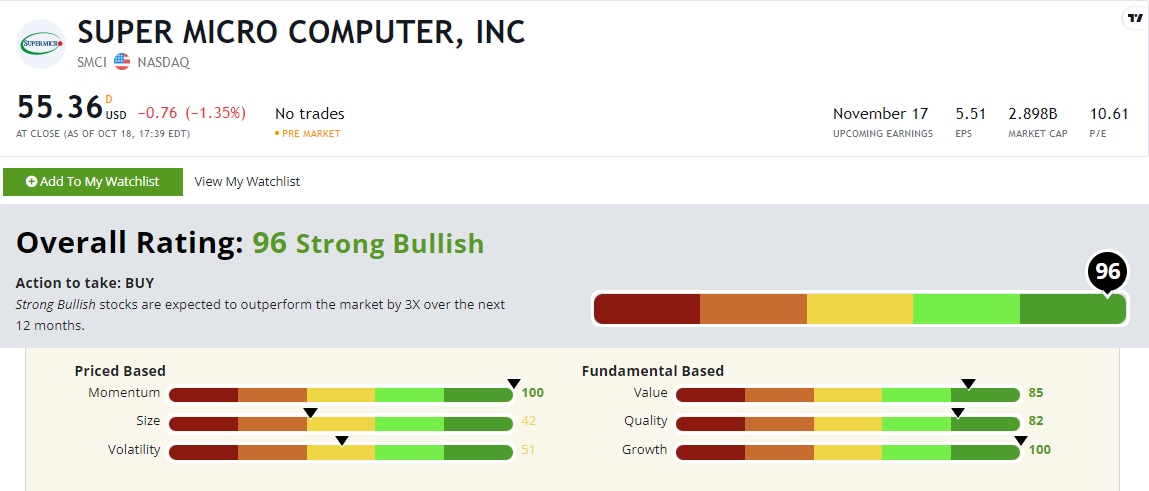

SMCI’s Stock Power Ratings in October 2022.

SMCI manufactures hardware for edge computing, Internet of Things processing and data storage.

SMCI scores a “Strong Bullish” 96 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

SMCI Stock: Strong Momentum + Fantastic Fundamentals

SMCI had a strong quarterly report.

Here are some highlights:

- It reported quarterly revenue of $1.64 billion — a 53% year-over-year increase!

- The company’s total annual revenue was $5.2 billion — up 46% over the previous year.

SMCI had a strong quarter and year … earning it a 100 on our growth factor.

Its fundamental ratings are also anchored by strong value.

Looking at its price-to-sales ratio, it’s half the industry average.

Another reason why SMCI shines is its “maximum momentum”:

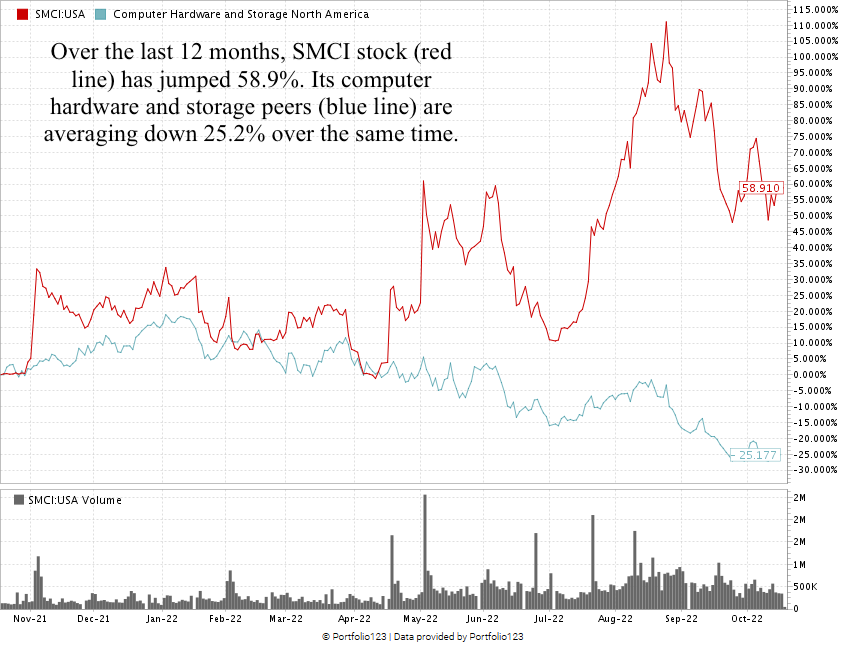

Created in October 2022.

Over the last 12 months, SMCI is up and beating the computer hardware and storage sector, which is down 25.2% over the same time.

SMCI stock scores a 96 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Processing and controlling data is big business.

Companies are looking for new ways to process large amounts of data faster.

Super Micro Computer is developing hardware to maximize the ability to handle data more efficiently.

This is one reason why SMCI stock is a great addition to your portfolio.

Bonus: The company’s forward dividend yield of 1.7% means it will pay you $1.00 per share, per year.

Stay Tuned: A September Stock Power Daily Win

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a stock that I talked about in September. It’s crushing the market — and it’s just getting started.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.