The goal we had when starting Stock Power Daily was to find profitable opportunities — in any market condition.

What fuels this mission?

Our proprietary Stock Power Ratings system that you can use for free at www.MoneyandMarkets.com.

I’ll be honest.

There hasn’t been a lot to brag about in the stock department.

Since we started Stock Power Daily in April, the S&P 500 is down 16% as of me writing this.

That hasn’t stopped my team and me from continuing to dig through our system to find the best opportunities available.

One stock I told you about on September 29 has gained 24% since I shared it with you.

Take note: The S&P 500 is up 1.1% during the same time!

The stock still earns a “Strong Bullish” Stock Power Rating, so I have high conviction this run is just the beginning.

Here’s why.

Downstream Power Stock Refines Oil

The International Energy Agency projects global oil demand to reach 104.1 million barrels per day in less than five years.

This is great news for refineries as they increase output.

Adding in the OPEC nations’ scaling back global oil production makes it even better for American refineries.

Power Stock PBF Energy Inc. (NYSE: PBF) is a “right place, right time” stock.

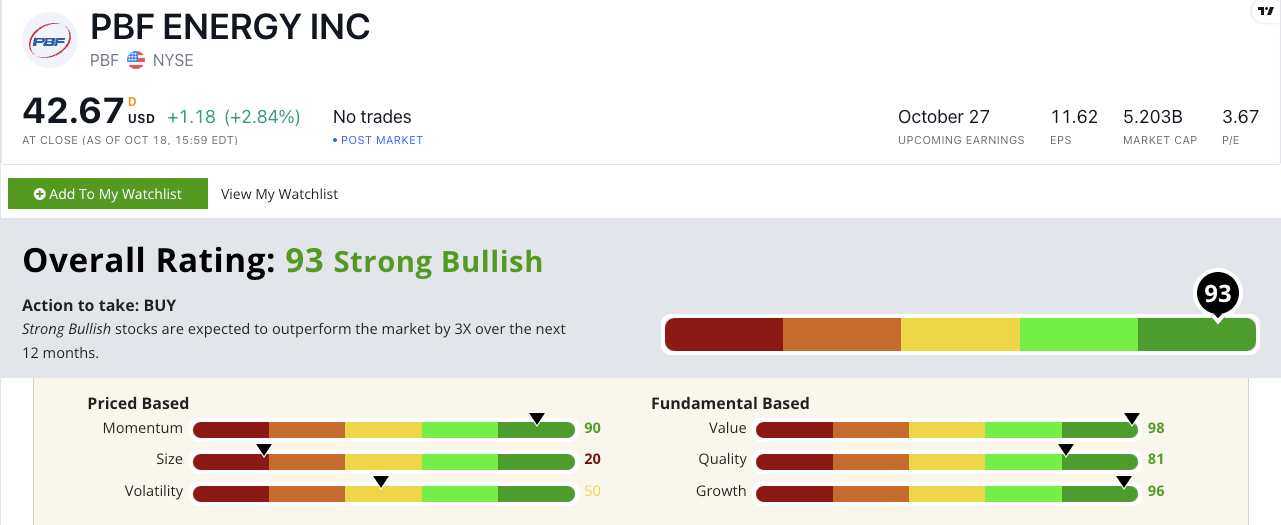

PBF’s Stock Power Ratings in October 2022.

PBF is a $3.9 billion downstream energy company.

It refines crude oil into petroleum, transportation fuels, heating oil and lubricants.

PBF Energy stock scores a “Strong Bullish” 93 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

PBF’s growth potential is one reason I like this stock.

In the second quarter of 2022, PBF reported total revenue of $14.1 billion — a 107.4% increase in revenue over the same period a year ago!

The stock’s value is another strong point.

Even with its recent run, PBF is still undervalued when compared to its peers.

The company’s price-to-earnings (P/E) ratio — a company’s share price relative to its per-share earnings — is 3.67. (With P/E, the lower, the better.)

Its industry peers average 8.4.

That means PBF’s ratio is less than half its peer average!

PBF Still Shows “Maximum Momentum”

Since I told you about PBF last month, the stock has rocketed up another 30%!

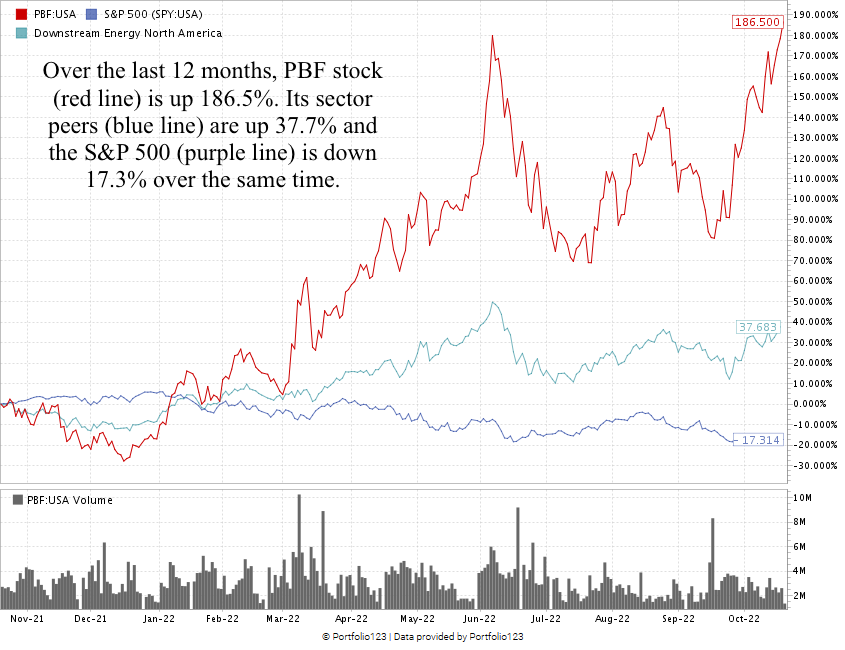

Created in October 2022.

Over the last 12 months, PBF is up 186.5%, while its industry peers are averaging gains of 34.7%.

That shows the “maximum momentum” we look for in stocks.

If you bought in when I told you about PBF, well done!

I’d love to hear from you.

Write to my team and me anytime to let us know if you’ve bought any Power Stocks and how they’re performing!

I have high conviction more gains are on the horizon for PBF.

Here’s why.

OPEC — the group of top oil-producing nations — is scaling back oil production starting next month.

This opens the door for more oil from the U.S., meaning more output for American refineries.

More Gains From Stock Power Daily

But PBF isn’t the only recent winner we’ve had with Stock Power Daily:

- Ryerson Holding Corp. (NYSE: RYI) — The global distributor of industrial metals is up 32% since I featured it on July 21. The stock earns a “Strong Bullish” 98 overall on Stock Power Ratings today.

- Enerplus Corp. (NYSE: ERF) — This company explores for oil and natural gas across Canada and the U.S. It’s gained 33.6% since I told you about it three days before PBF, and its 94 overall Stock Power Rating tells us it’s still a smart buy.

This is while the broader market struggles after a drop on the first of the year.

Make sure to open our Stock Power Daily email when it arrives in your inbox each weekday at 7 a.m. Eastern for more market-crushing stocks.

Stay Tuned: Perfect 100-Rated Pipe Power Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a Power Stock that manufactures large, high-pressure steel pipes used for water infrastructure projects.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.