Retirees, get ready!

Social Security’s cost-of-living adjustment (COLA) is set for 2021. Your regular monthly benefits will increase to compensate for inflation.

Except they won’t.

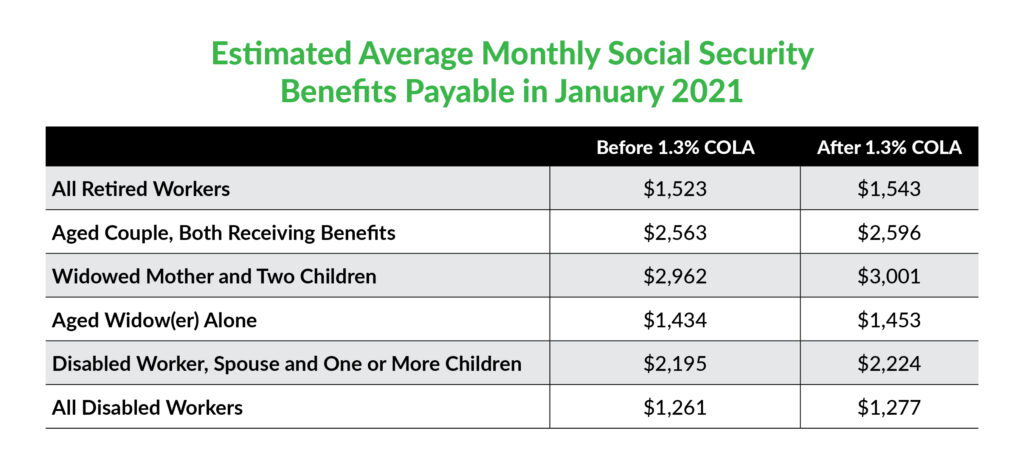

The Social Security COLA is only 1.3% for next year, which works out to an extra $20 per month for the average beneficiary. So, Uncle Sam is treating you to a Big Mac or two and a large coffee from Starbucks each month.

Source: Social Security Administration.

I won’t rag on Social Security too much. At its core, it was never meant to be a comprehensive retirement plan. It provides a basic safety net, not a lavish retirement. And making it more generous means taxing younger workers more today, which hardly seems fair.

The paltry Social Security COLA for 2021 highlights a major risk for retirees.

The cheapest way for the government to reduce its pension responsibilities is to slowly inflate them away.

Congress can’t cut benefits without risking the wrath of voters. But tweaking Social Security’s COLA so that benefits rise more slowly than inflation is a way around that. It’s an insidious death by a thousand cuts. If you’re Uncle Sam, it’s the only play you have.

To avoid losing wealth in retirement, you’ll need to take matters into your own hands. Let’s go over a few tricks to ensure your income stream negates the effect of a lousy Social Security COLA.

Offset the Social Security COLA

No. 1: Push Social Security as far into the future as possible.

As I wrote recently, it’s to your advantage to wait as long as possible to start collecting Social Security. (Caveat: This depends on a variety of factors, including your health and family history. But if you expect to live to a ripe old age, consider deferring benefits until age 70.)

Right now, the maximum monthly payout is $3,790 for a person waiting to file at age 70. It drops to $3,011 for someone filing at 67.

The “breakeven” point is around age 82. That’s when higher payouts from delaying until 70 make up for years of not receiving benefits at all.

No. 2: Focus on income growth rather than high yield.

Another way you can offset a paltry Social Security COLA is through dividend growth.

A high dividend yield is nice. But if it doesn’t grow, your purchasing power erodes over time due to inflation. Dividend growth is just as important as the current yield. You want stocks that pay competitive dividends and have a long history of raising payouts.

Earlier this year, I illustrated the power of dividend growth by comparing a 30-year bond paying 5.5% to one of my favorite long-term dividend growers, Realty Income (NYSE: O). At the time, Realty Income also yielded about 5.5%.

In 30 years, the bond will still be paying 5.5%, or $550 on a $10,000 investment. But if Realty Income continued to grow its dividend at, or near, its historical rate, it will pay out $2,059 per year.

Social Security COLAs might not keep up with inflation. But a good portfolio of dividend growth stocks can.

No. 3: Hedge your portfolio against inflation.

I believe that the bulk of a person’s retirement portfolio should be in good, old-fashioned stocks, bonds and other securities. But keep some funds in traditional inflation hedges, such as gold, real estate or Treasury Inflation Protected Securities (TIPS).

As my finance professor at Texas Christian University used to say: “The only perfect hedge is in an English garden.”

There is no guarantee that gold, real estate or TIPS will protect you against the ravages of inflation.

But gold soared during the stagflationary ‘70s, and investors have bought real estate to hedge inflation for centuries. Having at least a portion of your portfolio in these asset classes makes sense.

The Social Security COLA isn’t much in 2021. So use some of your other tools to make up for its shortcomings.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.