Many argue that Social Security is in need of reform, but one change could cause a domino effect of new issues: raising the full retirement age.

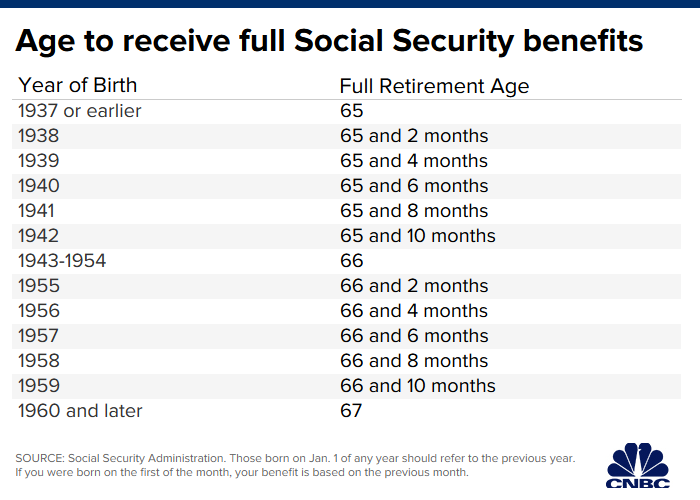

In 1983, President Ronald Reagan, a Republican, and Democrats came together to pass sweeping Social Security reform that included a gradual rise to the full retirement age from 65 to 67 depending on what year you were born.

Anyone can apply for Social Security benefits starting at age 62, but you won’t be able to receive 100% of what you are owed if you file before your full retirement age. Here’s a chart breaking down when you will hit your FRA:

You can even hold off on receiving your Social Security benefits past your full retirement age, up to age 70, for a boost of up to 8% to your checks.

But solvency in the program is an issue. Starting in 2035, the Social Security Administration will only be able to pay out 80% of promised benefits if no changes are made, according to a study earlier this year.

Sen. Mitt Romney, R-Utah, wants to establish bipartisan committees that would be in charge of finding a solution to Social Security’s balance sheet, according to a recent proposal. But critics argue his plan would eventually lead to a dreaded rise in the retirement age, which he advocated for while running for president in 2012.

Why Raising the Retirement Age Would Hurt Social Security

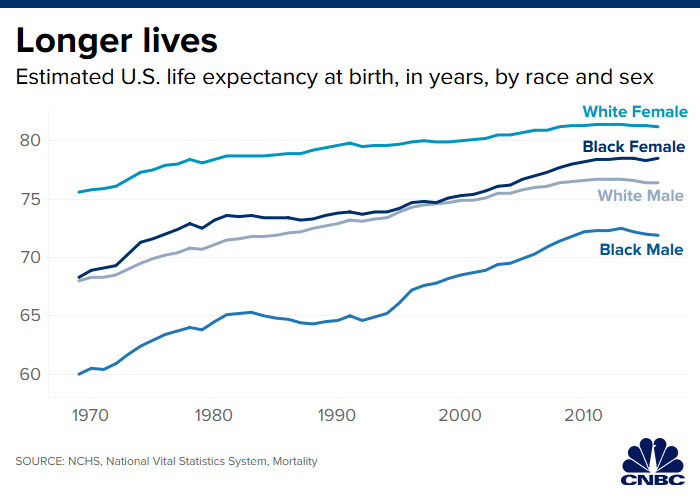

Advocates for raising the Social Security retirement age point to life expectancy, which has gone up quite a bit since the program started in 1935.

“When Social Security first started, the average life expectancy was 17 years lower than it is today,” Heritage Foundation research fellow Rachel Greszler said, according to CNBC. “And yet, the retirement age has only increased by two years.”

But what Greszler isn’t factoring in is that so many people are now entering retirement unprepared, and delaying the age that they could receive maximum benefits is only going to hurt them more.

“When you look at the retirement system as a whole, there’s not a lot of other sources of money for people other than Social Security,” Alicia Munnell, director of the Center for Retirement Research at Boston College, said.

In 2016, a typical 60-year-old didn’t even have $100,000 in their 401(k), according to a study from Munnell’s firm. And that, of course, assumes someone even has access to a 401(k), which many businesses do not even offer.

While life expectancy is rising, it’s not an equal rise across the entire population. In fact, some lower income groups have had stagnant life expectancy for the last 20 years, according to Richard Johnson of the Urban Institute.

Raising the Social Security Retirement Age Could Lead to More Changes

Raising the retirement age would mean would mean even less benefits for someone claiming at 62 because it would stretch out the time between their minimum and full retirement age.

A fix to that issue? Raise the minimum age needed to claim Social Security to 64 or 65. But that would only put more people in a tough spot if they are 62 and in need of those benefits.

“There are a lot of people who are really counting on Social Security as an important lifeline,” Johnson said. “If we remove that lifeline, what happens to those people? That’s kind of the policy dilemma.”

A potentially positive change would be to increase the age someone could claim maximum benefits from 70 to 75, which could lead to people working longer.

“People seem to take this full retirement age as kind of a signal as to when the appropriate time is to retire,” Johnson said.

More years to work means more years to save for retirement, and Johnson thinks it’s good for society because those people would keep paying taxes and contributing to workforce productivity.

Editor’s note: What do you think about raising the full retirement age for Social Security? Does it make sense, or do you think it would open up a new can of worms?

• You can find all of the latest and most important news about Social Security here on Money and Markets.