Social Security’s future was already in question, and another recession is going to put even more pressure on the social safety net, which means you may want to prepare for a very different program than what’s been the norm for decades.

The Social Security Board of Trustees recently projected the program’s trust funds would be insolvent by 2035, but they also acknowledged those findings were based on data prior to the coronavirus lockdowns that led to a surge in unemployment worse than the Great Depression.

Employment is so important for Social Security’s future because the program is heavily funded by a payroll tax. So if people aren’t working, Social Security’s future funding isn’t sustainable.

That’s exactly what the Bipartisan Policy Center looked into — and the results are eye-opening. The U.S. is likely already in a recession, so the organization looked back at 2008’s Great Recession model to see what a similar downturn would do to Social Security’s future.

It took just four years during the Great Recession to move Social Security’s insolvency date up eight years to 2033 in 2012, thanks to an abysmal labor market and weak economic growth.

And the same thing could happen again as the economy wades through another similar downturn, per the Bipartisan Policy Center’s blog:

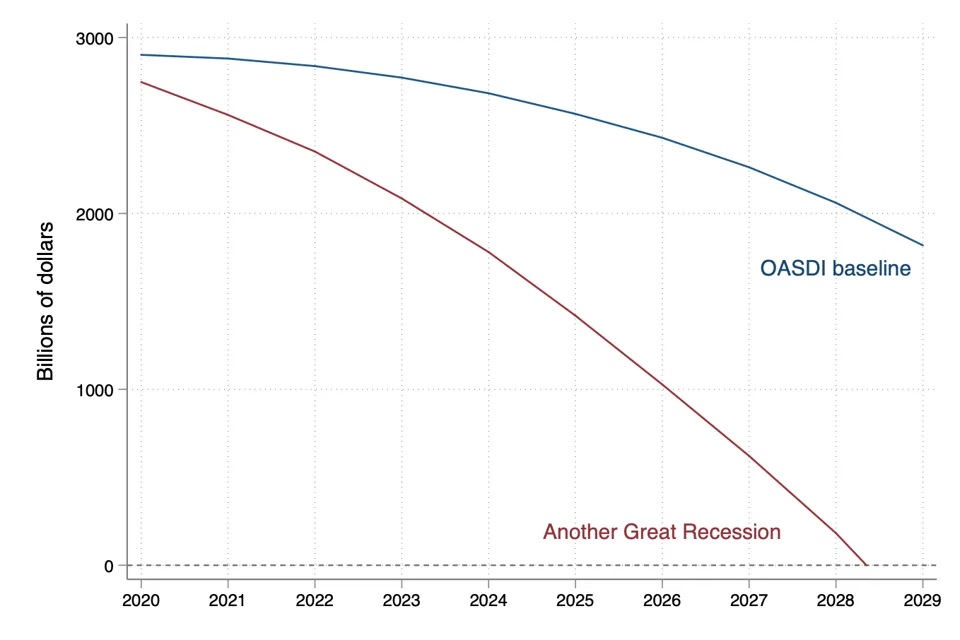

Based on these assumptions, we estimate that another economic downturn with severity and impacts similar to the Great Recession would accelerate the depletion date of the OASI trust fund reserves from 2034 (projected in this year’s trustees’ report) to 2029, the depletion date of the DI trust fund reserves from 2065 to 2024, and the depletion date of the combined (OASDI) trust fund reserves from 2035 to 2029.

While Social Security will still pay out benefits, the organization found checks would be reduced by about 31% because of lower revenues coming into the system. This is significantly higher than the trustees’ 24% projected cut in 2035.

Of course, this is a bit of an extreme projection, especially considering we don’t know how the economy will actually recover from the shock caused by the coronavirus lockdown. But it sheds light on Social Security’s future, and how quickly recessions can move the insolvency timeline up.

Planning for Social Security’s Future

Funding for Social Security has obviously been in question for a long time now as politicians in Washington continue to play kick the can. In fact, the program’s trustees have been warning about insolvency for years now to no avail.

The fact that lawmakers have not prioritized Social Security’s future should be a stark warning to anyone receiving benefits, or planning to start benefits in the coming years.

While Social Security will never run out of money completely because it is funded by a payroll tax on current employees and employers, benefits could be drastically reduced if a fix isn’t agreed upon soon.

Because funding is such a big question for Social Security’s future, you should already be planning to supplement those cuts with other forms of retirement income.

Planning for Social Security’s future cut, if and when it happens, means you’ll be prepared, and pleasantly surprised if Congress figures out a solution because you’ll have saved more for retirement than you may have originally intended — plan ahead and consider it gravy.

Using a Social Security calculator like this one to find your estimated benefits is a good first step to creating a plan for Social Security’s future. Calculating your benefits and then reducing them by 24% to 31% shows you how much you will need to save to supplement potential cuts.

We may still be 15 years off from Social Security’s insolvency, but looking at how the Great Recession negatively affected funding shows that date could move up a lot quicker than expected. Thinking about it now means you can have a plan for when it eventually happens.

• You can find all of the latest and most important news about Social Security here on Money & Markets.