Earnings season is ramping up. How does SoFi Technologies stock (Nasdaq: SOFI) look as it prepares to report quarterly numbers soon?

SoFi Technologies is a financial tech company that offers a variety of services and products, including digital banking, stock trading and personal finance.

Founded in 2011, the company has been expanding rapidly over the past decade and is now one of the top players in its field. I

n this blog post, we’ll explore the business model of SoFi Technologies and take a look at what lies ahead for the company in 2023.

Then we’ll run Sofi stock through our proprietary Stock Power Ratings system to see where it lands.

SoFi Technologies’ Business Model

SoFi Technologies provides a variety of products and services to both businesses and consumers.

The company’s main product offerings include digital banking, stock-trading tools, student loan refinancing, personal loans, mortgages, insurance products, and wealth management services.

The company also has an online platform for investors to find opportunities in the public markets.

SoFi Technologies has established itself as a market leader by providing its customers with convenient access to services such as automated investing advice from professionals or competitive interest rates on their investments. This allows customers to save time and money while still making informed decisions about their money.

SoFi has also developed its own proprietary software that helps customers manage their finances more efficiently by automating tasks such as bill payments or budgeting.

On the business side of things, SoFi provides companies with data analysis tools that allow them to better understand customer behavior and identify trends in order to optimize their operations.

The company also offers consulting services to help businesses maximize efficiency by streamlining processes or implementing new technologies.

Has that translated into gains for SoFi stock investors?

SoFi Stock Outlook for 2023

The outlook for SoFi Technologies looks OK for 2023 due to strong demand from consumers as well as businesses looking to streamline processes with technology solutions.

As more people become comfortable using digital tools for managing their finances, we expect SoFi will continue to grow its user base significantly over the next few years.

More businesses are also expected to turn toward technology solutions in order to improve efficiency which should result in increased demand for Sofi’s products on that front as well.

But that doesn’t mean SoFi stock is going to outperform from here.

Our proprietary system shows you why.

SoFi Technologies Stock Power Ratings

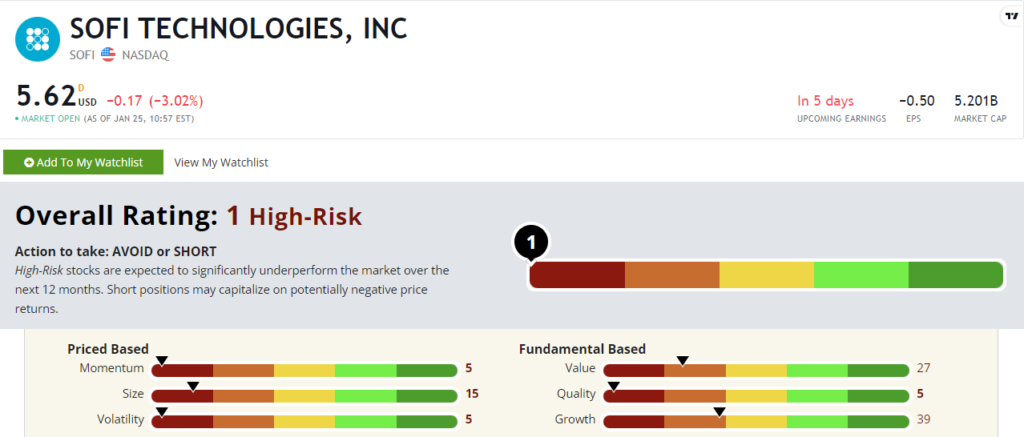

SoFi stock rates a “High-Risk” 1 out of 100. It’s in the worst 1% of more than 8,000 stocks we rate.

And our system expects the stock to underperform the broader market over the next 12 months!

SOFI’s quality factor score of 5 explains a lot.

Like many other tech stocks, this company is struggling to turn a profit:

- Its return on equity is negative 7.77% for the third quarter of 2022.

- Its return on assets is also negative 3.27%.

- And its return on invested capital is sitting in the red at negative 3.44%.

That shows why SoFi stock is “High-Risk” within our system.

Bottom Line: With innovative products aimed at both businesses and consumers alike, SoFi could be a promising investment one day.

But our Stock Power Ratings says to avoid SoFi stock for now.