Do you have a Whirlpool appliance in your house? Let’s see how Whirlpool stock (NYSE: WHR) looks for 2023 using our proprietary Stock Power Ratings system.

Whirlpool Corp. is a global leader in the appliance industry. It provides innovative home appliances to customers around the world.

As a multibillion-dollar company, Whirlpool has been able to leverage its extensive network of partners and suppliers to remain profitable despite the ever-changing nature of the industry.

Let’s take a look at how Whirlpool has fared over the last few years, as well as what is in store for its stock in 2023, according to Stock Power Ratings.

Whirlpool’s Financial Performance

Whirlpool’s financial performance was strong for years, with revenue increasing steadily since 2018.

The company benefited from an increase in demand for its products during the pandemic. As more people stayed home due to lockdowns and restrictions, they needed reliable appliances to help them keep their homes running smoothly.

This surge in demand allowed Whirlpool to offset some of the losses incurred from decreased sales due to supply chain disruptions caused by lockdowns in certain countries.

But things changed last year.

It reported three-straight quarters of revenue losses in 2022. Its total revenue decreased by a massive 12.84% to $4.79 billion in the third quarter compared to the previous three-month stint.

We’ll see if things have improved when it reports fresh numbers in the coming days.

For now, let’s run Whirlpool stock through our proprietary system to see if things look any better there.

Whirlpool Stock Power Ratings

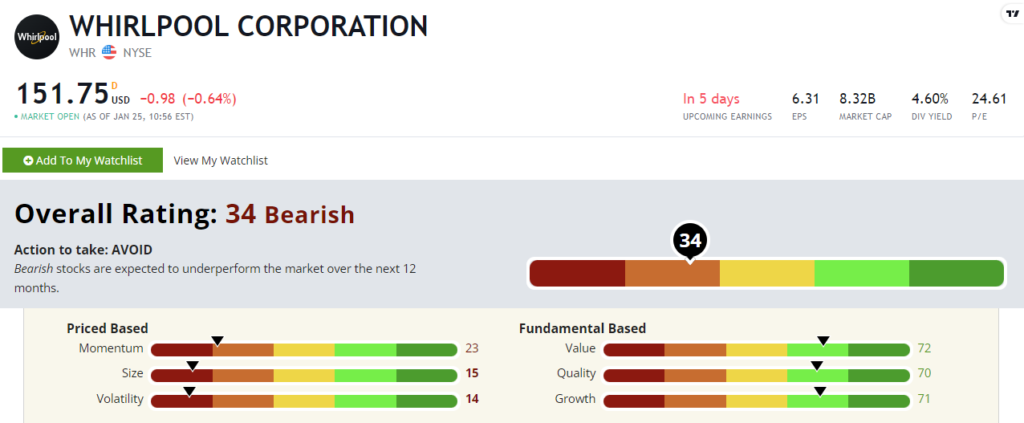

Whirlpool stock rates a “Bearish” 34 out of 100. That means our system expects the stock to underperform the broader market over the next 12 months!

I want to focus on WHR’s momentum (or lack thereof).

Over the last 12 months, Whirlpool stock has lost almost 27% of its value as I write.

Stretching out to five years, WHR is down 18.2% over that time frame. That’s not what investors want to see!

The last month has been better, with the stock gaining 7.3%. That’s probably kept its momentum score from hitting single digits.

For now, Whirlpool stock scores a 23 out of 100 on that factor.

Bottom Line: While Whirlpool enjoyed increased demand for its products during the COVID-19 pandemic, this is one to avoid, according to Stock Power Ratings.