In my last Better Buy, I highlighted an innovative renewable energy company that produces biofuels from used cooking oils.

Since restaurants typically pay to have their cooking oil waste removed, this company’s ability to turn it into a fuel source is a classic case of “one man’s trash is another man’s treasure.”

You don’t have to be a hippy to see where the trend in renewable energy is going over the coming decades.

A colleague of mine recently joked about how they used to stick a drinking straw in the ground in Texas, and crude oil would come gushing out.

Today, though, the supply of natural resources is lesser and more difficult and costly to access. Innovative companies are figuring out how to do more with less … or, as I said in the case of a restaurant’s french fry oil, how to turn one man’s trash into treasure.

The solar energy industry has been working on that puzzle for decades already. The sun graciously bathes the earth with tons of solar energy each day (particularly for us lucky folks here in Florida).

But most of that has gone wasted for centuries. Harnessing that energy is a challenge. Even when the industry saw the value in doing so, the technology necessary to collect and store solar energy was expensive.

Prohibitively expensive. And that led a lot of would-be investors away from solar stocks.

Solar Stock’s Day in the Sun

I wrote recently about how investors are “voting” with their dollars in the wake of the November 2020 presidential election.

Well, get this … shares of the Invesco Solar Energy ETF (NYSE: TAN) are up nearly 60% since the November 6 result.

Clearly, investors are clamoring to own solar stocks in anticipation of Biden’s friendlier stance on renewable energies.

Back in July of last year, I recommended my Green Zone Fortunes subscribers lean into the growing interest in solar stocks, which was gaining steam well before Biden’s win.

The trouble was, most of the solar stocks I reviewed were quite over-valued … sometimes trading with price-to-earnings ratios in the hundreds!

I get it … solar is a high-growth industry, so investors might be willing to pay up.

What’s more, solar stocks became a “momentum trade” last year, as more folks piled in at higher and higher prices.

But I was resolved to recommend to my Green Zone Fortunes readers a solar stock that not only had strong momentum but one that was also a decent value. And not only did I find a decent value … I used my Green Zone stock rating model to find a massively undervalued solar stock … one that was trading for less than its book value.

A solar stock that has since more than doubled … and, yet, is still a better value than its peers.

CSIQ: The Best Value in Solar

Realize, I don’t typically share the full names and ticker symbols of the stocks I recommend in my subscription services, like Green Zone Fortunes.

I trust you’ll understand why. It’s simply not fair to those who pay a nominal fee for me and my team’s advice.

But today, I’m breaking that rule and revealing full details on this company, which is still the best “value” play in the solar space … even though my Green Zone Fortunes readers have already ridden the stock’s more than 160% rally over the last six months.

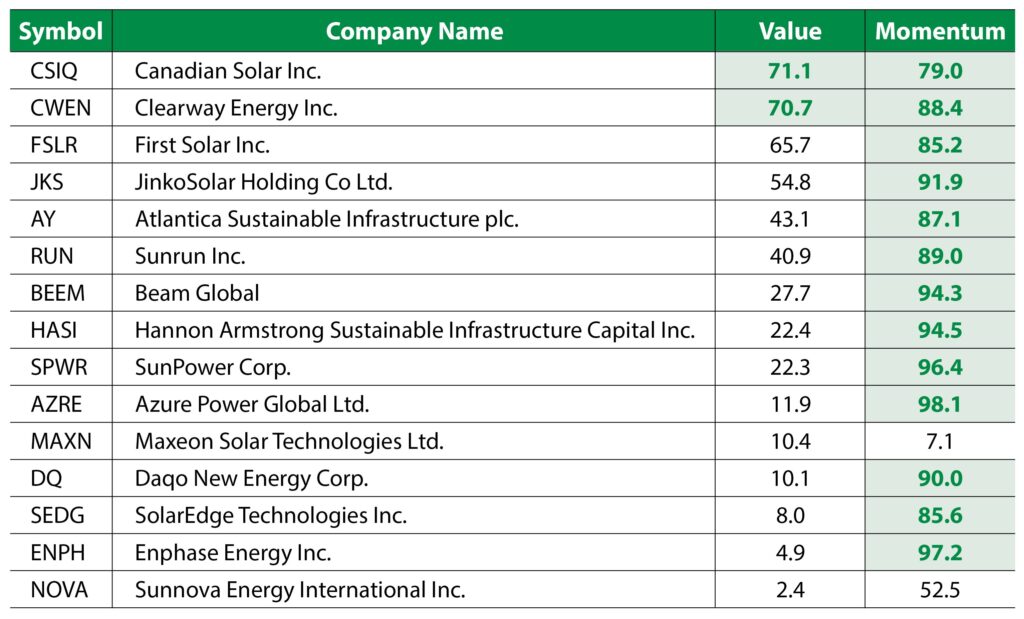

Have a look at this table …

Here are the 15 stocks held in the Invesco Solar Energy ETF (NYSE: TAN) that can be rated by my Green Zone stock rating model.

I’ve included each stock’s momentum rating, just to show you what I meant when I said the solar industry is already a popular momentum trade.

Alongside that strong momentum, you’ll see that many of the solar stocks you could buy aren’t good values. Most of them have value ratings below 50, which means they’re expensive.

But, at the top of that table (which is sorted on the value rating) … is Canadian Solar Inc. (Nasdaq: CSIQ). It currently earns a Green Zone value score of 71, which means it’s a better value than all but 29% of all 8,000 stocks I rate each week.

More importantly, it’s the best “value” stock within the solar industry.

And that’s after the stock’s price has rocketed 160% higher in the past six months!

You see, when I originally shared my buy recommendation of Canadian Solar with my Green Zone Fortunes readers, it was rated 93 on value. Naturally, that rating had to come down alongside the stock’s nearly tripling in price.

But even today, shares of Canadian Solar still only trade at a P/E ratio of 18 — which is around half the average P/E of its peers.

It’s also a better value on price-to-book and price-to-sales. So, no matter how you slice it, and even after an impressive run-up in its share price … Canadian Solar is still the best value in the solar space right now!

It’s a great value … with strong, market-beating momentum … and it’s operating in the high-growth solar space, which I expect to run circles around traditional energy companies for years to come.

What’s not to love about that combination?!

Of course, if you simply want to add a diversified play on the solar space to your portfolio, I think the Invesco Solar Energy ETF (NYSE: TAN) is a great, one-click way to do that.

But if you want access to all my weekly updates on Canadian Solar, including my next recommended entry and exit points, I think it’s a good idea to go here and join us at Green Zone Fortunes.

Canadian Solar isn’t the only innovative, industry-disrupting company we’ve added to our portfolio of recommended positions in the last year. And my team and I anticipate a number of equally-lucrative opportunities in 2021 … so I hope you’ll join us in our adventure!

To good profits,

Adam O’Dell

Chief Investment Strategist