An overall bullish tone has returned to the market after the S&P 500 put in its seventh consecutive higher session yesterday.

That’s encouraging, for sure.

But we’ll also caution against assuming a week and a half of positive price action guarantees we’re out of the woods.

What’s more, while we look to the major U.S. stock indexes for indications of sentiment and trend, we don’t limit ourselves to investing in just the market’s 500 largest stocks.

Top-rated stocks come in all shapes and sizes … and very often, you can position yourself for market-beating returns by looking outside the most popular group of stocks.

That is, in fact, what our “New Bulls” screen is all about…

We identify newly top-rated stocks, some of which you might not have heard of!

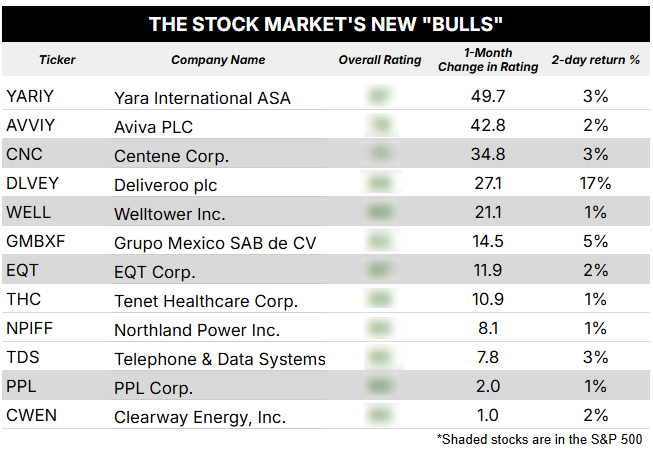

Let’s have a look at the 12 stocks that my system just flagged as “Bullish” this week.

Did This Norwegian Chemicals Stock Make Your List?

As a reminder, here’s what my “New Bulls” screen looks for:

- The stock must currently rate 60 or higher (that is, “Bullish” or “Strong Bullish”),

- The stock must have been rated less than 60 for each of the last four weeks.

In short, these are stocks that have been rated “Neutral” or worse … but now are rated “Bullish” or better.

Here are the 12 stocks that made the list this week:

I’ll note here that the table is sorted by each stock’s change in rating over the past month, from high to low. And while it’s not uncommon to see a stock’s rating increase or decrease by five, 10, or even 15 points in a given month … we have a handful of stocks this week that have increased by 30 or more!

At the top of today’s list is Yara International ASA (YARIY), a Norwegian chemicals company that specializes in nitrogen-based mineral fertilizers.

They reported earnings last Friday and, clearly, my system liked what it saw!

I don’t expect many people have heard of this stock before, nor that you’d be able to follow the earnings reports of more than a couple dozen companies, let alone the thousands that report each quarter!

But that doesn’t mean you have to miss out on these opportunities!

By tuning into these daily issues of What My System Says Today, you can position yourself to spot more opportunities as they hit our radar. You can dive deeper with the help of my Green Zone Power Rating system, which is a complimentary feature of my Green Zone Fortunes newsletter.

Doing this will be particularly important now that we’ve been plunged into a massive “shakeout” in the market, thanks to the unconventional ways of Trump’s administration.

A “Shakeout” Full of Opportunity

In short, I believe this massive shakeout will very cleanly divide the market into two camps – simply, the “winners” and the “losers.”

That may be disconcerting to many investors, particularly those who see no other way to invest outside the broad indexes, where you’re practically guaranteed to be in a messy mix of winners and losers.

Frankly, I didn’t foresee this massive shakeout coming to be when I designed my Green Zone Power Rating system from the ground up in early 2020…

But I sure am thankful to have this stock-picking system running like a well-oiled machine now that we’re in this “stock picker’s market!”

Until next time…

P.S. We had a busy week in Green Zone Fortunes, adding a brand-new position to the model portfolio — a 96-rated company in an incredible mega trend for today’s market. Click here to find out how you can join us, gain access to that recommendation, and have full 24/7 access to my Green Zone Power Rating system!

To good profits,

Editor, What My System Says Today