Baseball teaches us so much about life — and even the stock market.

America’s pastime teaches us about winning and losing, humility, respect and dignity.

Life isn’t always fair. Sometimes, you beat the market, but sometimes, the market beats you.

Elwin Charles “Preacher” Roe made his Major League Baseball debut with the St. Louis Cardinals in 1938 and played his last game with the Brooklyn Dodgers in 1954.

Now, “Preacher” worked with what he had. New York Giants All-Star outfielder Willie Mays once said that Roe had two speeds to his fastball … slow and slower.

In a game between the Dodgers and the Pittsburgh Pirates, “Preacher” pitched so poorly that he was removed from the game in the second inning.

When asked about being replaced so early in the game, Roe supposedly said:

“Sometimes, you eat the bear, and sometimes, the bear eats you. Today, the bear ate me.”

In Roe’s example of this mythical quote, the bear was the game of baseball. In the stock market, the bear can mean all sorts of things.

Today, I’ll share my take on “the bear” and how it applies to one of 2024’s hottest sectors. I’ll use Adam’s Green Zone Power Ratings system to show why and give a little bonus at the end.

The Bear, Semiconductors and Volatility

Noted American author Ralph Waldo Emerson is credited with originating “the bear” in his 1870 essay, “Farming.” Emerson’s “bear” was literally a bear.

The saying transformed over the years to take on a deeper meaning.

In the market, you can equate “the bear” to terms like volatility.

- Sometimes, you eat volatility — A highly volatile stock can provide investors with “moonshot” returns. But…

- Sometimes, the volatility eats you — Volatility cuts both ways. A stock can fall just as far and just as fast as it can rise. This is why those “moonshot” stocks are extremely rare to find.

Today, investors are looking for that “moonshot” in stocks related to artificial intelligence (AI) … especially in semiconductor (aka chip) stocks like Nvidia Corp. (Nasdaq: NVDA).

And looking at a stock chart of the iShares Semiconductor ETF (Nasdaq: SOXX) tells us part of the reason why:

In the last 12 months, SOXX is up 43%, compared to the S&P 500 gain of 28%.

However, you can see that SOXX’s moves are considerably more pronounced (bigger ups and bigger downs) than those of the broader market. SOXX is volatile.

(Note: Adam is going to talk about one AI glitch that may be contributing to this volatility — and how you can take advantage — in a free presentation next week. Click here to sign up now.)

To illustrate that volatility, consider this: The 60-month beta of SOXX is 1.34. The baseline S&P 500 beta is 1.

That means the semiconductor ETF is 34% more volatile than the market.

So, I did an X-ray of SOXX, pulling out all of the holdings and computing averages on the six factors that make up the Green Zone Power Ratings system.

SOXX Volatility Is Bearish

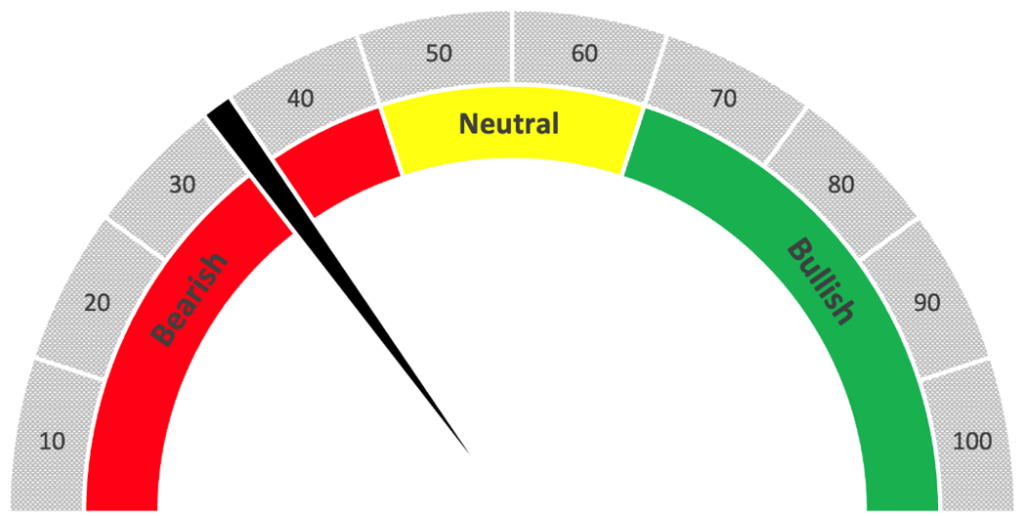

Overall, SOXX rates a “Bearish” 36 out of 100 on Adam’s system. But its volatility and momentum stood out to me.

SOXX earned a “Bearish” 29 out of 100 on Volatility while, at the same time, a “Neutral” 52 on Momentum.

Plus, of the 30 holdings in SOXX, 16 have a Volatility factor rating below 30 (a lower rating signals more volatility in the stock).

What it means… The x-ray of SOXX implies weak overall performance, but a stronger rating on Momentum tells me investors are looking at semiconductors for that “moonshot.”

This doesn’t mean there aren’t gems within the semiconductor industry, but investors have to be willing to accept a higher degree of volatility than in other areas of the market.

In fact, after closely examining each stock in the SOXX ETF, I’ve identified one that you should certainly monitor.

This Semiconductor Stock Is On the Rise

When I did a deep dive into SOXX, I looked at everything from Momentum to Value.

I also looked at each stock’s progression (or regression) on the Green Zone Power Ratings system.

I found Teradyne Inc. (Nasdaq: TER) — a company that specializes in creating test equipment and systems for semiconductors. Its software and hardware can conduct high-volume tests for memory capacity and signal processing.

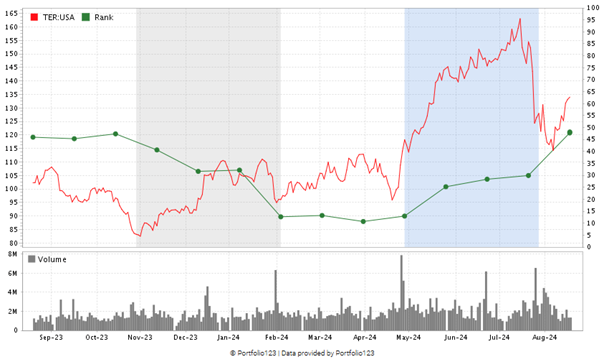

TER rates a “Neutral” 48 out of 100 on Adam’s system, but it earns “Bullish” marks on Momentum, Quality and Growth.

But here’s what stood out to me:

TER Overall Rating Continues To Climb

Just 24 weeks ago, TER’s overall rating (the green line in the chart above) was a paltry 13. Since then, the stock has moved into “Neutral” territory and shows potential to continue that upward movement.

Its Volatility is at 25, up from the 23 it earned on the factor in February.

There’s no question that the semiconductor sector of the market contains high volatility compared to the broader market.

But that doesn’t mean there aren’t investable stocks in the sector.

TER could be one of those stocks where you eat the volatility.

Until next time…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. I mentioned Nvidia above, and it has certainly experienced its fair share of volatility while gaining 167% in 2024 alone. The king of AI chips is set to report earnings next week, and Adam has something you need to see before those quarterly numbers drop.

He’ll have all the details for you on Tuesday, September 27, at 1 p.m. ET. Click here to make sure you’re one of the first to see his critical presentation. He’ll send you some preview materials before pulling the curtain all the way back next week.