Optimism replaced pessimism in late March. Investors believed the stock market bottomed and a buying frenzy ensued, but we’re likely about to see a second leg down.

We have about 120 years’ worth of history telling us the S&P 500 is unlikely to move higher in the next weeks.

Students of history aren’t so sure. They’re familiar with the law of action and reaction that Charles Dow, developer of the Dow Jones Industrial Average, wrote about on May 21, 1901.

In an editorial for The Wall Street Journal, Dow, explained:

“We have usually after panics figured out the movement for the purpose of testing in each case the theory that the swing of prices in and after a panic is always the same in character although of course not in extent. The figures have almost invariably shown a first a severe drop, then a strong recovery, and then a relapse carrying prices back from one-half to two-thirds the amount of recovery.

It will be seen … that the decline was very severe and the rally correspondingly strong amounting in every case to more than half the loss, and in most cases to about two-thirds of the loss.”

Writing was less clear in 1901 but Dow was saying that after panics push prices down, expect a rally. In the rally, prices should retrace half to two-thirds of the decline. After the retracement, expect a second leg down. Losses in that move should equal about one-half to two-thirds of the rally.

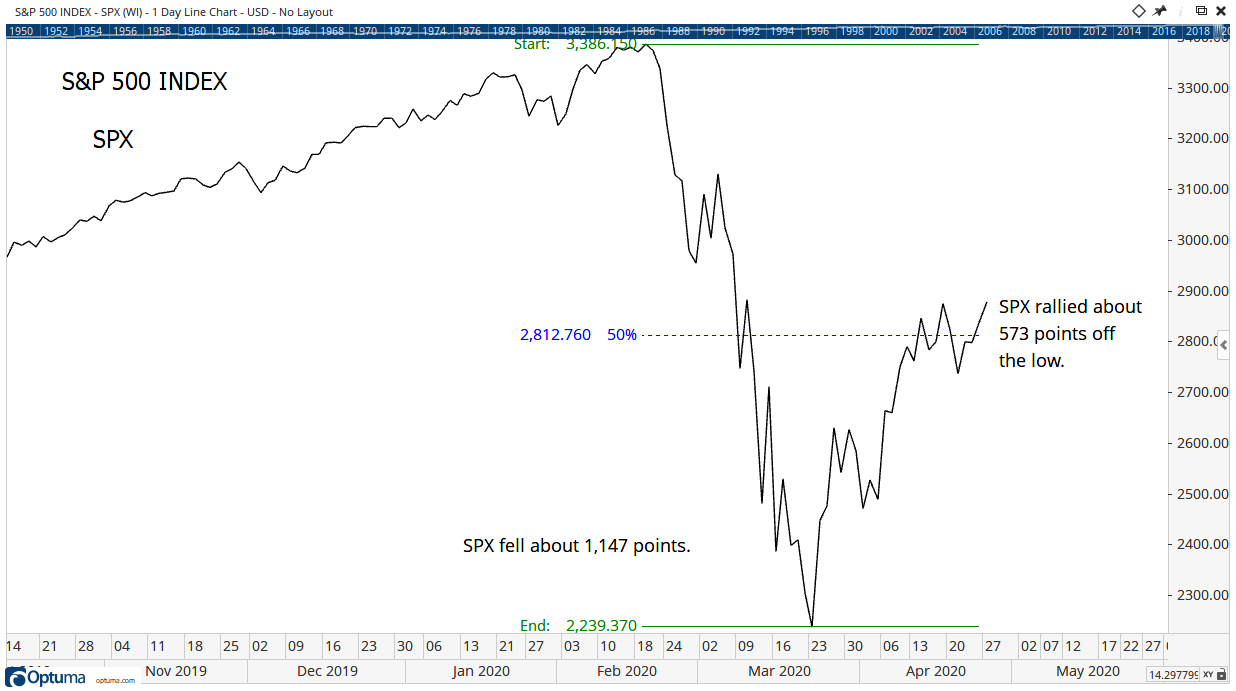

The chart of the S&P 500 below shows that the current rally retraced about half of the panic decline.

A Second Leg Down Is Likely, According to History

With Dow’s 119-year old road map, it’s not a surprise to see the S&P 500 stall at the current price level.

Now, it’s time to look for a second down leg — a decline of at least 250 points in the Index.

Dow also wrote about a pattern he called a “line.” That’s a consolidation where prices move in a narrow range. Lines can replace declines in Dow’s theories. To complete a line, prices need to remain in a narrow range for at least a month, or until the middle of May.

Of course, we could see a sharp rally in the next few days. History says that is unlikely.

In fact, we have about 120 years’ worth of history telling us the S&P 500 is unlikely to move higher in the next weeks.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the editor of Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Michael also is the former editor of the CMT Association newsletter Technically Speaking.