Gold is moving up. But some investors have a rational fear of the yellow metal.

Right now, GLD is a buy.

Some remember the bubble in gold that pushed prices to record highs in 1980. The bear market that followed lasted 26 years.

Another bubble followed the end of that bear market. That five-year bull market in gold ended with a five-year decline.

Gold’s years-long bear markets scare some investors. But the big price moves that occur in gold’s bull markets are appealing, even to those worried about the downside. Fortunately, there are trading strategies that can avoid the worst of the bear markets.

How to Play Gold’s Bull Market

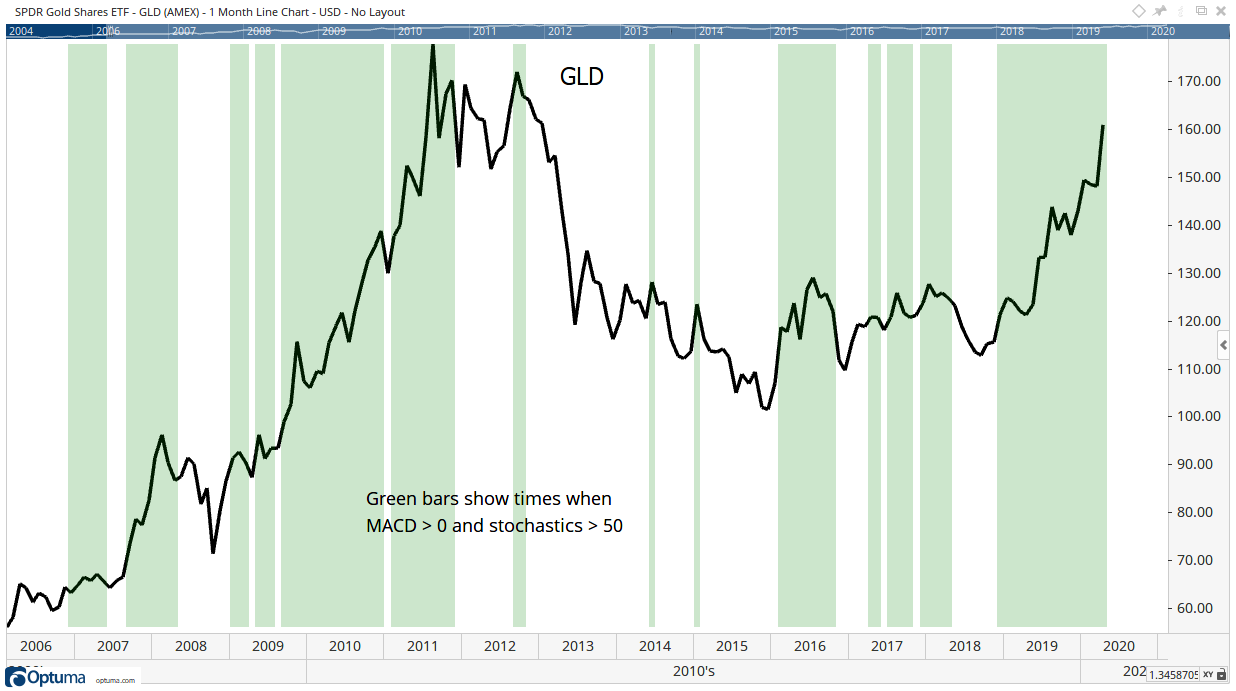

The chart below shows the results of one of those strategies. It’s a chart of SPDR Gold Shares (NYSE: GLD), an exchange-traded fund that holds physical gold and sells for a price equivalent to one-tenth of an ounce of the precious metal. Green shaded areas show the times when GLD is on a buy signal — gold’s bull market.

This chart requires updating just once a month. The strategy to determine when to buy and sell uses two popular technical indicators, MACD and stochastics. These indicators are also updated just once a month.

Both of those indicators measure momentum. They are available on many websites for free. Because they are widely available, I won’t go into detail on the indicators.

Traders often follow complex rules to follow these indicators. Strategies based on complex systems tend to fail because they are too difficult to follow in real time. There are other reasons the strategies fail, but that’s a big one.

The strategy shown in the chart relies on simple rules — when the value of MACD is greater than zero and the value of stochastics is greater than 50, buy and hold GLD. When MACD falls below zero or stochastics falls under 50, sell and hold cash.

Right now, GLD is a buy.

Someday, gold will have another bear market and it may last for years like other bears. This simple strategy can help you avoid that problem and allow you to benefit from gold’s bull market, delivering large gains.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the editor of Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Michael also is the former editor of the CMT Association newsletter Technically Speaking.

Editor’s note: We also wrote about why you should be in gold mining stocks here on Money & Markets on Wednesday, and Carr wrote a bit more on this topic over on BanyanHill.com. Click here to read more of Carr’s thoughts.