If you can’t beat ‘em, join ‘em.

That’s my philosophy when it comes to investing and e-commerce juggernaut Amazon.com. Inc. (Nasdaq: AMZN).

I don’t want to own anything that is a direct competitor with Amazon. To do so is to back an underdog with no real chance of winning. Rather than compete with Amazon, I’d rather own companies that collaborate with Amazon.

That brings me to our dividend stock of the week: STAG Industrial Inc. (NYSE: STAG).

STAG is an industrial real estate investment trust (REIT) that buys standalone properties in the light industrial space. Think distribution centers and warehouses. You know those huge buildings with a gazillion truck ramps you tend to see around airports? STAG owns 98.2 million square feet of properties like those.

I love industrial real estate. There is virtually zero maintenance. This isn’t a five-star hotel or a posh office building. If there are a few scuff marks or a little chipped paint, who cares? It’s a warehouse. You’re not wining and dining customers there.

These properties are also recession-proof and, more importantly, Amazon-proof. In fact, Amazon is STAG’s largest single tenant, accounting for about 4% of its portfolio. Approximately 40% of the portfolio handles e-commerce activity. So STAG is embracing the future with its portfolio positions.

STAG Stock’s Dividend and Green Zone Rating

Let’s talk dividends. At current prices, the stock yields 4.2%, and STAG has raised its payout every year since its 2011 IPO. And as an added bonus, STAG pays its dividend monthly rather than quarterly. Your bills come on a monthly cycle; it’s nice if your income does too.

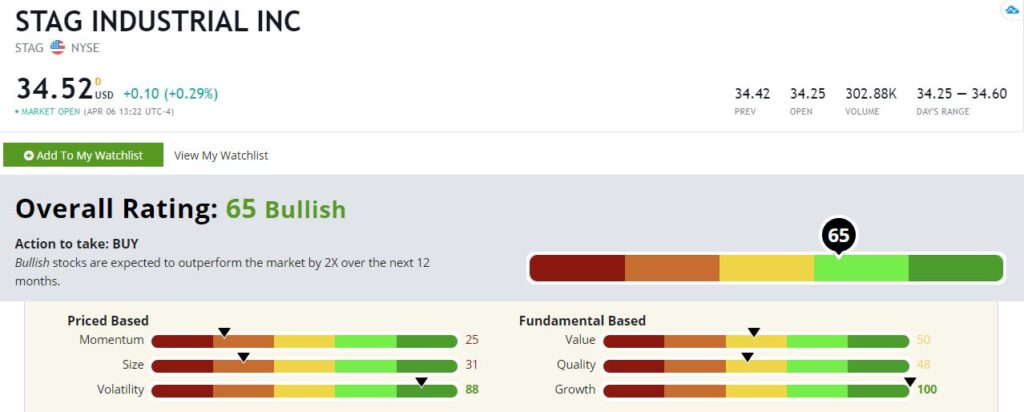

With an overall rating of 65 out of 100, STAG is “Bullish” in our Green Zone Ratings system. Based on our historical work, we expect Bullish stocks to outpace the market’s returns by two times over the following year.

STAG Industrial Inc.’s Green Zone Rating on April 6, 2021.

Growth — For a gritty industrial REIT, STAG rates at the tip-top of our growth metric, rounding up to 100. This unassuming landlord has been growing like a weed. It increased its square footage under management from 14 million square feet at its 2011 IPO to 98 million today. And more growth is planned. STAG operates in a highly fragmented industry. Potential acquisitions are plentiful.

Volatility — STAG also rates high on volatility at 88 out of 100. A high rating here means less volatility. STAG’s lack of volatility isn’t too shocking when you consider how simple its business model is. It serves as a landlord for industrial properties, and it keeps its leverage within reasonable levels. There’s not a lot of room for volatility here.

Value — STAG is in the “middle of the pack” in terms of value, with a rating of 50. REITs are penalized on our scale due to the quirkiness of their accounting. Official earnings tend to be depressed by non-cash expenses like depreciation, and this penalizes REITs on earnings-based valuation metrics like the price-to-earnings ratio.

Quality — It’s a similar story with quality. STAG rates a modest 48 out of 100 on our quality scale. But REITs carry a lot of debt, and their profitability metrics are penalized by the same factors that affect valuation. This is a long way of saying that STAG is a higher-quality company than its raw score would suggest.

Size — STAG is a midcap with a market cap of $5.5 billion. That’s a little too big to be an undiscovered gem in the rough. It rates a 31 out of 100 on our size metric.

Momentum — STAG rates a 25 out of 100 on our momentum metric, which is lower than I’d like to see. In particular, it gets penalized on its up-volume vs. down-volume sub metric. These metrics revolve around how much a stock is traded in a certain period of time. All the same, the stock has been trending higher for several years, so we’re hardly trying to catch a falling knife.

Bottom line: If you’re looking for a solid monthly dividend payer that is pretty much Amazon-proof, STAG is a solid choice.

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.