Checks for almost everyone are now the weapon of choice for Congress — this time to the tune of almost $1.9 trillion. Many families will receive their third check in a year from the government this week.

Headlines tell us the checks are targeted to families in need. Individuals reporting adjusted gross income below $75,000 qualify for the checks, as do married couples with an AGI under $150,000.

AGI is your income after certain deductions. Those deductions include retirement account and health savings account contributions, interest on student loans, income from municipal bonds and dividends on stocks held for a year or more.

For the self-employed, deductions include an allowance for home offices and other expenses associated with their business.

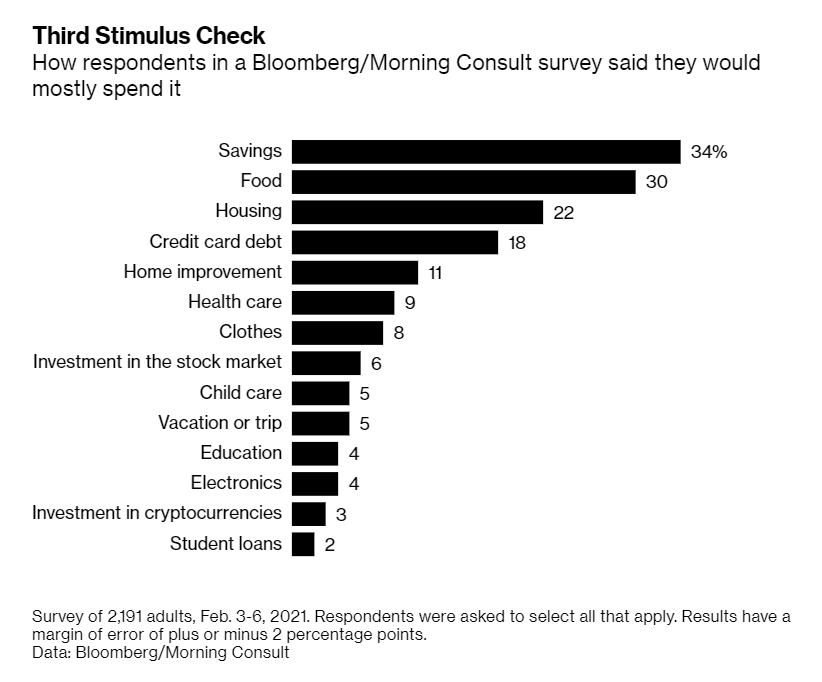

In other words, some high earners are receiving $1,400 from the government — whether they need it or not. That may explain why 43% are depositing at least part of the stimulus checks in savings or investment accounts. That includes 34% who plan to save some, 6% looking at stock market investments and 3% who plan on buying cryptocurrencies.

What High-Earning Americans Will Do With Stimulus

Saved Stimulus Money Won’t Save Stocks

All these savings are bad for the economy.

Recent research from Ned Davis Research shows:

A high savings rate correlates with slower economic performance. That makes sense since personal consumption drives 70% of the economy.

Since 1959, when the savings rate was more than one standard deviation above trend (think much higher than normal), has performed worst. The difference is material:

- Savings rate high: economic growth 0.31% per year.

- Savings rate neutral: economic growth 2.34% per year.

- Savings rate low: economic growth 3.51% per year.

In general, that means companies in aggregate will earn less, and if earnings remain low, the current overvaluation of equities—absent a meaningful correction—will remain high.

This has important implications for the stock market. All those savings might benefit banks and investors who make short-term trades to benefit from potential volatility.

Stocks of companies without earnings are most at risk. Low economic growth means they have lower chances of sales growth that will deliver earnings.

Investors should remember all stocks are risky right now.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.