“With this split between large and small investors, the market could be preparing for at least a short-term rally.”

Wall Street has rallied hard off its March lows, but the sideways movement trend has created a lot of frustration for investors looking for signals that will send shares through the roof — or back to the floor.

Cannacord Genuity Chief Market Strategist Tony Dwyer called the last month of trading Wall Street’s “frustration” phase Monday during an interview on CNBC’s “Trading Nation.” Check out the chart below to see what he’s talking about.

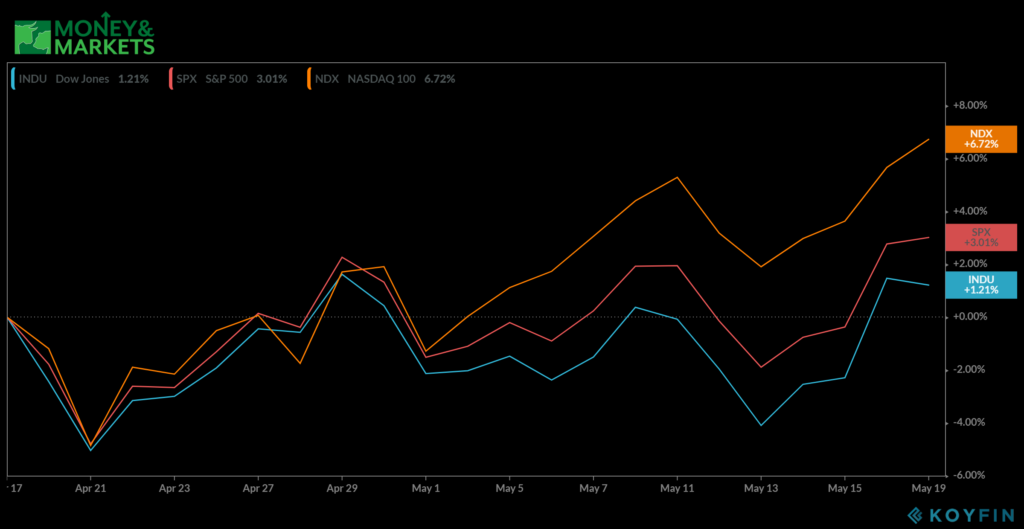

It’s been exactly three months since the S&P 500 crash triggered by coronavirus fears started Feb. 20, and while the three major U.S. indexes rallied back in late March through April, the last 30 days of trading have been a roller coaster without a lot of sustained movement in either direction.

There have been slight-to-good gains over the last month (especially in the Nasdaq composite, which is the only major index positive year to date), but after so much movement the S&P 500 has only risen around 3% in a month, and the Dow Jones Industrial Average has managed to barely break over 1% gains.

Playing the Current Stock Market Trend

Banyan Hill CMT Michael Carr

So the question traders would like to know is what exactly is going on here?

Banyan Hill Publishing Chartered Market Technician Michael Carr points to large institutions driving the market trend slightly higher, offsetting the pessimism of individual investors.

“Sentiment seems to be increasingly bullish from my perspective,” Carr said. “Large institutions are starting to buy as individuals turn more and more bearish. In a recent survey, less than 24% of individuals were bullish. That’s important because institutions tend to have a long-term view while individuals seek immediate gratification.

“With this split between large and small investors, the market could be preparing for at least a short-term rally.”

Dwyer calls this the “frustration phase” of the relief rally, noting two extremes investors are worried about: a crash, or a rally straight up that they miss out on.

“It’s one of those frustrating times where you’re not sure exactly what to do in the split between angst and Fed optimism,” he said, which echoes that bearish mindset of individual investors Carr was talking about.

And Carr, Editor of

“Institutions tend to follow trends and they buy when the trend is up,” he said. “Large managers face the risk of losing their job if the market moves up and they are in cash. That career risk drives trend following, and when the major market averages decisively break out, expect the big money to follow the trend.”

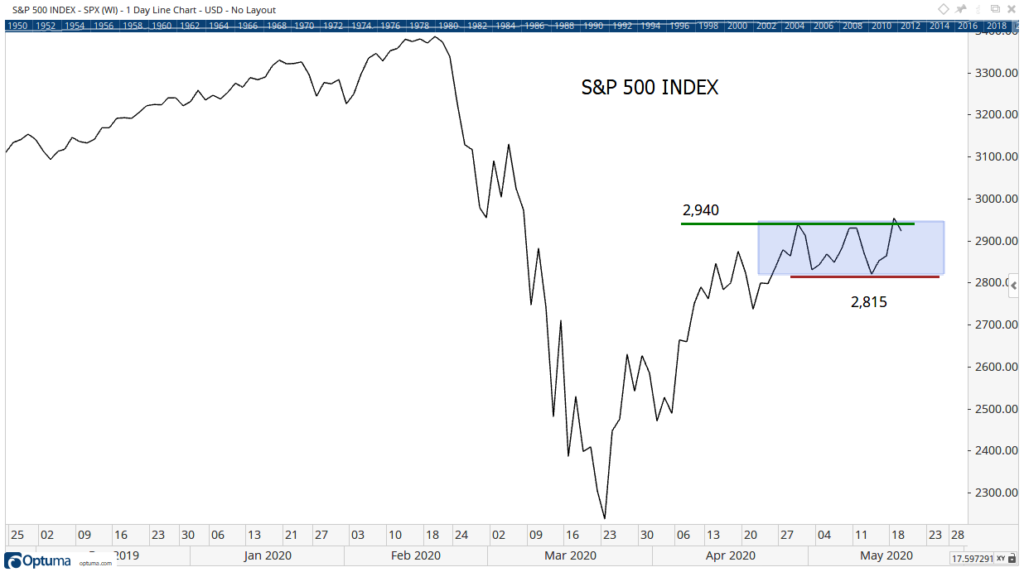

Looking at the above chart, you can see the trend that has formed as the S&P 500 trades between two levels — and creating a plan for how to trade when the market has created such a strong trend is helpful.

“Investors should trade this market the exact same way they would a strongly trending market,” Carr said. “Have a plan, and stick with the plan. That’s a cliche so let’s look at an example. The chart above shows a trading plan. This plan recognizes the S&P 500 index is moving sideways. When there’s a break of the range, act. Until there is a break, sit tight.”

So the stock market trend has been established and if you are growing increasingly frustrated while trying to suss out where it will go next, maybe crafting your own trading plan will help.

And strap in, because it’s going to continue to be a bumpy ride — though today’s move upward could be the exact breakout trend we’ve been waiting for.