Editor’s Note: This story was originally published in November 2020, but the underlying research on the volatility factor of Adam O’Dell’s Stock Power Ratings system is a must-read in any market.

Falling stocks dominated the headlines last week, and fear plagued the markets.

Now, you need to understand a simple truth that Wall Street would rather keep to itself: When stock prices fall … volatility rises.

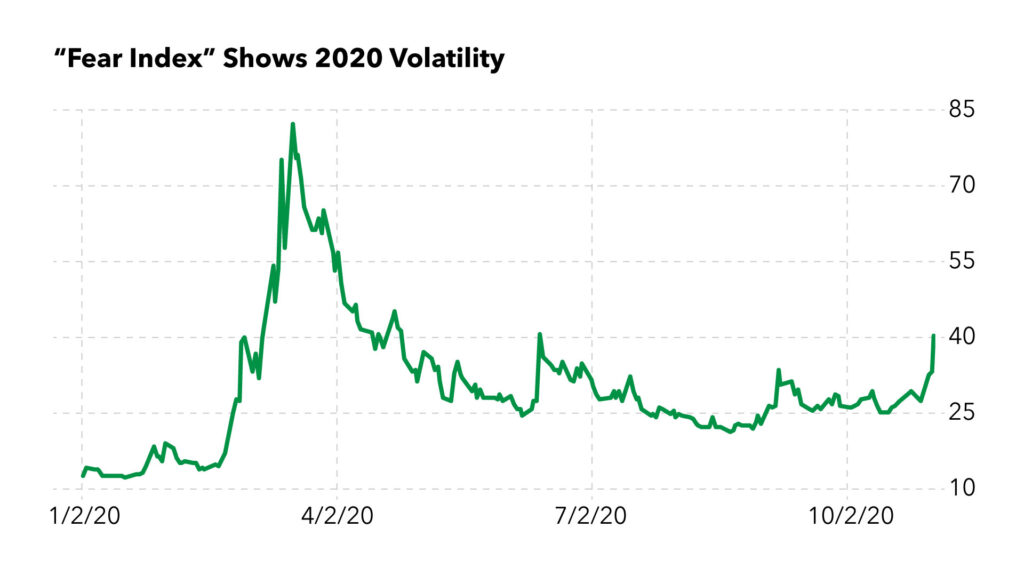

Wall Street even invented a special indicator for this. It’s called the CBOE Volatility Index (VIX).

You may have heard it called the VIX or even the fear index, since it tends to spike when investors panic.

The VIX rose last week — but as you can see in the chart below, investors weren’t nearly as fearful as they were in March and in the following weeks:

When the market behaves as it did last week … well, most of the stocks in your portfolio will experience volatility.

However, some stocks are prone to volatility even when the markets are calm.

In the chart above, you can see that the VIX was below 20 in January and February — the lowest volatility has been all year.

And we’ve had periods of (relative) peace since.

The stocks that rise and fall on those calm days are what we call high-volatility stocks.

Now, I know what Wall Street would tell you. Perhaps you’ve even told yourself this: “To make higher returns, you must take more risk.”

But that isn’t the whole truth.

Compared to bonds, for instance, stocks have historically provided much stronger returns. They are indeed both riskier and more volatile than bonds.

But when you look within the stock market, folks, it isn’t that simple.

High volatility — those intraday swings in stock prices — doesn’t always mean higher returns.

Hertz Stock vs. Generac Holdings

For example, I publish a watchlist of the top 10 stocks to consider for your next investment every week. My team and I base this list on several factors, including stocks’ overall Stock Power Ratings. (You can see the latest watchlist here.)

My Stock Power Ratings system ranks stocks between 0 and 100 on six factors:

- Momentum.

- Size.

- Volatility.

- Value.

- Quality.

- Growth.

It assigns each stock an overall Stock Power Rating as well.

But the higher a stock’s Volatility score … the less volatile it is.

That might seem counterintuitive, but stay with me.

Car rental company Hertz Global Holdings Inc. (NYSE: HTZ) stock chart looks like the definition of volatility this year. Its headline-making moments in 2020 included:

- Filing for bankruptcy.

- Billionaire investor Carl Icahn selling his entire stake in HTZ for a loss of more than $1.8 billion.

- Hertz’s stock rising over 800% after retail investors on Robinhood loaded up on it.

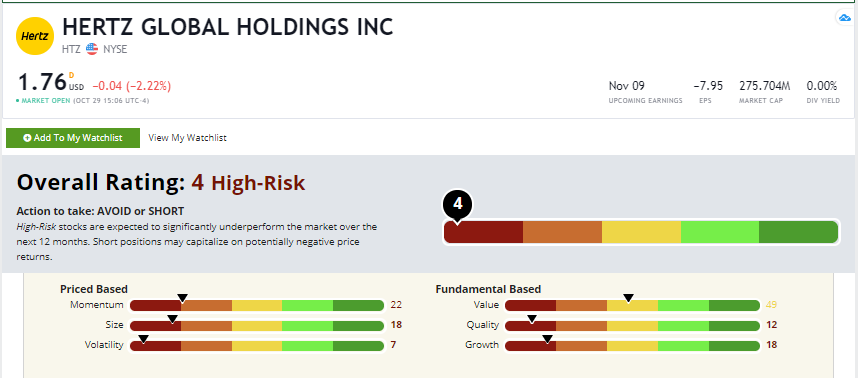

My Stock Power Ratings system tells us we should avoid or short Hertz stock:

Hertz’s Stock Power Ratings on October 29, 2020.

HTZ ranks poorly across the board, but its worst rating of the six factors is its Volatility score, a 7 out of 100.

On the other hand, low volatility (i.e., a high Stock Power Volatility score) doesn’t mean you shouldn’t expect upward movement in a stock.

On July 28, backup-power generation company Generac Holdings Inc. (NYSE: GNRC) made its way onto my Weekly Watchlist:

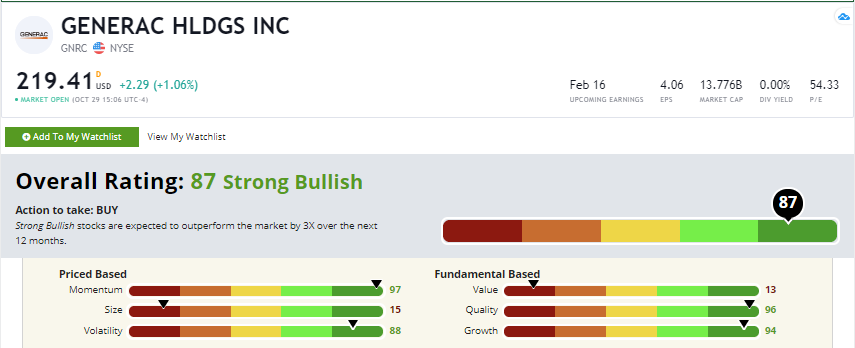

Generac’s Stock Power Ratings on October 29, 2020.

As you can see, this stock ranks an impressive 88 on Volatility (meaning its volatility is low) — but with its overall Stock Power Rating of 87, we still expect it to crush the market by three times over the next 12 months.

And Generac stock is up 62% in the three months since we published the watchlist!

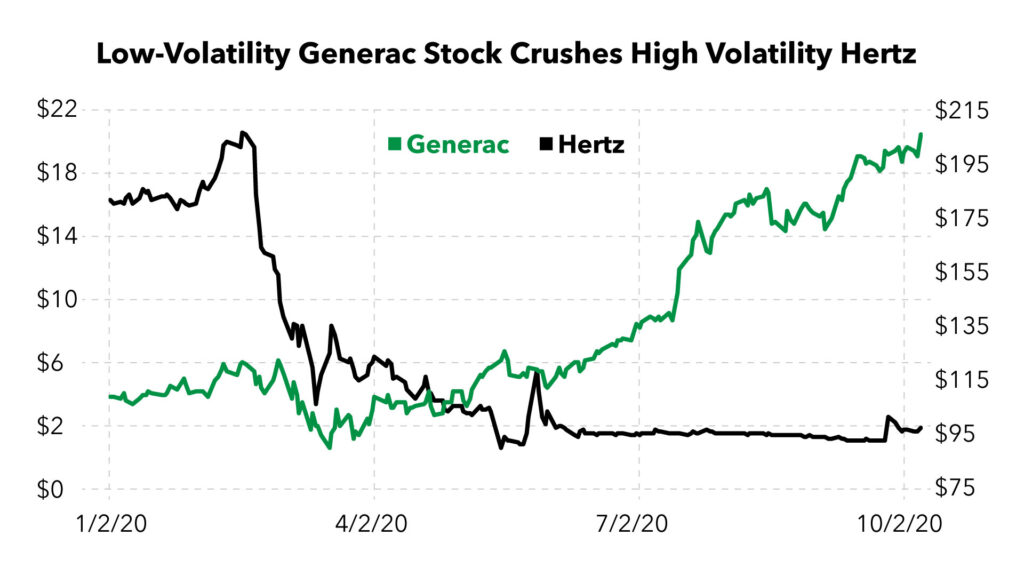

As you can see in the chart below, the volatile Hertz (in blue) is no match against Generac (orange).

Generac is up 112.8% this year, while Hertz has lost 88% of its value.

But wait! There’s more.

Not so Fast…

I told you about Momentum and the Size factor recently.

The Volatility factor is a bit more like the Size factor than Momentum in one way.

I explained that a stock can earn a low score in Size (meaning it’s a large-cap or mega-cap stock) — but it can still outperform the market. This is despite the research showing that smaller stocks are more likely to beat the market in the long run.

Similarly, you won’t necessarily earn the absolute highest return if you buy stocks with the absolute highest Stock Power Volatility score (i.e., the lowest volatility).

It turns out that buying stocks with high and average Stock Power Volatility scores (think: 20 and higher), all other factors being equal, will give you fairly similar returns.

What’s most helpful about the Stock Power Volatility factor is that it can tell you the stocks to avoid at all costs.

Over time, the horrible underperformance of the market’s 20% most volatile stocks is the biggest driver of the Volatility factor.

Based on volatility alone, I’d encourage you to consider buying 80% of all stocks in the market.

Just make sure you don’t buy the worst 20%, high-volatility stocks. Because over time, they will crush you!

The academic research on this unique factor tells us precisely the type of company to avoid at all costs: small, high-volatility “growth” companies that are unprofitable.

I call these companies “high-beta bombs.” (I routinely run screens to make sure the companies I’m recommending are not of this type. I published a list of these stocks in early October, which you can view here.)

All told, the Volatility factor isn’t as powerful as my favorite: Momentum.

But it can help us avoid some of the worst stocks out there.

I don’t choose stocks based on their Stock Power Volatility score alone.

But given the choice between two stocks, which both rank highly on Momentum, Value, Growth and Quality … we can further tip the odds in our favor by choosing the one with lower volatility (i.e., the higher Stock Power Volatility score).

Why Low-Volatility Stocks Outperform

I would be remiss if I didn’t explain the behavioral reasons that low-volatility stocks tend to outperform high-volatility stocks.

1. There’s what’s known as “limits to arbitrage.” This means that smart investors may want to short-sell high-volatility stocks that are unjustifiably overvalued … but they can’t actually do it. This is because of a restriction related to short-selling (i.e., the stock is too expensive to short-sell, or it can’t be “borrowed” from the broker — a necessity of short-selling). What’s more, some institutional funds and individual investors are simply prohibited from short-selling stocks.

For these reasons alone, the unjustified price increases of many high-volatility stocks go “unchecked” by would-be short-sellers who simply can’t make the trade.

2. There’s a pervasive limit and aversion to using leverage. Meaning, a wise investor might choose to buy shares of Walmart, a low-risk, low-volatility stock … and simply leverage their investment (using “margin,” or borrowed money), in order to earn a higher return.

But get this: Most investors are scared of using leverage. It’s like a “four-letter word” to most folks. So, instead of using leverage on a low-volatility stock … many investors choose to buy shares of a higher risk, high-volatility stock. And that leads to more demand for high-volatility stocks (which causes overpricing) and less demand for low-volatility stocks (which causes underpricing).

3. Finally, an even more interesting explanation for many novice investors flocking to high-volatility stocks, even though the academic literature is clear on low-volatility stocks being a better long-term choice: the “lottery ticket” effect.

In the words of Larry Swedroe, a foremost expert on factor investing (and one of my favorite authors):

In the real world, there are investors with a “taste,” or preference, for lottery-like investments. This leads them to “irrationally” invest in high-volatility stocks (which have lottery-like distributions) despite their poor returns. They pay a premium to gamble. Among the stocks that fall into the “lottery ticket” category are IPOs, small-cap growth stocks that are not profitable, penny stocks and stocks in bankruptcy.

That explains Robinhood investors piling into Hertz stock post-bankruptcy, as well as plenty of other examples.

But we don’t need to treat investing like a lottery. If we simply stay disciplined and buy high-ranking Power Stocks — which display market-beating momentum — and avoid those “high-beta bombs,” we’ll do far better.

That’s enough on Volatility for now.

To good profits,

Adam O’Dell

Chief Investment Strategist, Money & Markets