It’s inevitable that equities will come back up after being down, which is why investors should be in a pole position for profits with these three stocks to buy when the market rebounds.

Thousands of businesses and millions of Americans are being crippled by the coronavirus lockdown imposed by governments across the country.

Markets are also volatile, dropping into bear market territory from all-time record highs in record time.

But just as markets fall down, they will get back up at some point. As an investor, you want to be poised to capitalize when they do.

That’s why we have three stocks to buy when the market rebounds.

3 Stocks to Buy When the Market Rebounds

1. KBR Inc.

Market Capitalization: $2.9 billion

Annual Sales (2019): $5.6 billion

5-Year Earnings Growth: 187%

Annual Dividend Yield: 1.93%

Because of the coronavirus lockdown, major construction projects around the country have been paused. But when things open up, it will mean big things for companies like KBR Inc. (NYSE: KBR).

KBR is a Houston-based engineering and construction company that works on projects like stadiums and oil rigs.

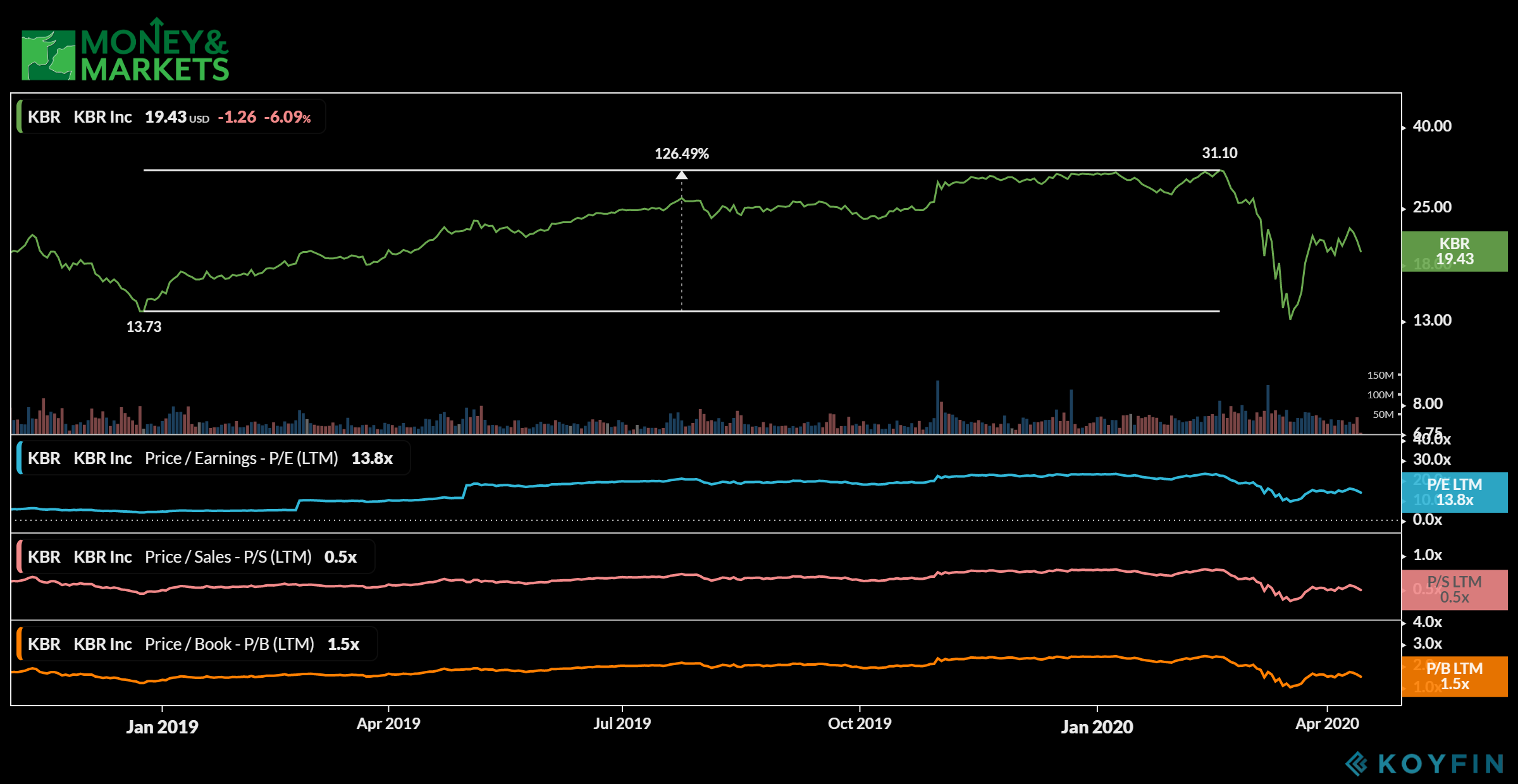

From the end of December 2018 to the beginning of the market crash in mid-February 2020, KBR stock jumped more than 126% on the back of all the significant projects it worked on.

The market drop then shed nearly half its share price. However, the company has started to come back, despite continued talks of recession.

Its current share price of around $20 is a bargain for a company its size. That figure has KBR undervalued with a price to sales of 0.5 and a price to book of 1.5. It has a price-to-earnings ratio of 13.7.

Another benefit of KBR is it pays shareholders a slight dividend. Its last dividend payment was $0.10 per share — up from the $0.08 rate it paid the previous seven quarters.

It’s priced low enough for even the hobby investor, and coupled with the fact that construction will pick back up once the COVID-10 outbreak has passed, KBR is one of the three stocks to buy when the market rebounds.

2. Booz Allen Hamilton Holding Corp.

Market Capitalization: $10.6 billion

Annual Sales (2019): $6.7 billion

5-Year Earnings Growth: 69.3%

Annual Dividend Yield: 1.63%

Companies that work with the U.S. government are typically positioned to earn a profit, even in down times. Booz Allen Hamilton Holding Corp. (NYSE: BAH) is no different.

The Virginia company provides management and technology consulting services to the U.S. government in defense, intelligence and civil markets — including cybersecurity.

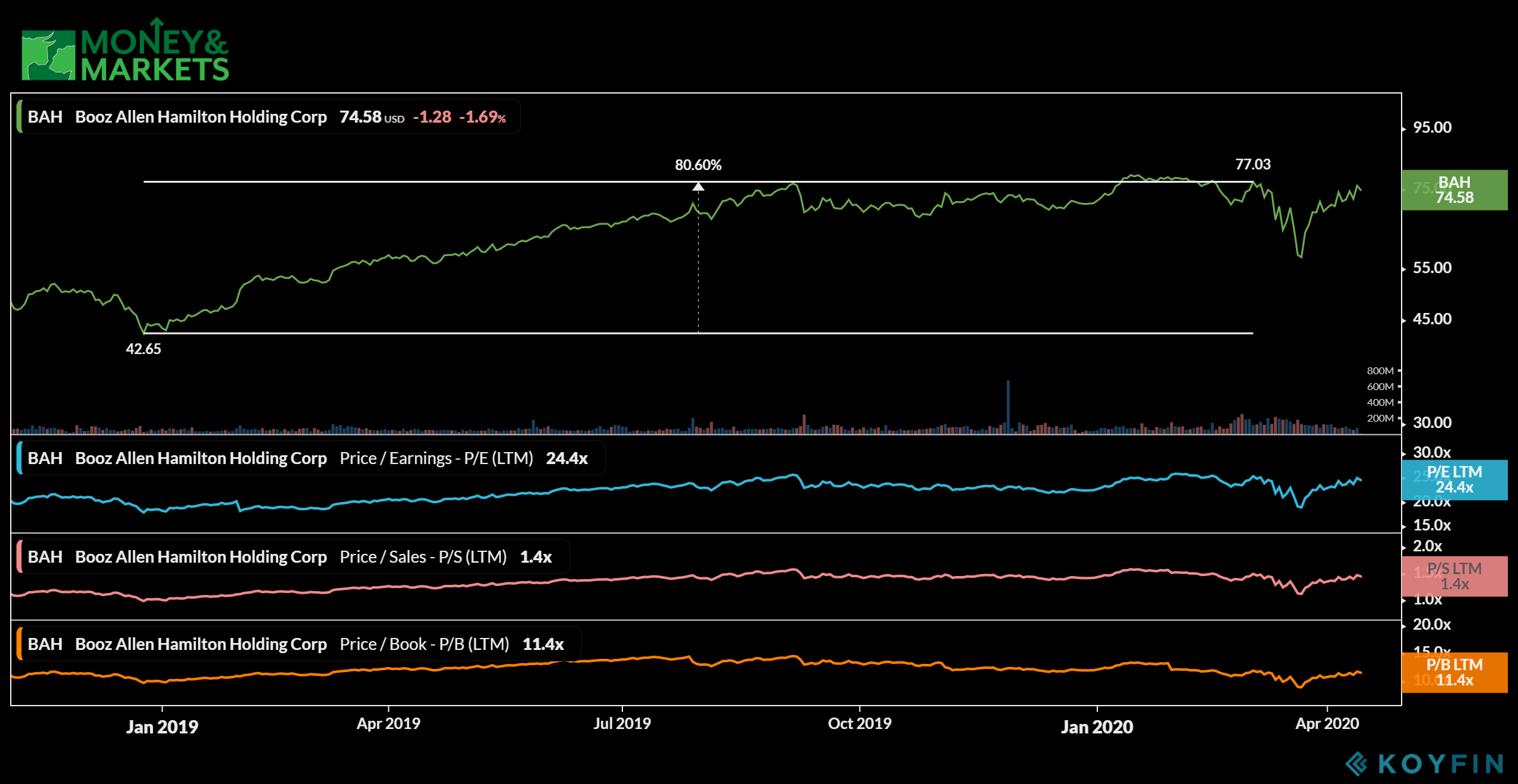

The company had a tremendous year in 2019 as its share price jumped more than 80%.

What’s even better is that Booz Allen weathered the recent market fall much better than most companies. Its share price rebounded close to its post-crash level.

Its current price of around $75 per share is higher than KBR and very close to its 52-week high of $82.

The stock remains a good value with a price-to-sales ratio of 1.4 and a price-to-book ratio of 11.5. It’s also less prone to overall market volatility with a 60-month beta of 0.86.

Booz Hamilton also rewards its shareholders with a dividend each quarter. Its last dividend payment was $0.31 per share, which jumped from the $0.19 per share it paid in 2018.

Overall, the company provides necessary services to the U.S. government which won’t change no matter what the market conditions are. That’s why Booz Allen Hamilton Holding Corp. is one of the three stocks to buy when the market rebounds.

3. Domino’s Pizza Inc.

Market Capitalization: $13.9 billion

Annual Sales (2019): $3.6 billion

5-Year Earnings Growth: 230%

Annual Dividend Yield: 0.87%

Everybody likes pizza, right? Well, Domino’s Pizza Inc. (NYSE: DPZ) is the second-largest pizza restaurant chain in the world.

While it focuses on pizza delivery, a good portion of its overall sales also come from carryout customers. It has a mix of corporate and franchise stores around the world.

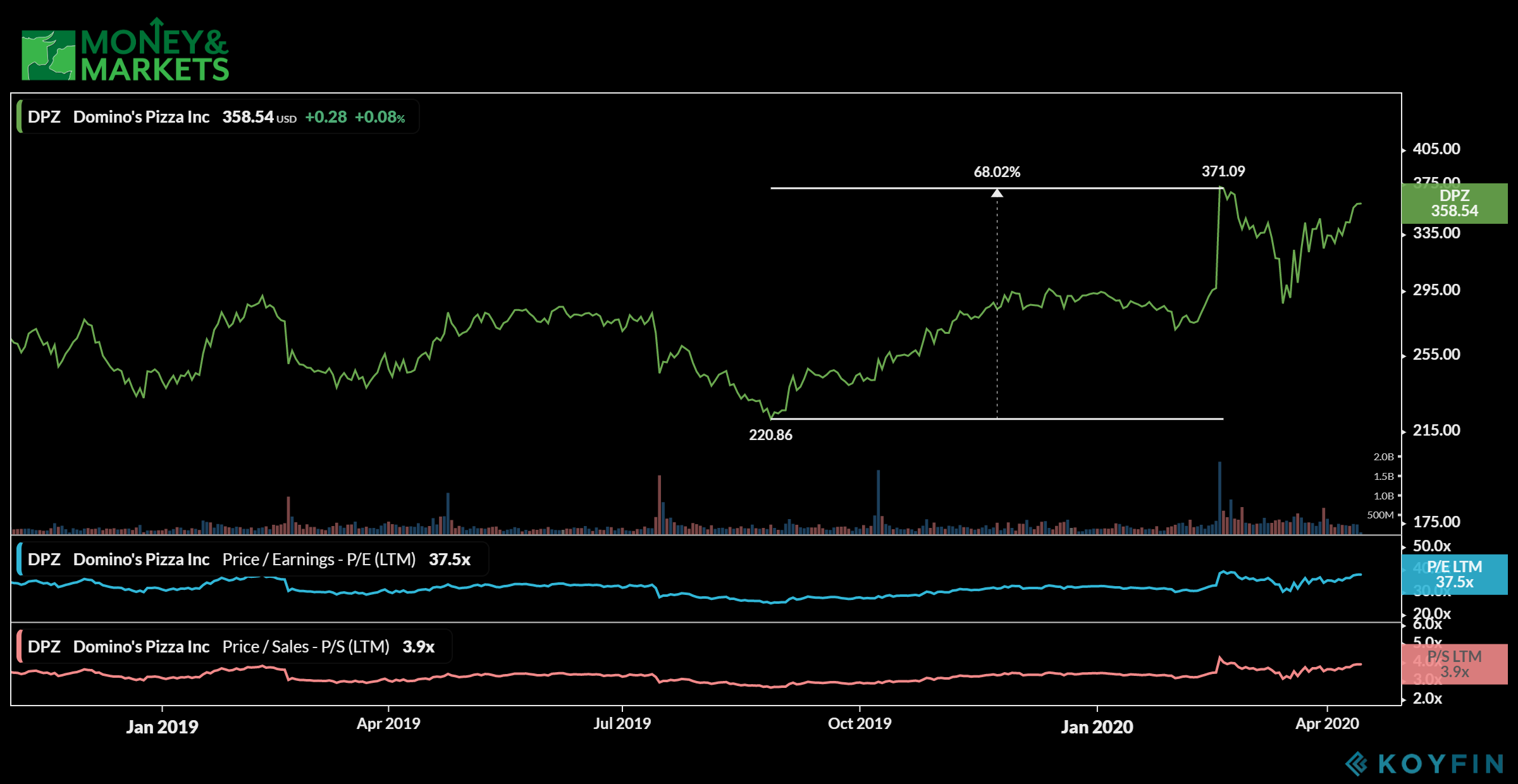

Just prior to the market crash, the company’s share price jumped about 26% from July 2019 to early February 2020. Then, it bounced another 40% in short order. Shares trended down in March but have climbed back up nicely.

Domino’s is the most expensive stock on our list with a current price of around $358 per share. It’s still short of its 52-week high, but it’s moving up thanks to its contactless pizza delivery option.

The company’s stock is extremely stable, with a 60-month beta of 0.3. Over the last five years, Domino’s has seen earnings growth of 230%.

Its value is a little high with a price-to-earnings ratio of 37.5, but Domino’s price to book is 3.9.

While the price is a bit high, the company does come with a very good dividend. Its last dividend payment was $0.78 in March — up from the $0.65 per share it paid in the last quarter of 2019.

A big dividend coupled with a continued pattern of growth puts Domino’s Pizza Inc. on our list of the three stocks to buy when the market rebounds.

All of these companies come with dividends — which is great for investors in any market condition. But they also have growth potential and the ability to show shareholders gains when the market returns.

That’s why they are our three stocks to buy when the market rebounds.

Editor’s Note: Booz Allen Hamilton was profiled in five stocks that drenched investors in cash in 2019.