Markets are up fairly big this morning, political ads are down on Facebook plus stocks to watch today in the Money and Markets Wall Street Wake-Up.

The Morning Open

The U.S. markets opened up big Thursday morning with the Dow Jones Industrial Average jumping 122 points, or 0.4% as of 10 a.m. Eastern time.

The S&P 5oo rose by nearly 0.4% while the Nasdaq was up 0.7%.

The Opening Bell

Oil prices were down under $60 a barrel early Thursday, falling from their recent highs of $65. Other safe havens, such as gold and 10-year Treasurys, also were down. Gold dropped 0.3% while the U.S. 10-year Treasury was down 0.01%.

In other market-related news, U.S. jobless claims dropped but the number of unemployed rose to a 1 1/2-year high, according to Labor Department statistics released Thursday morning.

Stocks to Watch Today

Bed Bath & Beyond Inc. (Nasdaq: BBBY) — The domestic retailer was down nearly 12% in Thursday premarket trading after it reported less-than-stellar earnings and withdrew its 2019 outlook.

Tesla Inc. (Nasdaq: TSLA) — The electric carmaker saw its stock rise nearly 5% Wednesday and it was up another 1.3% in premarket trading Thursday, even after Baird Equity Research downgraded Tesla to “neutral” from “outperform.”

Voya Financial Inc. (NYSE: VOYA) — The financial, investment and insurance company saw its shares jump 0.9% in premarket trading Thursday following the news the company is eyeing a possible sale.

In the News

Facebook Inc. (Nasdaq: FB) announced new updates including letting users see fewer political ads, according to CNBC.

As the 2020 presidential campaign gets into full swing, Facebook joined Twitter Inc. (NYSE: TWTR) — who banned political ads completely — and Google (Alphabet Inc. (Nasdaq: GOOGL) in limiting how political groups can target users with paid ads.

All three companies saw their stock price elevate in premarket trading Thursday.

China Sending Chief Trade Negotiator to Sign Phase-One Trade Deal

Chinese President Xi Jinping is sending chief trade negotiator Liu He to Washington next week to sign a phase-one trade agreement with the U.S., according to The Wall Street Journal.

The two sides announced a trade deal on Dec. 13. It includes China increasing it purchases of farm goods and other products from the U.S., opening the Chinese financial sector, not devaluing the Chinese yuan and to better protect American intellectual property.

Oil and Gas Heading in Opposite Directions

The oil-to-gas price ratio has expanded to its highest in six years, according to Reuters.

The level at which oil trades compared with natural gas hit 30-to-1 recently and analysts are anticipating natural gas prices to fall for a second year in 2020 to their lowest levels in more than 20 years.

The main reason for the divergence is because U.S. drillers aren’t looking for gas. They are seeking more valuable oil and natural gas liquid.

Other Morning Reads

5 5G ETFs to Buy Now (Money and Markets)

WeWork Hits the Brakes in New York, London After IPO Debacle (Bloomberg)

Reliable ‘Buffett Indicator’ Flashing Market Crash Warnings (Money and Markets)

Earnings Report

Here are the companies releasing earnings reports today:

PriceSmart Inc. (Nasdaq: PSMT)

WD-40 Co. (Nasdaq: WDFC)

Simply Good Foods Co. (Nasdaq: SMPL)

Synnex Corp. (NYSE: SNX)

Franklin Covey Co. (NYSE: FC)

Chart of the Day

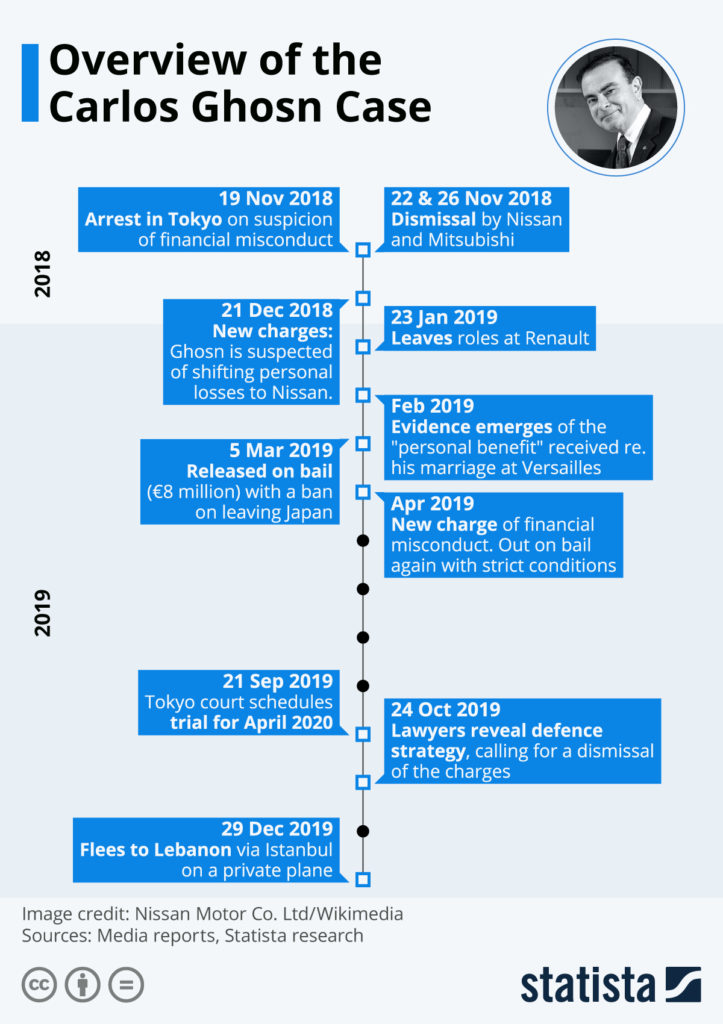

Say what you will about the case surrounding former Nissan boss Carlos Ghosn, but his escape from Japan has been nothing short of interesting.

Ghosn, who is charged with financial misconduct in Japan, recently fled — under cover of darkness in a box made for large musical instruments — to Lebanon via Turkey. He held a press conference Wednesday, attacking the Japanese justice system.

Check back each morning before the opening bell for stocks to watch today with the Wall Street Wake-Up, here on Money and Markets.