A Swiss bank spy scandal costs a high-profile job, earnings aren’t yielding big gains plus stocks to watch today in the Money and Markets Wall Street Wake-Up.

The Morning Open

Despite a strong jobs report this morning, U.S. equities markets have opened down Friday morning.

As of the market open, the Dow Jones Industrial Average dropped 0.4% while the S&P 500 and Nasdaq Composite were both down 0.3%

The Opening Bell

More than half of the companies listed in the S&P 500 reported, though, stronger earnings aren’t typically reaping big rewards for investors.

According to analysis by FactSet, companies reporting earnings beats have only gained 0.7% in share price.

However, the response to companies reporting weaker earnings hasn’t been as strong in the other direction either. Shares of companies falling behind analysts’ expectations have dipped 2.1%, compared to a five-year average loss of 2.6%.

U.S. markets have used most of this week to rally back losses from late last week. Those losses were attributed to investor fears over the coronavirus.

In all, 71% of S&P 500 companies that have reported earnings have beaten Wall Street expectations — that falls in line with the five-year average of 72%. Analysts are forecasting a 0.7% growth in S&P 500 earnings quarter-over-quarter.

Stocks to Watch Today

Canadian Goose Holdings Inc. (NYSE: GOOS) — The Canadian-based clothing manufacturer reported stronger profit and revenue but said the coronavirus is having “a material impact” during the current quarter. Shares of Canadian Goose were off 7% in premarket trading.

Spirit Aerosystems Holdings Inc. (NYSE: SPR) —The Boeing Co. (NYSE: BA) subcontractor cut its dividend to $0.01 following the grounding of the 737 Max. The company said the cut was “in the best interests of Spirit and its stockholders.” Shares of the company dropped 2.9% in Friday premarket trading.

Aurora Cannabis Inc. (NYSE: ACB) — Shares of the Canadian-based cannabis producer were down 16% Friday morning after Thursday’s announcement that CEO Terry Booth was resigning and the company would be shedding jobs due to weak performance.

In the News

Amid allegations of spying on a former executive, Credit Suisse Group AG (NYSE: CS) CEO Tidjane Thiam has been ousted.

Several media reports said the board gave “unanimous” support to Chairman Urs Rohner to replace Thiam with 20-year company veteran Thomas Gottstein.

The conflict between Thiam and Rohner escalated after allegations surfaced that former Credit Suisse executive Iqbal Khan was attempting to poach former employees and clients after he left the Swiss investment bank.

The bank ordered surveillance of Khan — who was subsequently cleared.

Another spying allegation was that Thiam ordered surveillance on the bank’s former head of human resources last year.

Thiam will officially step down when the bank presents its Q4 report to investors next week.

Shares of the bank were down 1.3% in premarket trading.

Wynn Loses $2.6 Million Each Day its Macao Casino is Closed

Due to the coronavirus outbreak in China, casinos in Macao are closed and costing owners millions.

Among the biggest is Wynn Resorts Ltd. (Nasdaq: WYNN), which is losing $2.6 million every day its operations are shut down, according to CNN Business.

Wynn employs more than 12,200 people at its property in the semi-autonomous Chinese territory. The Chinese government ordered casinos closed nearly two weeks ago.

Elliott Management Builds More Than $2.5 Billion Stake in SoftBank

Investment firm Elliott Management Corp. has made SoftBank Group Corp. one of its biggest bets to date.

The New York-based Elliott has built up a $2.5 billion stake in the Japanese technology conglomerate and The Wall Street Journal reports it is pushing SoftBank to make changes to boost share price.

Some of those changes include more transparency and management of business decisions at SoftBank’s $100 billion Vision Fund.

Other Morning Reads

4 Cloud Software Stocks to Buy Now (Money and Markets)

NASA Budget Will Earmark 12% Increase for 2021 (The Wall Street Journal)

Aurora Cannabis CEO Steps Down Amid Massive Restructuring (Money and Markets)

Earnings Report

Here are the companies releasing earnings reports today:

AbbVie Inc. (NYSE: ABBV)

Canada Goose Holdings Inc. (NYSE: GOOS)

Domtar Corp. (NYSE: UFS)

Honda Motor Co. Ltd. (NYSE: HMC)

Madison Square Garden Co. (NYSE: MSG)

Chart of the Day

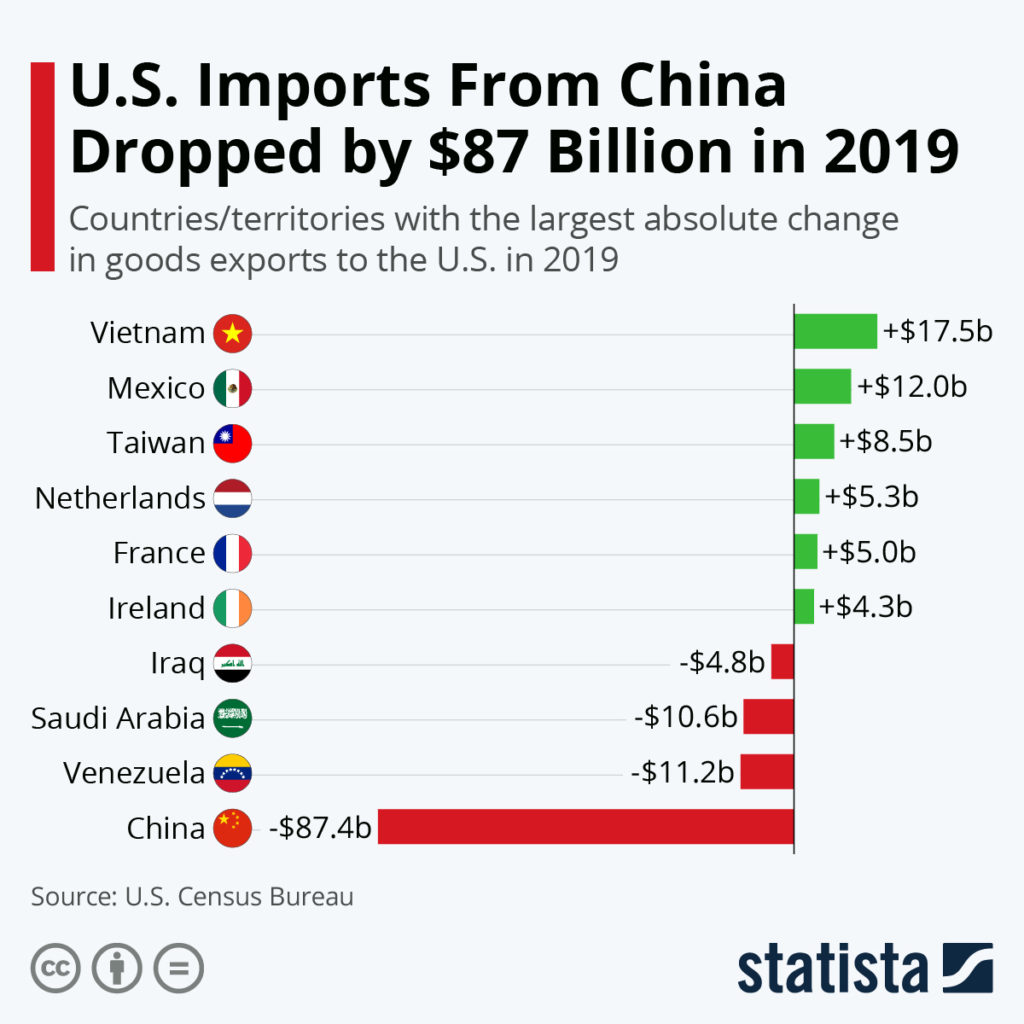

The trade war between the U.S. and China had a drastic impact on U.S. imports.

According to the U.S. Census Bureau, imports to China dropped $87.4 billion in 2019. U.S. imports also fell off to Venezuela, Saudi Arabia and Iraq.

On the other side of the coin. Imports to Vietnam jumped $17.5 billion.

Overall, the U.S. trade deficit in goods and services declined by $10.9 billion in 2019.

Check back each morning before the opening bell for stocks to watch today with the Wall Street Wake-Up, here on Money and Markets.