Goldman Sachs is looking at a multi-billion-dollar fine plus stocks to watch today in the Money and Markets Wall Street Wake-Up.

The Market Open

As of 10 a.m., U.S. markets were up.

The Dow Jones Industrial Average was up 0.25% to 28,308.9 while the S&P 500 jumped 0.1% and the Nasdaq was up nearly 0.2%.

The Opening Bell

Wall Street giant Goldman Sachs is in talks with the Justice Department to pay a nearly $2 billion fine to settle a criminal investigation, according to an exclusive report from the Wall Street Journal.

The settlement would also include a subsidiary of Goldman Sachs Group Inc. (NYSE: GS) admitting guilt to U.S. bribery law.

It comes after an investigation into the looting of money from a Malaysian government fund known as 1MDB. One Goldman banker has already agreed to a lifetime ban from the securities industry as a result of the investigation.

Stocks to Watch Today

Micron Technology Inc. (Nasdaq: MU) — The microchip maker reported earnings and revenue above expectations Wednesday. It’s adjusted quarterly earnings were $0.48 a share — $0.01 above estimates.

Rite Aid Corp. (NYSE: RAD) — The national drug store chain blew Wall Street estimates out of the water with its quarterly earnings. The company reported quarterly profits of $0.54 compared to estimates of $0.09.

FactSet Research Systems Inc. (NYSE: FDS) — The Connecticut-based financial data and software company reported its quarterly profit at $2.58 per share — $0.16 above Wall Street estimates. But its revenue was below forecasts.

In the News

On Thursday, China announced six chemical and oil products would be exempt from import tariffs, according to CNBC.

The waivers apply to high-density polyethylene, linear low-density polyethylene and refined oil products including white oil and food-grade petroleum wax, according to the report.

The Finance Ministry said the tariff exemptions would be for a year from Dec. 26 and that duties already imposed on U.S. products would not be refunded.

Energy Stocks Continue to Be Biggest Losers

In eight of the last nine years, natural gas and energy stocks have been the biggest losers in the U.S. market.

2019 isn’t going to be any different, according to CNN Business.

The S&P 500’s energy sector generated returns of just 6% — including dividends — for the year, making it the weakest sector in the market.

Options Traders Still Looking for Insurance Despite Market Upswing

Don’t let the good market news fool you, options traders aren’t necessarily buying it.

While the Nasdaq, S&P 500 and Dow Jones Industrial Average have enjoyed a run of recent gains, the Wall Street Journal reports that option traders are still buying contracts that pay if the S&P 500 falls in the coming months.

The S&P 500 has jumped 27% this year, but traders still remember 2018 when markets jumped all year — until a big sell-off in December that sent markets lower for the year. The S&P 500 itself has risen better than 25% this year.

Other Morning Reads

Former Officials Say Federal Reserve Is Creating Crisis Environment (Money & Markets)

Instagram Bans Influencers From Getting Paid to Promote Vaping and Guns (CNBC)

China Won’t Rush Into Ag Purchases Under “Phase One” Deal (South China Morning Post)

Earnings Report

Here are the companies releasing earnings reports today:

Conagra Brands Inc. (NYSE: CAG)

Accenture PLC (NYSE: ACN)

Nike Inc. (NYSE: NKE)

Shiloh Industries Inc. (Nasdaq: SHLO)

Scholastic Corp. (Nasdaq: SCHL)

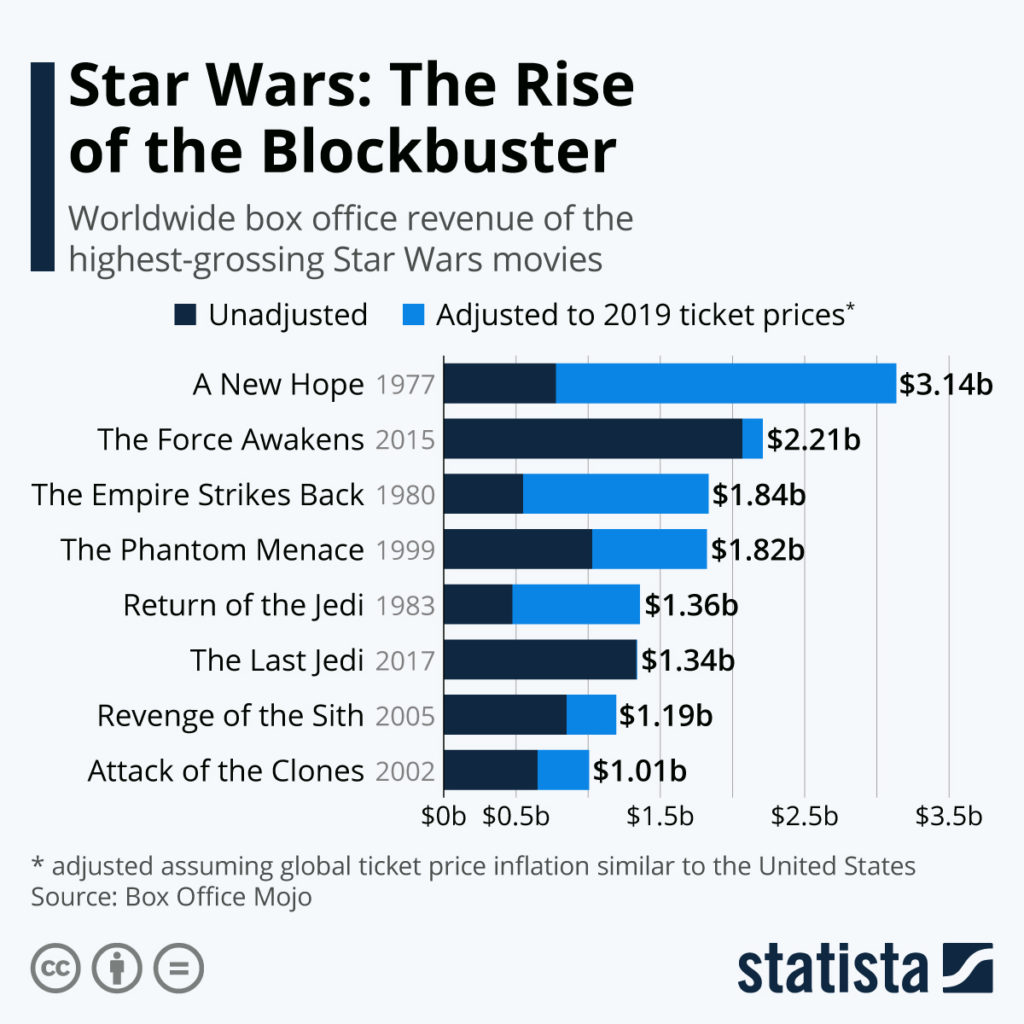

Chart of the Day

It’s a big week for Star Wars fans as “Star Wars: The Rise of Skywalker” is officially released today.

It will be hard for the last in the Star Wars franchise films to top the first. “Star Wars: A New Hope” was the highest-grossing film in the series, bringing in $3.14 billion — when adjusted to 2019 ticket prices.

“Star Wars: The Force Awakens” brought in $2.21 billion following its release in 2015.

Check back each morning before the opening bell for stocks to watch today with the Wall Street Wake-Up, here on Money and Markets.