Market futures are up, European markets near record highs plus stocks to watch today in the Money and Markets Wall Street Wake-Up.

The U.S. Markets Open Strong Monday

After strong premarket trading, U.S. markets opened Monday up to near-record levels.

The Dow Jones Industrial Average opened up 0.6% at the morning bell. The S&P 500 opened up 0.7% and the Nasdaq opened up 0.8%. The gains would likely be higher if not for a posted 2% loss by Boeing Co. after a report in the Wall Street Journal suggested the aircraft maker was pondering a halt in 737 Max production.

The Opening Bell

Despite the limited details of the phase one U.S.-China trade deal, Wall Street is responding positively.

Dow Jones Industrial Average futures were up as much as 0.2%, while S&P 500 futures jumped 0.4% Monday morning. Nasdaq futures climbed 0.4%.

On Sunday, U.S. Trade Representative Robert Lighthizer told “Face the Nation” the phase one deal was finished and that it addresses agriculture as well as intellectual property, enforcement of financial services and currency.

“This is something that happens in every agreement. There’s a translation period. There are some scrubs. This is totally done. Absolutely. But can I make one point? Because I think it’s really important. Friday was probably the most momentous day in trade history ever,” Lighthizer told Margaret Brennan Sunday. “That day we submitted the USMCA, the Mexico-Canada Agreement with bipartisan support and support of business, labor, agriculture.”

Stocks to Watch Today

Amarin Corp. (Nasdaq: AMRN) — This Irish-based pharmaceutical company just received Food and Drug Administration approval for a new label usage for its Vascepa drug. The drug is aimed at reducing heart attacks and strokes in high-risk patients. Company stock is up 8% Monday premarket trading.

PG&E Corporation (NYSE: PCG) — The California utility had its bankruptcy reorganization plan rejected by California Gov. Gavin Newsom. The governor said the plan doesn’t comply with state law. PG&E stock is down 25% on premarket trading Monday morning.

DuPont de Nemours Inc. (NYSE: DD) — DuPont’s nutrition and biosciences unit is acquiring International Flavors and Fragrances (NYSE: IFF). DuPont shareholder will own 55.4% of the new companies while IFF shareholders will own 44.6%. DuPont shares were up 4.9% on Monday premarket trading. IFF shares were down 5%.

In the News

Thanks to the recent UK election and ease in U.S-China trade tensions, European stocks moved to near-record levels Monday.

Markets in the U.K., France and Germany were all up. The German DAX jumped 0.6% while the French CAC 40 moved up 1$ and the UK FTSE 100 jumped up 1.2%. The market was up despite a report that the eurozone manufacturing purchasing index dropped to a two-month low in December.

Bank of America: Market Set for “Melt-Up” in 2020

In a note to clients, Bank of America analysts said the financial markets are set for a “risk asset melt-up,” according to a report in Bloomberg.

Analysts concluded that with a Brexit resolution in the offing and the European Central Bank and Federal Reserve adding liquidity, their outlook for the beginning of 2020 was bullish.

Boeing Is Considering a Halt on 737 Max Production

Boeing Co. (NYSE: BA), is examining a possible halt to its 737 Max production, according to a report in the Wall Street Journal.

It is possible Boeing officials could make a final decision as early as today, according to the report. Boeing stock was down nearly 4% Monday in premarket trading.

Other Morning Reads

U.S. Steel, the Company That Built America, Faces Its Age (Wall Street Journal)

AT&T 5G Isn’t The 5G You Think It Is … Or Want It To Be (Money & Markets)

China Suspends Tariffs on U.S.-Made Cars, Corn and Other Goods (CNN Money)

Earnings Report

Here are the companies releasing earnings reports today:

Anavex Life Sciences (Nasdaq: AVXL)

Heico Corp. (NYSE: HEI)

Kewaunee Scientific (Nasdaq: KEQU)

Chart of the Day

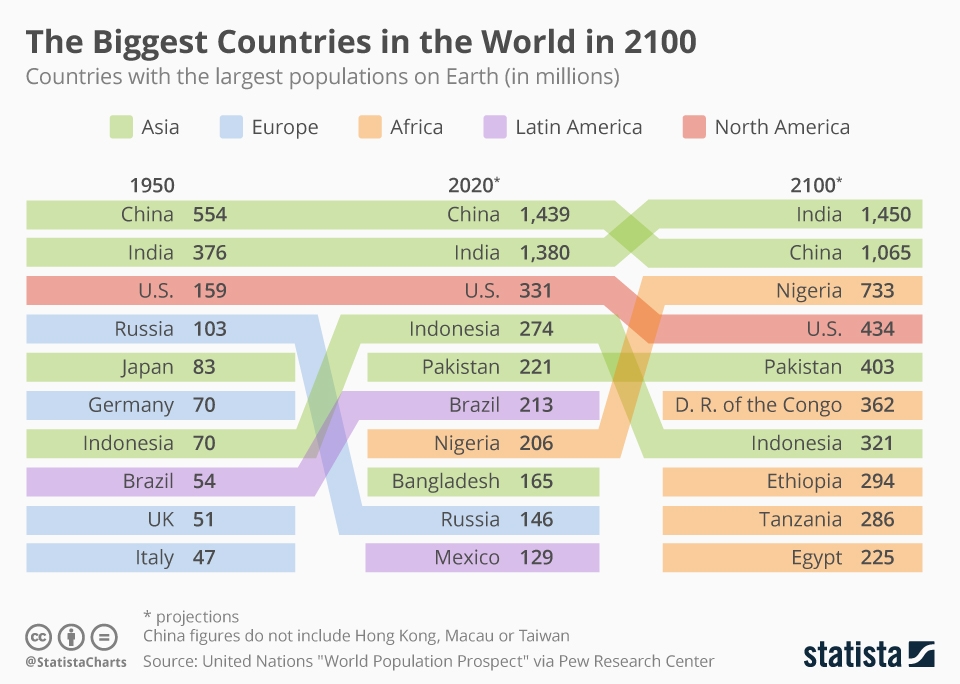

According to research from the United Nations and Pew Research Center, five of the largest countries in the world in 2100 will be in Africa.

This is a stark difference from 2020 when only Nigeria is listed as one of the top 10 countries by population. By 2100, Nigeria could be the third-largest country in the world and be joined by the Democratic Republic of the Congo, Ethiopia, Tanzania and Egypt.

The research showed India will surpass China as the largest while the United States will fall to fourth. Pakistan and Indonesia will be the other countries in the top 10 in 2100.

Check back each morning before the opening bell for stocks to watch today with the Wall Street Wake-Up, here on Money and Markets.