The microscope on big tech gets wider, the South Korea movie payout, plus stocks to watch today in the Money and Markets Wall Street Wake-Up.

The Morning Open

U.S. markets were set for a much stronger day Wednesday as the three main indices opened up.

As of 10:30 a.m. Eastern time, the Dow Jones Industrial Average was up 0.75% after a lackluster performance Wednesday. The S&P 500 moved up 0.4% while the Nasdaq Composite jumped 0.3%.

The Opening Bell

The federal government is expanding its probe in acquisitions made by big tech companies over the past decade.

On Tuesday, the Federal Trade Commission announced it has requested acquisition information from Amazon.com Inc. (Nasdaq: AMZN), Apple Inc. (Nasdaq: APPL), Alphabet Inc. (Nasdaq: GOOG) and Microsoft Corp. (Nasdaq: MSFT) going back 10 years.

According to CNN Business, the FTC is focusing on acquisitions made that were not required to be reported to antitrust agencies because of the lower dollar amount of those moves.

In a release, FTC Chairman Joseph Simons said the study will allow regulators to determine if “federal agencies are getting adequate notice of transactions that might harm competition.”

The agency is already probing Facebook Inc. (Nasdaq: FB) while Google is under an antitrust investigation by the Justice Department. The DOJ is also reviewing the entire tech industry for data practices and the handling of online content.

Additionally, the House Antitrust Subcommittee has opened its own investigation into big tech companies.

Stocks to Watch Today

Shopify Inc. (NYSE: SHOP) — The online retailer reported earnings of $0.43 per share — beating expectations of $0.24 per share. Its reported revenue also beat Wall Street forecasts. Shares of Shopify were up 7.7% Wednesday morning.

CVS Health Corp. (NYSE: CVS) — The retail pharmacy chain beat analysts’ estimates for quarterly earnings and revenue. It also reported full-year earnings that were higher than expected. As a result, shares of CVS were up 2.6% in premarket trading.

Lyft Inc. (Nasdaq: LYFT) — Shares of the ride-hailing company dropped 5.1% early Wednesday morning after reporting an earnings loss of $1.19 per share. Its revenue for the quarter did, however, beat analysts’ estimates and the company said it was on track for profitability by the end of 2021.

In the News

Who knew the Korean movie industry could pay off so handsomely?

A small South Korean hedge fund that invested nearly $500,000 in the Oscar-winning moving “Parasite” has returned 72.1% since launching in July 2018, according to Bloomberg.

Ryukung PSG Asset Management only invests in movies distributed by Korea’s CJ Group. It manages about $2.6 billion in assets.

“Parasite” recently won the Oscar for best picture and has brought in $165 million at the box office. It cost just $11 million to make and ticket sales are expected to jump after the Oscar win.

In the U.S., the average stock market return is about 10% annually while the best-performing mutual funds return around 14%.

Nissan Sues Former CEO Carlos Ghosn in Japan

It’s the battle that never seems to end.

Nissan Motor Co. is now seeking $90 million in damages from former CEO Carlos Ghosn related to his alleged financial misconduct.

The latest suit in Japan comes just a month after Ghosn fled the country for his native Lebanon.

Ghosn has sued Nissan in the Netherlands, seeking nearly $18 million in damages and has denied any wrongdoing regarding the criminal charges he faced in Japan.

Samsung Enters Folding Smartphone Fray

No, it’s not the late 90s, but the battle for flip phone supremacy is ramping up again.

On Tuesday at an event in San Francisco, Samsung unveiled a new foldable smartphone called the Galaxy Z Flip.

Its screen is 6.7 inches and will cost $1,380, according to CNN Business. Samsung plans to put the phone on sale beginning Friday, Feb. 14, in select stores and cities.

Other Morning Reads

3 Cheap 5G Stocks to Buy Right Now (Money and Markets)

Coronavirus Toll on Shipping Reaches $350 Million a Week (The Wall Street Journal)

Peter Schiff Blasts Fed Chief Powell for ‘Fooling the Markets’ (Money and Markets)

Earnings Report

Here are the companies releasing earnings reports today:

Ares Capital Corp. (Nasdaq: ARCC)

Cisco Systems Inc. (Nasdaq: CSCO)

CVS Health Corp. (NYSE: CVS)

HubSpot Inc. (NYSE: HUBS)

U.S. Global Investors Inc. (Nasdaq: GROW)

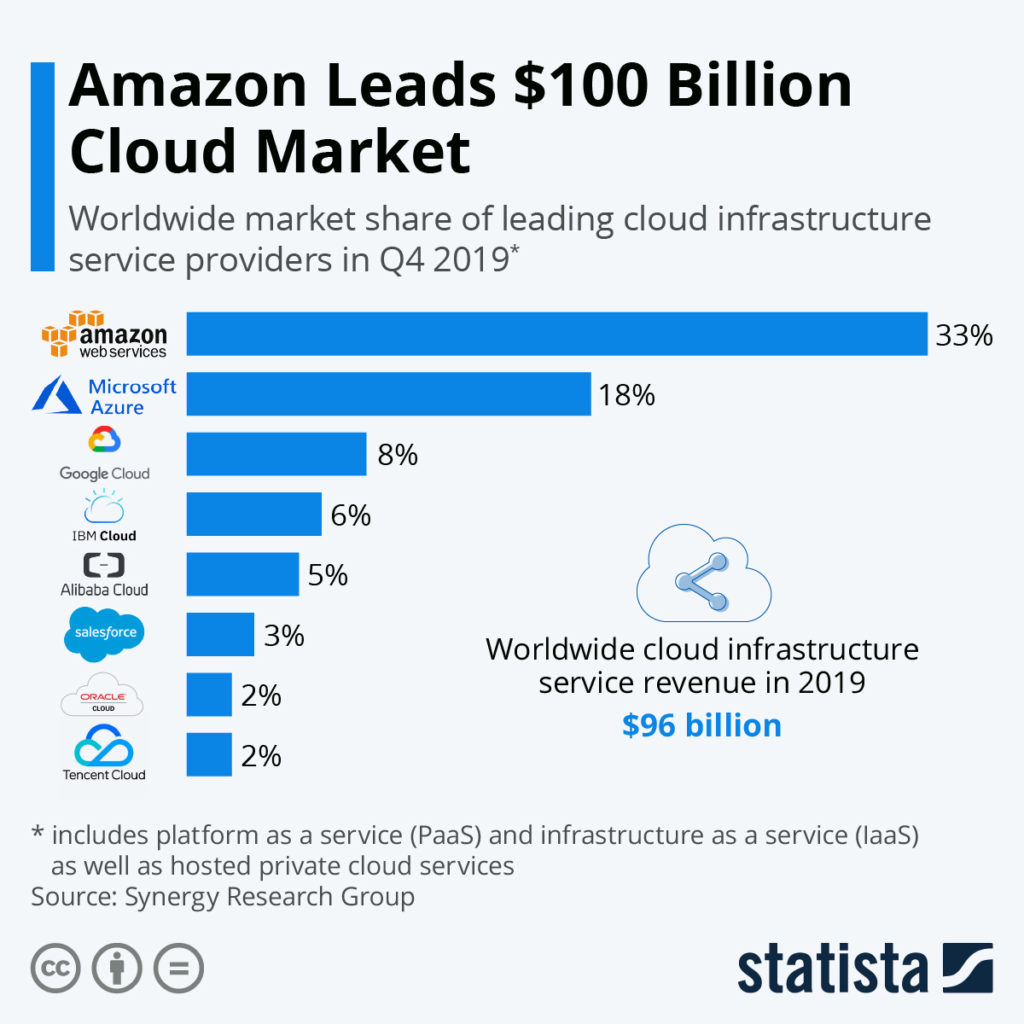

Chart of the Day

It may be an interesting court battle but don’t be mistaken: Amazon still holds a commanding market share in the cloud space, despite losing the JEDI defense contract to rival Microsoft.

According to Synergy Research Group, Amazon holds 33% of the $100 billion cloud market. Microsoft is a distant second with 18% and Google is third with 8%.

Check back each morning before the opening bell for stocks to watch today with the Wall Street Wake-Up, here on Money and Markets.