Today is trade deal day, plus stocks to watch today in the Money and Markets Wall Street Wake-Up.

The Morning Open

Market futures were mixed, but they were up following Wednesday’s open.

As of 10 a.m. Eastern time, the Dow Jones Industrial Average was up 0.4%, or 122 points. The S&P 500 saw a 0.3% gain while the Nasdaq was up nearly 0.4%.

The Opening Bell

President Donald Trump will sign a phase one trade deal with China Wednesday. The deal keeps some tariffs in place and could punish China for not fulfilling parts of its end of the agreement, according to Bloomberg.

Treasury Secretary Steve Mnuchin told CNBC the some of those tariffs in place could be rolled back with the “phase two” part of the trade deal.

Stocks to Watch Today

Target Corp. (NYSE: TGT) — Shares of the retailer were down nearly 7% in Wednesday premarket trading after the company reported “disappointing” holiday sales growth and maintained its Q4 guidance.

BlackRock Inc. (NYSE: BLK) — The global investment company beat both revenue and earnings estimates. Shares of the company were up 0.1% in Wednesday premarket trading.

UnitedHealth Group Inc. (NYSE: UNH) — The Minnesota-based for-profit health care company reported an earnings beat, but revenue was just below forecasts. Shares were up 0.09% in premarket trading.

In the News

Nissan Corp. is recalling around 308,000 vehicles in the U.S. to replace potentially faulty airbag inflators, according to the Associated Press.

The Takata inflators could inflate and explode. This is the last recall the now-bankrupt Takata agreed to as part of a 2015 settlement with U.S. safety regulators.

Sprint/T-Mobile Deal Concern Mounts on Wall Street

The proposed merger between Spring Corp. (NYSE: S) and T-Mobile US Inc. (Nasdaq: TMUS) is still not setting well with some on Wall Street, according to The Wall Street Journal.

Sprint shares are trading at a 40% discount to the value of T-Mobile’s all-stock deal — worth nearly $34 billion. The discount has increased since a group of states filed a lawsuit against the deal, citing antitrust issues.

Amazon to Pour Money Into India

Amazon.com Inc. (Nasdaq: AMZN) CEO Jeff Bezos said his company plans to spend $1 billion on small business development in India over the next five years, according to CNN Business.

He said the plan was to help manufacturers, resellers, shops and brands in the country. He said the investment could help traders export $10 billion in Indian-made goods in the next five years.

Other Morning Reads

Biden Is Trying to Flip His Social Security Script After Seeking Cuts for Decades (Money and Markets)

Tesla Skeptic With Downgrader’s Remorse Digs In Over Valuation (Bloomberg)

Earnings Are in Recession but Investors Are Hopeful for a 2020 Rebound (Money and Markets)

Earnings Report

Here are the companies releasing earnings reports today:

Alcoa Corp. (NYSE: AA)

Bank of America Corp. (NYSE: BAC)

BlackRock Inc. (NYSE: BLK)

Goldman Sachs Group Inc. (NYSE: GS)

U.S. Bancorp (NYSE: USB)

Chart of the Day

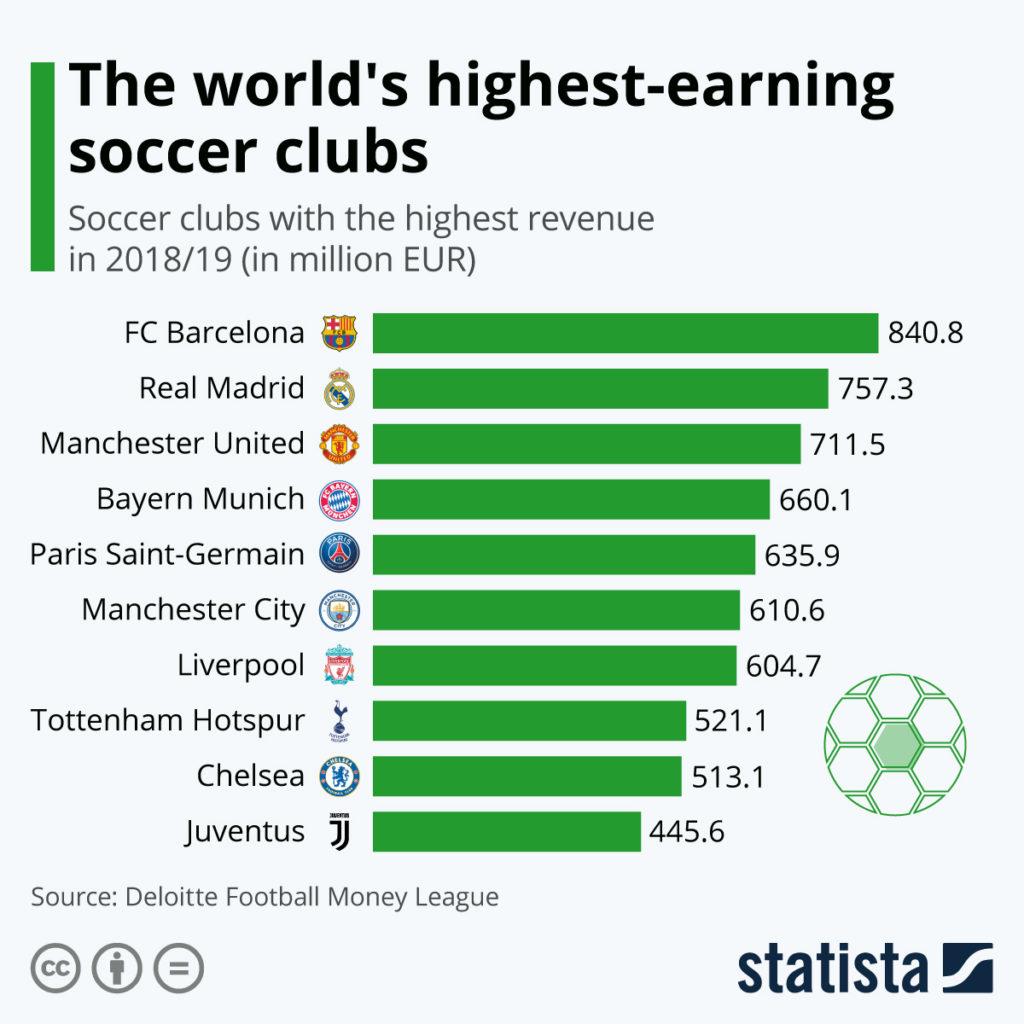

Soccer is big business, and the top clubs bring in a ton of cash.

According to the latest Deloitte Football Money League report, FC Barcelona generated more money than any other club for the first time in history — to the tune of €840.8 million.

In all, seven clubs earned more than €600 million during the 2018-2019 season.

Check back each morning before the opening bell for stocks to watch today with the Wall Street Wake-Up, here on Money and Markets.