China plans to cut U.S. tariffs in 2020 to boost its sagging economy, plus stocks to watch today in the Money and Markets Wall Street Wake-Up.

The Market Open

The U.S. markets opened up Monday.

Boeing Co. (NYSE: BA) led with a 3% rise after it was reported the company parted ways with CEO Dennis Muilenburg. The Dow Jones Industrial Average was up more than 0.3% in early trading while the S&P 500 was up 0.1% and the Nasdaq was up nearly 0.2%.

The Opening Bell

To help boost its slowing economy, China will lower tariffs on more than 850 U.S. products.

The Finance Ministry said tariffs will be lowered on various products including certain kinds of semiconductors. The ministry said the changes to tariffs were to “increase imports of products facing a relative domestic shortage, or foreign specialty goods for everyday consumption.”

The temporary tariffs will be lower than those of most-favored-nation status.

Stocks to Watch Today

JD.com Inc. (Nasdaq: JD) — The Chinese e-commerce company’s logistics company is considering an overseas initial public offering that could raise nearly $10 billion, according to Reuters. JD.com stock is up more than 2% in premarket trading this morning.

Tesla Inc. (Nasdaq: TSLA) — In addition to a new loan from Chinese banks (see below), the automaker has reportedly come close to a landing deal for its German gigafactory outside Berlin. The company’s stock is up more than 2% in premarket trading.

Sarepta Therapeutics Inc. (Nasdaq: SRPT) — Shares of the pharmaceutical company were up 9% in premarket trading Monday after it announced a $1.15 billion licensing agreement with Swiss-based Roche.

In the News

Vanguard Group Inc.’s investment strategy chief said U.S. stocks will face a greater-than-usual risk of a selloff, in a report by Bloomberg.

Joseph Davis said, “financial markets run the risk of getting ahead of themselves.” He added he sees 50% odds of a correction in 2020, compared to 30% — what he sees as a more typical figure

Tesla Inc. Getting Loan From Chinese Banks

Tesla is reportedly getting a $1.4 billion, five-year loan from Chinese banks, according to Reuters.

Part of the loan will be used to roll over an existing loan while another part will be used for the automaker’s Shanghai factory.

TikTok Looking for Headquarters Outside China, Report Says

Bytedance Inc. is looking for a global headquarters for the popular video-sharing app, TikTok, according to the Wall Street Journal.

While Singapore is one city being considered, others include London and Dublin. There are no American cities being considered, according to the report.

Other Morning Reads

Analysts: Gold Will Hit $1,700 By March (Money and Markets)

DraftKings Is Going Public in Deal Valuing Firm at $3.3 Billion (Bloomberg)

The Yankees Are Coming! U.S. Firms Rush Into Euro Debt Markets (Reuters)

Chart of the Day

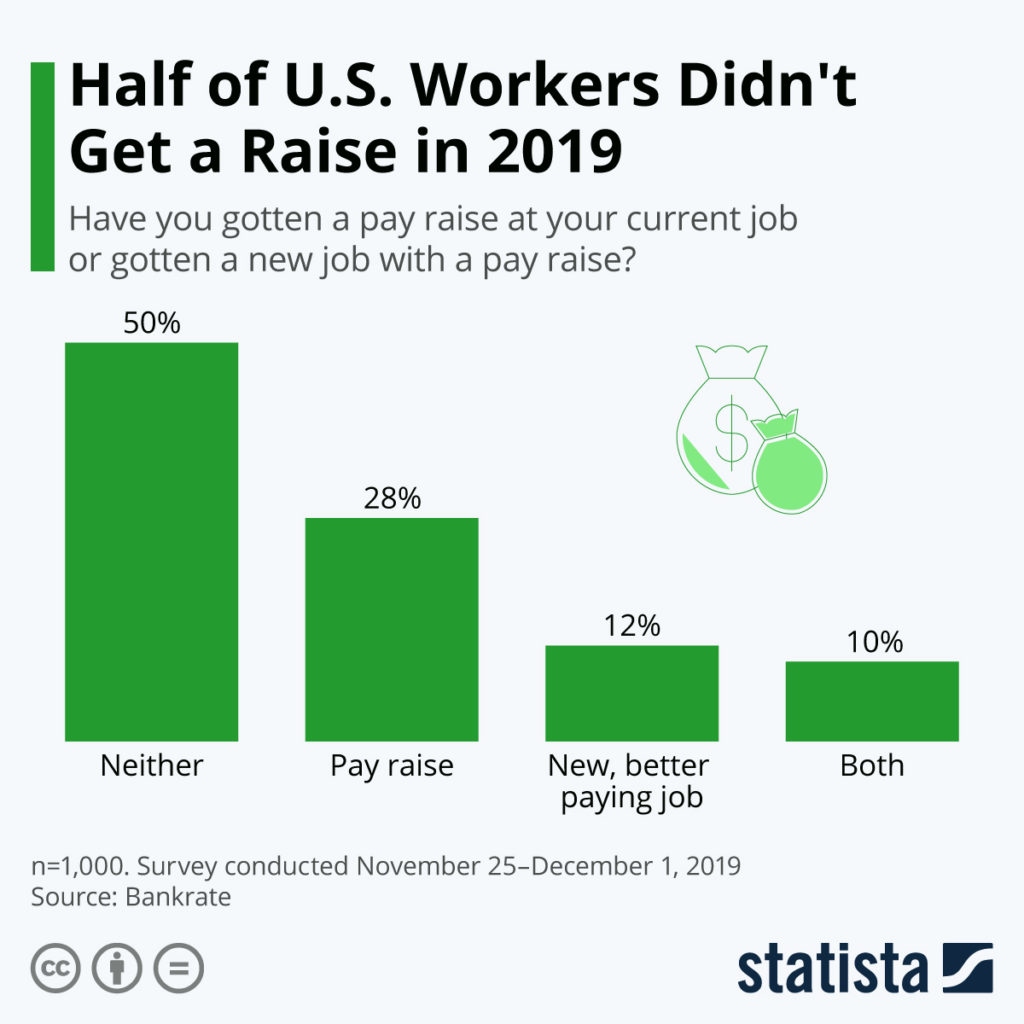

According to a poll conducted by Bankrate, half of American workers did not receive a pay raise in the last 12 months.

The poll was conducted from Nov. 25 to Dec. 1 as the U.S. economy continued to make gains.

Only 28% of workers said they got a pay raise while 12% said they got a new, better-paying job.

Note: We at Money & Markets will be taking the next few days to spend with our families for the holidays. We will have the next Wall Street Wake-Up on Thursday, Dec. 26. Merry Christmas and happy holidays from the team at Money & Markets.

Check back each morning before the opening bell for stocks to watch today with the Wall Street Wake-Up, here on Money and Markets.