Boeing blunders, equities are up again, a promising jobs report falls short plus stocks to watch today in the Money and Markets Wall Street Wake-Up.

The Morning Open

The U.S. markets opened up Friday morning, setting the stage for another day of gains.

As of 10 a.m. Eastern time, the Dow Jones Industrial Average was up 24 points, or 0.08% to 28.981 — continuing to flirt with 29,000. The S&P 500 opened up 0.1% while the Nasdaq was up 0.2%.

The Opening Bell

The Labor Department jobs report was supposed to be full of good news for business and U.S. markets.

Instead, the report showed job and wage growth fell short of expectations as nonfarm jobs grew by just 145,000 and unemployment held at 3.5%. Average hourly earnings rose slightly by 2.9% — below expectations of 3.1%.

Economists expected the report to show solid job growth and the possibility that wages are up as employers try to find ways to attract and keep talented employees in a tightening job market.

U.S. long-term mortgage rates fell this week to their lowest level in 13 weeks, as financial markets roiled by U.S.-Iran conflict pushed investors toward the safety of Treasury bonds.

The yield on Treasury bonds, especially the 10-year note, tends to influence mortgage rates. Mortgage buyer Freddie Mac said Thursday the average rate for a 30-year fixed-rate mortgage dropped to 3.64% from 3.72% last week. The benchmark rate was 4.45% a year ago.

The average rate on a 15-year mortgage declined to 3.07% from 3.16% last week. The historically low levels of borrowing rates are fueling demand from prospective homebuyers.

Stocks to Watch Today

WD-40 Co. (Nasdaq: WDFC) — The household products manufacturer dropped 4.8% in Friday premarket trading after falling short of earnings and revenue estimates for its Q1 2020.

Synnex Corp. (NYSE: SNX) — After reporting strong quarterly earnings and that it plans to split into two publicly-traded companies, shares of the IT company jumped more than 8% in premarket trading Friday.

GrubHub Inc. (NYSE: GRUB) — The food delivery company’s shares dropped more than 7% in premarket trading Friday after it denied reports it was going up for sale.

In the News

It’s likely not going to be a good day for Boeing Co. (NYSE: BA) after internal communications show how the plane maker persuaded airline and government officials that a simulator wasn’t necessary for the 737 Max, according to multiple media outlets.

Additionally, the memos also revealed internal strife about the Max, including one company pilot suggesting “this airplane is designed by clowns, who in turn are supervised by monkeys,” according to Bloomberg.

The 737 Max has been grounded since March following crashes that killed 346 people.

After gaining 1.5% in Thursday trading, shares of Boeing were down 0.6% in Friday premarket trading.

Life on the Run Is Proving Expensive for Carlos Ghosn

It was expensive for former Nissan CEO Carlos Ghosn to flee justice in Japan, according to a report in Bloomberg.

He forfeited $14 million in bail money when he escaped Japan and it cost around $15 million for him to flee to Lebanon. In all, Ghosn has seen his fortune shrink by nearly 40%.

2019 a Record Year for CEO Turnover

It was a record year for CEO departures in 2019, according to CNN Business.

Last year, 1,640 CEOs left their jobs — more than in any year since 2002. Of that number, 35 left because of scandal or allegations of professional misconduct.

For the first time since 2013, more companies (784) chose people outside the company as replacements than did companies that promoted from within (620).

Other Morning Reads

Nuveen’s Bob Doll: ‘Sigh of Relief’ for Stocks if Trump Is Reelected (Money and Markets)

Money-Losing Companies Mushroom Even as Stocks Hit New Highs (Wall Street Journal)

The S&P 500 Is Massively Undervalued and the Numbers Don’t Lie (Money and Markets)

Earnings Report

Here are the companies releasing earnings reports today:

Infosys Ltd. ADR (NYSE: INFY)

SemiLEDs Corp. (Nasdaq: LEDS)

Chart of the Day

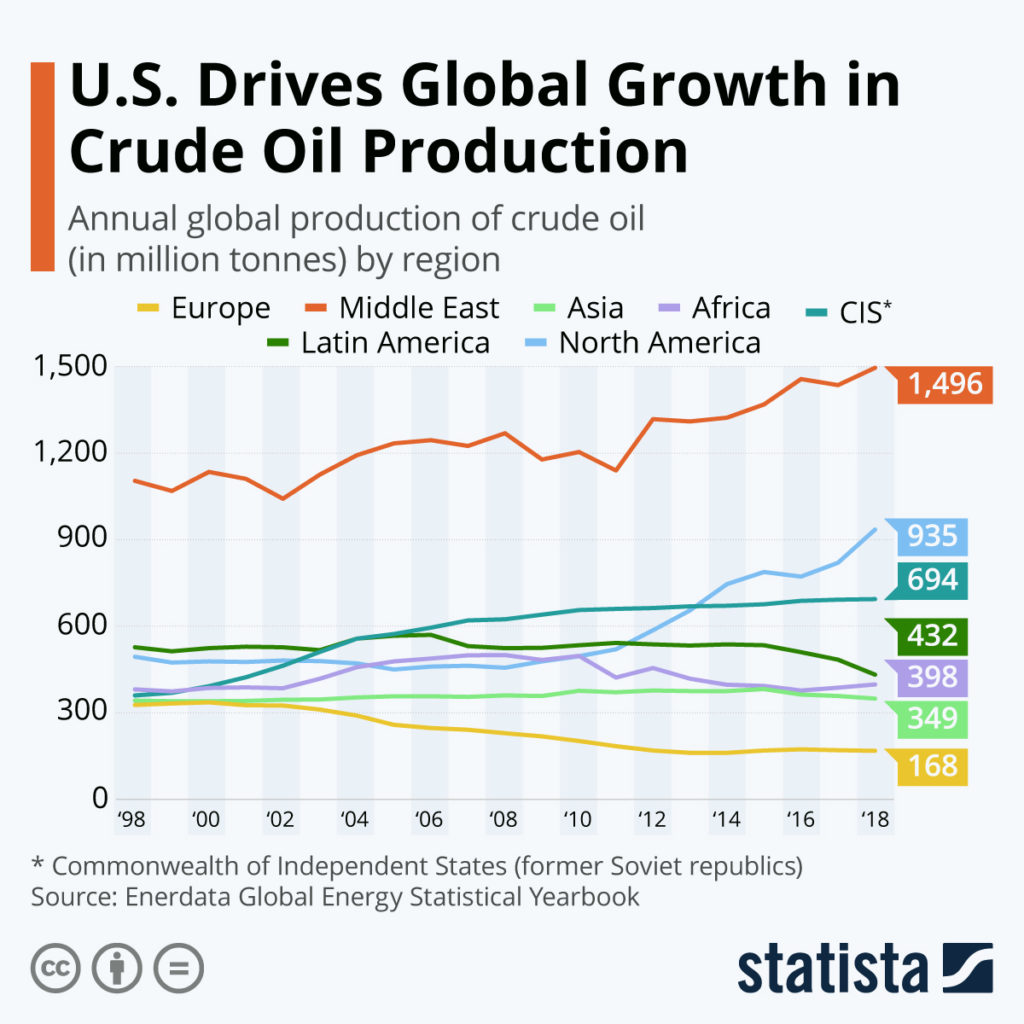

Crude oil production could set a new record in 2019 for the United States.

North America became the second-highest producer of crude oil in 2018, surpassing Latin America, according to Enerdata Global Energy Statistical Yearbook.

The U.S. has been growing its production steadily since 2011.

Check back each morning before the opening bell for stocks to watch today with the Wall Street Wake-Up, here on Money and Markets.