My first week as an editor of a North Carolina newspaper wasn’t typical…

I witnessed something huge, and I’m still in awe 10 years later.

I was granted a tour of the Facebook Data Center in Forest City — about 90 miles east of Charlotte.

The building was massive… and it’s only been built out since.

Inside the first building — which was the length of four football fields — sat thousands of server racks that stored the data of millions of Facebook users. If you live on the East Coast of the U.S., there’s a good chance your Facebook account lives on one of these servers.

There was miles of cables connecting all of these racks together, allowing them to work in tandem and process hundreds of thousands of gigabytes of data.

While the internal workings of data centers are often proprietary, I know that the amount of hardware housed in just that one North Carolina facility was more than anywhere I had ever seen in one place before.

With the rise of artificial intelligence and machine computing, the need for these huge data centers is growing every day.

And that means companies like Meta need more software and hardware to operate.

Using Adam O’Dell’s proprietary Green Zone Power Ratings system, I found a company that provides the critical equipment that data centers need to function.

Today, I’ll share that company, but first I want to share just how big this infrastructure mega trend is.

The Cloud Infrastructure Mega Trend

The cloud isn’t this mythical place where you can store and access data.

There is a massive amount of hardware and software that goes into creating and operating a cloud.

Cloud storage, like Amazon AWS, is used by businesses to store massive amounts of data while you and I use the cloud to clear space on our phones for more photos of our kids and grandkids.

According to CloudZero, 47% of businesses are pursuing a cloud-first data storage strategy while 65% of individuals use personal cloud storage as their primary way of storing data.

This tells me the market for cloud infrastructure is only growing:

In 2023, global spending on cloud IT infrastructure was $93.7 billion. By 2026, that figure is estimated to be $133.7 billion — a 42.7% jump in three years!

There’s a lot of money on the table. And the right company providing the right type of infrastructure is in a prime position to rake in profits.

Using Adam’s Green Zone Power Ratings system … I found one.

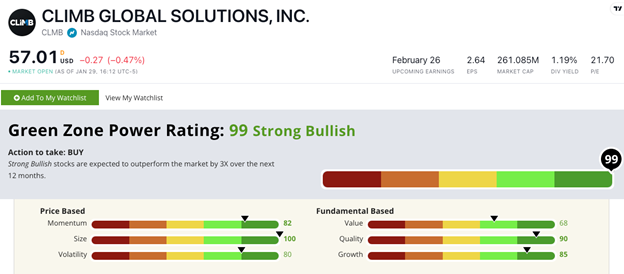

CLMB Green Zone Power Ratings

Climb Global Solutions Inc. (Nasdaq: CLMB) specializes in connecting software resellers indirectly with customers shopping for cloud IT infrastructure solutions.

CLMB rates 99 out of 100 on our Green Zone Power Ratings system. That means we are “Strong Bullish” on the stock and expect it to outperform the broader market by 3X over the next 12 months.

CLMB's Green Zone Power Ratings in February 2024.

The stock rates in the green on all six of the factors that make up Adam’s proprietary system.

On fundaments, CLMB rates the highest on Quality (90). This is in large part due to its high return on equity (ROE), a measure of financial performance that’s found by dividing a company’s net income by its shareholder equity.

This is a key metric for tech companies as they are constantly looking to achieve growth, attract new investments and make strategic acquisitions.

CLMB’s ROE is 19.6%. A competitor like PC Direct Inc. has an ROE of 0.4%. The higher the percentage, the better.

This comparison means CLMB does a much better job at converting its equity financing into profits than its competition. That‘s music to any investor’s ears.

Climb’s stock has also seen strong momentum over the last six months:

From its August 2023 end-of-day low of $38.36 to its price as I write this ($57.01), CLMB has jumped more than 48%! That’s why it boasts an 82 on Momentum.

Over the same time, the Global X Cloud Computing ETF (Nasdaq: CLOU) has gained 17%, so CLMB is crushing that broader ETF by almost 3X.

Bottom line: With more businesses and individuals pushing their data to the cloud, IT and cloud infrastructure is paramount.

CLMB is focused on providing emerging data center and cloud-based hardware and software to systems integrators and resellers, globally.

With strong momentum and an outstanding return on equity, CLMB is a compelling choice to add to your portfolio.

Until next time…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets