Saving for retirement.

Buying a boat.

Providing a better future for your children or grandchildren.

These are just a few reasons we might invest in the stock market.

But you can’t do it alone. You need a dependable platform to execute trades with transparency and trust.

Using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Stock Power Ratings system, I found a “Strong Bullish” investing stock that provides investment services around the world:

- It just reported increased sales for its fourth straight quarter.

- Its stock hit a 52-week high in the middle of July.

- We expect it to beat the market by 3X over the next 12 months.

Here’s why this investment services stock I’m sharing with you today will continue its strong performance through this shaky market.

More Americans Are Investing

Whether the market is up or down, investors can make money.

That’s part of the Money & Markets M.O.: We help you make money — no matter the market.

Everyday Americans have latched on to this idea and are looking for ways in.

And the number of people investing is growing:

Gallup reported 56% of adults were investing in 2021 — the highest percentage since 2010.

Bottom line: We all want more money in the bank. One way to do that is to invest in the stock market … but you need a platform to do it.

Great Growth, Value and Momentum: Stonex Group Inc.

Whether you are an institutional investor (the big companies that invest for a living) or an individual who wants to carve their own path, you need a platform that connects you to the market.

This is where Stonex Group Inc. (Nasdaq: SNEX) comes in. The New York-based company connects companies, traders and investors to global markets.

Stonex provides:

- Physical trading on U.S. and global markets.

- Currency and commodities trading.

- And over-the-counter (OTC) access.

It recently launched a cryptocurrency division as well.

Stonex serves more than 32,000 commercial and institutional clients and more than 330,000 retail investors (people like you and me) across 180 countries.

Now, let’s look at how this investment services stock has performed.

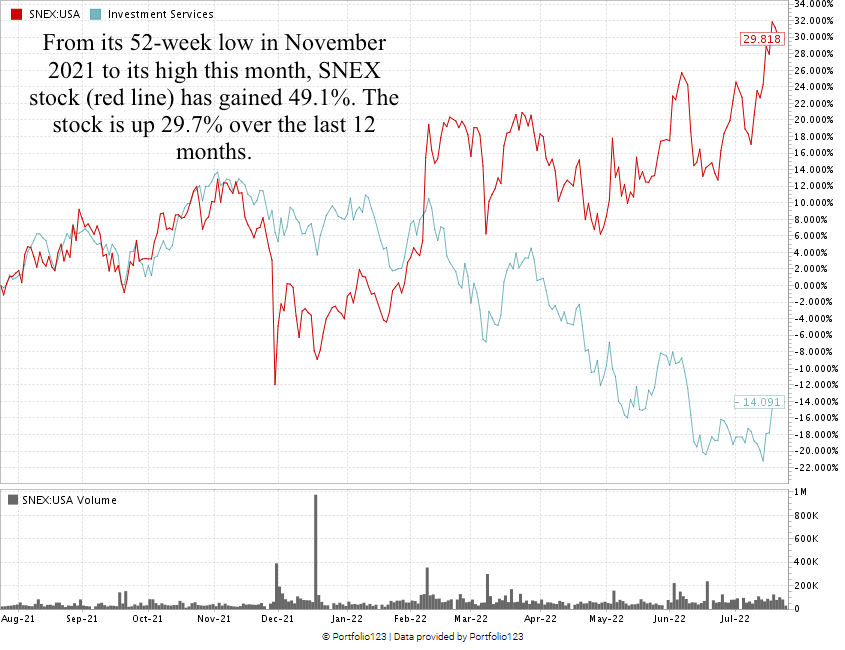

SNEX Hits New 52-Week High

SNEX is now trading $7 over its 50-day simple moving average — a bullish indicator for a stock. It’s also blasting past its investment services peers, which are down 14.1% over the last year.

Stonex Group Inc. Stock Rating

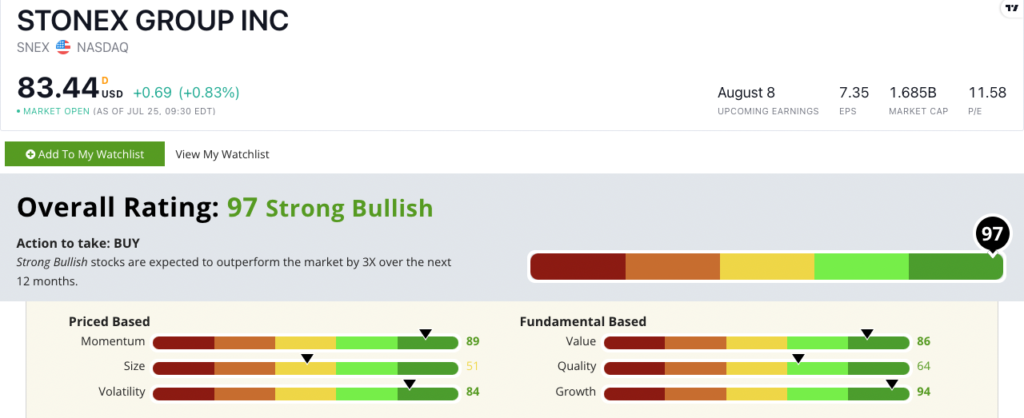

Using Adam’s six-factor Stock Power Ratings system, Stonex Group Inc. stock scores a 97 overall.

That means we’re “Strong Bullish” on the stock and expect it to beat the broader market by at least three times over the next 12 months.

SNEX rates in the green on five of our six factors:

- Growth — SNEX scores a 94 on growth, with a 45.7% increase in sales from the same quarter a year ago. Its earnings per share grew 14%.

- Momentum — Since this time a year ago, Stonex’s stock price is up around 30%. SNEX earns an 89 on momentum.

- Value — Stonex’s price-to-earnings ratio is nearly three times lower than the investment services industry average. Its price-to-sales ratio is 0.03, while its peers are averaging 5.08. Stonex earns an 86 on value.

- Volatility — Recent broader market headwinds have had little impact on SNEX’s share price, as it reached a 52-week high in July … when the rest of the market was in whipsaw. SNEX rates an 84 on volatility.

- Quality — Stonex’s return on equity is 15.3%, compared to the industry average of just 4%. SNEX scores a 64 on quality.

SNEX earns a 51 on size, but its market cap is $1.7 billion, which is still a good-sized stock for strong gains.

Bottom line: More and more Americans are turning to the stock market to gain wealth.

Stonex provides a one-stop shop platform to connect traders of all experience levels to a broad range of markets.

This is why SNEX is a strong performer for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Stock Power Podcast, as well as the Marijuana Market Update. He’s also a certified Capital Markets and Securities Analyst through the Corporate Finance Institute. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.