As soon as Russian troops crossed the border to invade Ukraine, renewable energy took center stage.

Following the invasion, the global community banded together to ensure Russian President Vladimir Putin couldn’t finance this invasion by selling natural resources like oil and natural gas.

Sanctions against Russia cut off the European Union from these critical supplies.

Renewable energy was the instant choice for replacement. The sanctions created a massive tailwind for green energy companies all around the world.

However, constructing renewable energy infrastructure can take years. So the EU couldn’t just turn off oil and gas and switch to solar and wind power.

Renewable energy is a growing mega trend, but our Stock Power Ratings system shows you that many of the stocks within this industry are not worth buying right now.

This is the case with Sunnova Energy International Inc. (NYSE: NOVA).

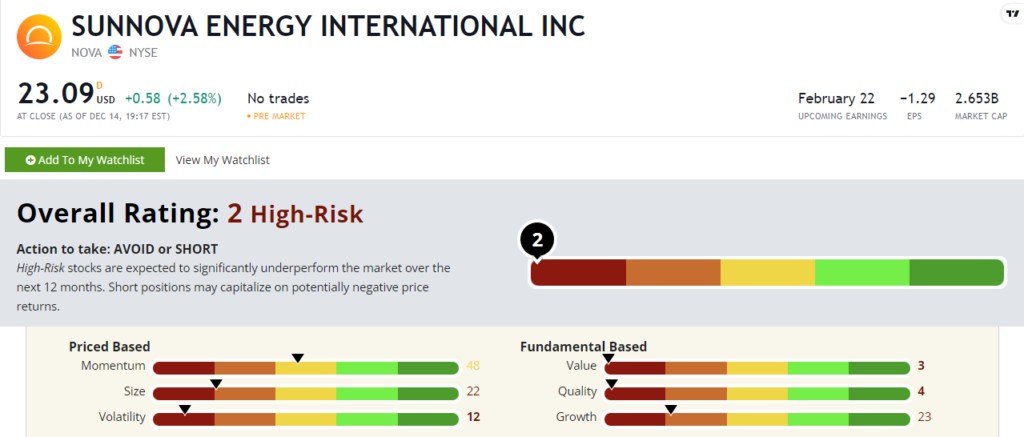

NOVA stock scores a “High-Risk” 2 out of 100 on our Stock Power Ratings system, and we expect it to underperform the broader market over the next 12 months.

Sunnova Stock: Poor Value + Quality

Here is where I usually tell you about positive company financials.

This isn’t the case for Sunnova:

- In third-quarter 2022, the company’s total operating expenses jumped to $177.1 million — a 129.7% increase from the same period a year ago.

- Its earnings per share dropped 120% from second-quarter 2022 to third-quarter 2022.

That’s why Sunnova stock scores a 23 on growth.

It also scores in the red on four of our other factors.

NOVA stock has negative price to earnings, meaning it’s not making any money.

Its price-to-cash flow ratio is nearly seven times higher than the energy utilities industry average.

That means the stock is way overvalued compared to its peers.

It scores a 3 on value.

The company’s returns on assets, equity and investment as well as its net and operating margins are all negative, earning it a 4 on quality.

This stock is overvalued and, despite increasing sales in the last two quarters, isn’t generating any profit.

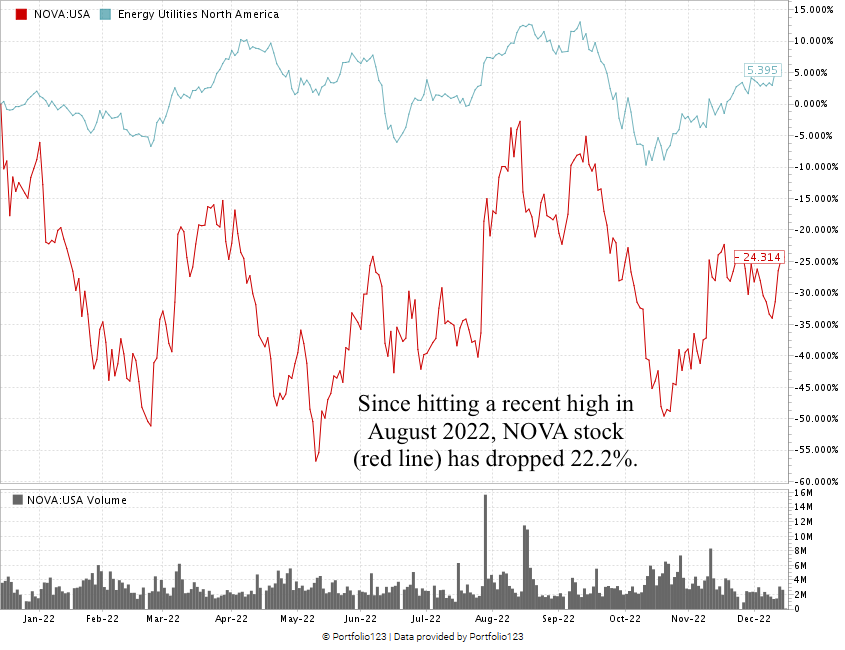

Chart created in December 2022.

Over the last 12 months, NOVA stock has dropped 24.8%.

Its energy utility peers gained an average of 5.4% over the same time.

NOVA stock scores a horrendous 2 overall on our proprietary Stock Power Ratings system.

That means we consider it “High-Risk” and expect it to underperform the broader market.

Bottom line: Renewable energy will replace conventional power sources — eventually.

But the cost and time it takes to install solar and wind energy infrastructure takes time … and money.

With no profit and negative margins, Sunnova stock is one you should avoid.

Stay Tuned: Another Top-Rated Oil and Gas Play

Monday, we’re returning to our original Stock Power Daily form with a little twist.

Stay tuned — I’ll share all the details on a top gasoline distributor in the U.S.

And if that isn’t enough, you need to sign up for my colleague Adam O’Dell’s upcoming presentation.

On December 28, he will reveal his top stock for the developing oil super bull market. He’s confident it will soar 100% higher in only 100 days when things kick off.

Click here to put your name on the guest list for his upcoming “Oil Super Bull Summit.”

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. I’d love to hear what you thought about my “Stock to Avoid” article today. Was it valuable? Would you like us to continue sharing high-risk stocks on occasion, so you know what to stay away from?

Would you prefer that we only share “Bullish” and “Strong Bullish” stocks?