Every month, the Institute for Supply Management (ISM) provides a glimpse into the manufacturing front line.

ISM surveys supply managers — one of the most important positions in manufacturing. Their job ensures there are enough raw materials to meet customer demand.

If supply managers don’t have enough inventory, workers sit idle, sales are lost and business suffers. If they order too much, capital is tied up in inventory, which costs the company money and the business suffers.

Because inventory demands change with orders, supply managers are the first to see changes in economic conditions. The ISM survey offers insights into what supply managers see in real-time. It’s among the most useful economic reports released each month.

There was some good news in the December report. A chemical product manager noted, “Chemical supply chains are filling very slowly. Still not full, but (my) gut feeling says it’s getting easier to source chemical raw materials.”

A manager at a fabricated metal products facility said, “Price increases appear to be slowing. Lead times are shrinking slowly, and inventories are growing. I hope we have reached the top of the hill to start down a gentle slope that lets us get back to something that resembles normal.”

There were some concerns about supply chains from the transportation equipment sector and furniture manufacturers. But data shows early signs that the worst may be behind us.

Supply Chains Are Recovering

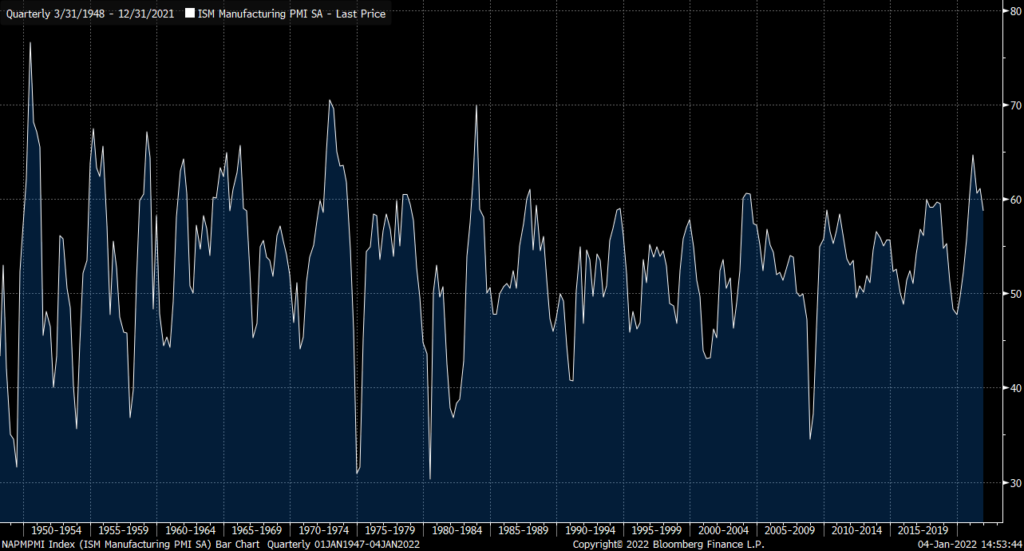

The chart below shows the “price paid” component of the survey. While prices remain high, the index dropped more than 14 points, the largest one-month decline in more than 10 years.

Price Paid Index

Source: Bloomberg.

The index is now back below 60. Since the 1980s, it has only moved above 60 two other times. When it dropped back below that level in December 1987 and June 2004, stocks began sustained uptrends.

In both cases, the S&P 500 declined about 5% immediately after the Prices Paid Index dropped, but stocks were up about 8% a year later. Multi-year bull markets followed in each case.

This is bullish news for the stock market, indicating inflationary pressures could be easing. Stocks will rally as additional data confirms this.

Click here to join True Options Masters.