Economists suffer from physics envy. They build complex mathematical models to explain how the economy works rather than seek to understand how real people react to the economy. This creates opportunities for investors.

Economists at the International Monetary Fund tell us to expect problems as interest rates rise. They believe: “Emerging and developing economies are viewing rising interest rates with trepidation … Now, capital inflows to emerging markets have shown signs of drying up.”

Financial analysts latch on to that idea and warn against investments in emerging markets. However, history shows that global stock markets, especially emerging markets, can do well as rates rise.

Emerging Markets Follow U.S. Trends

The chart below shows that global stock markets can rally in the face of higher rates in the U.S.

U.S. Drives the Global Market

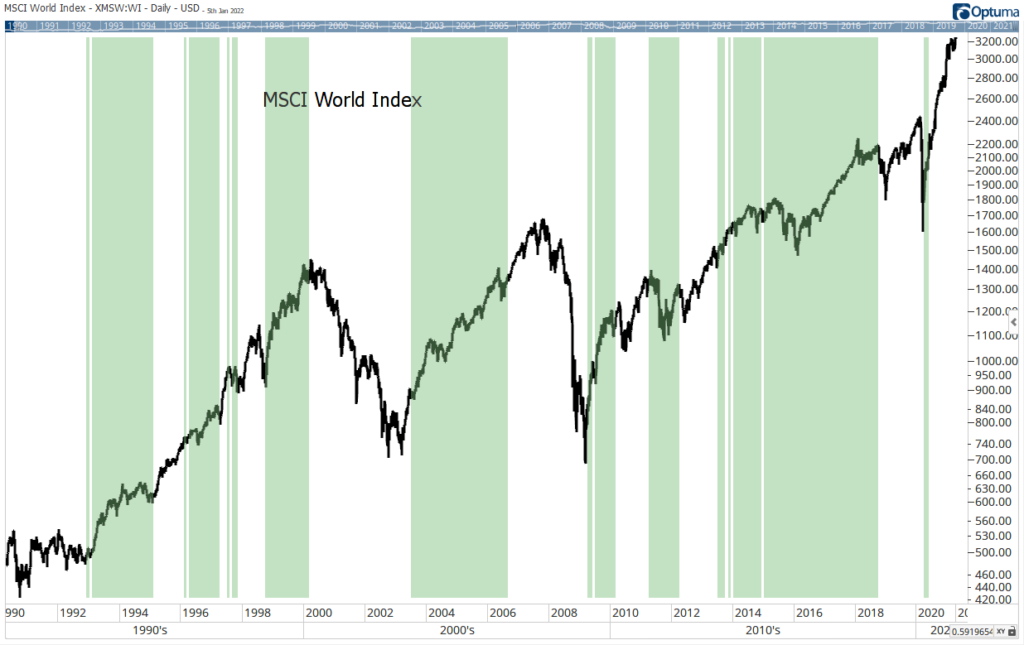

This chart shows the MSCI World Index. It demonstrates that global and emerging markets are highly correlated. Stock market indexes worldwide tend to follow the trend in U.S. stocks during bear markets.

However, rising rates have little impact on stock prices. The green shaded areas in the chart above show when the Federal Reserve funds rate is higher than a year earlier. The Fed controls the short-term funds rate.

Rising rates coincide with bull markets in stocks in most cases. That is because rising rates show that the economy is expanding. If the U.S. economy expands, many economies worldwide will also expand, since the U.S. imports so many goods and services.

The chart doesn’t show that higher rates are always bullish for stocks. But it suggests that higher rates are not an insurmountable hurdle to bull markets.

Economists will disagree, and their models will show that there will be pain as rates rise. But history tells us that, as investors, we should almost always ignore what economists say.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters.