As a Florida native, nothing is more refreshing than a hard seltzer when I spend the day on a boat.

But some people prefer beer or something a little stronger.

For that, we have Molson Coors Beverage Co.’s (NYSE: TAP) latest venture into next-gen alcohol with the help of its collaborator, Coca-Cola Co. (NYSE: KO): ready-to-drink cocktails.

This is not the first innovative partnership between TAP and KO.

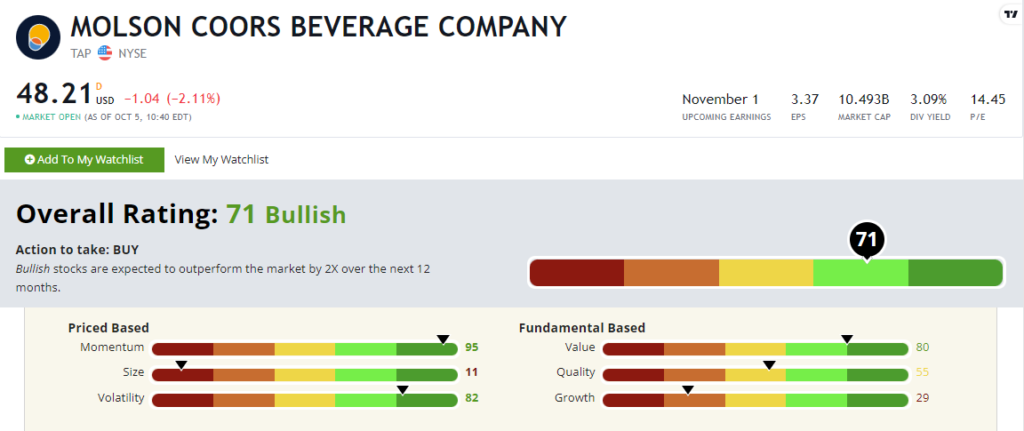

The collaboration has led to lucrative products and contributed to TAP’s “Bullish” 71 out of 100 on our proprietary Stock Power Ratings system.

Let’s check out how this collaboration came to be.

Molson Coors and Coca-Cola

Molson Coors had a great 2020.

After a successful launch of the hard seltzer brands Vizzy in April and Coors Seltzer in August, Molson Coors was ready to expand.

TAP announced a 2021 product release with Coke: a new line of hard seltzer inspired by Topo Chico’s 125-year history of producing sparkling water.

The two companies kept it simple with the name Topo Chico Hard Seltzer.

The drink contains a gluten-free alcohol base and natural flavors with minerals added.

This successful launch was just the beginning.

Molson Coors + Coke’s Modern Moves

Next year brings an exciting new release for TAP.

David Coors, vice president of next-gen beverages at Molson Coors, released a statement:

Getting into spirits is part of the evolution of this company. We’re laying a foundation not for 2023, but years and decades down the road. We’re excited to have Topo Chico Spirited play a leading role.

Topo Chico Spirited will contain 100% real spirits, including premium tequila.

The product lineup will include three classic cocktail flavors.

The buzz around the news added some excitement for TAP, which rates a “Bullish” 71, as seen below.

Molson Coors’ Stock Power Ratings in October 2022.

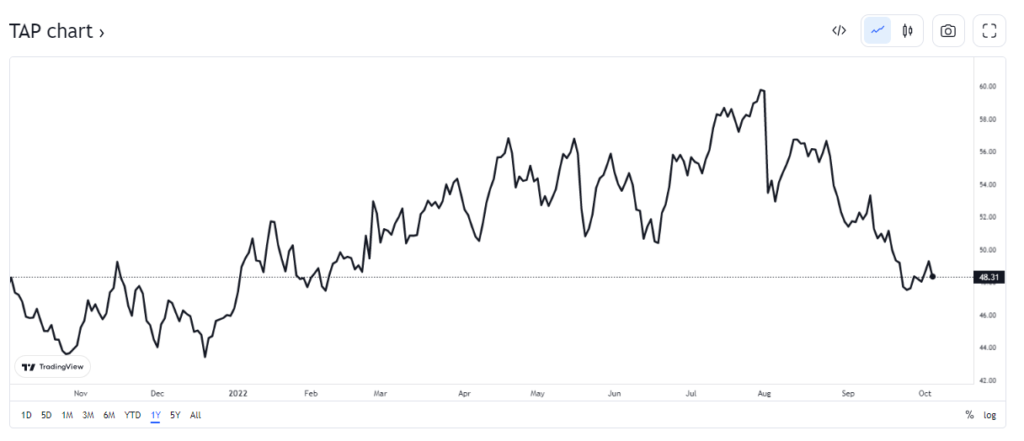

Because momentum rates the highest, I will zoom in on the stock’s performance over the last year.

TAP’s Momentum

TAP hit a 52-week high of $59.31 hit around the summer months.

That strong rally from the end of 2021 has helped it score a 95 on our momentum factor.

Hotter summer weather means increased demand for cold beverages.

Source: Tradingview.

Next year’s big release could bring more upward movement.

With TAP putting both feet in the door of this industry, it is on the right track to being a leading competitor against its peers.

The Bottom Line

TAP scores a “Bullish” 71 out of 100 on our Stock Power Ratings system.

However, “Strong Bullish” stocks are no anomaly.

We expect those stocks to beat the broader market by 3X in the next 12 months!

To get one highly rated stock you should consider investing in every weekday, check out Matt Clark’s Stock Power Daily.

Monday through Friday, he gives you one stock that scores 80 or above on our system and tells you why you should add it to your portfolio — for free!