In real estate it’s all about location, location, location.

Another huge factor when buying a home is mortgage rates (i.e., the percent of interest on a home loan).

The Federal Reserve’s rapid interest rate hikes have walloped prospective homeowners. Buying a house is now much more expensive than it was even 12 months ago.

But after months of ripping higher, mortgage rates are trending lower once again.

The Federal Reserve Bank of St. Louis calculated the average 30-year fixed mortgage rate to be 6.13% in the last week of January.

That’s the lowest the average rate has been since September 2022, when the average rate was 6.02%.

This means it is becoming more advantageous for potential homebuyers to get a competitive rate … thus increasing the number of homes being bought.

And that sets up well for the company I just found using our proprietary Stock Power Ratings system.

Today’s Power Stock is Taylor Morrison Home Corp. (NYSE: TMHC), a $3.7 billion homebuilder focused on some of the fastest-growing regions of the country.

A Quick Mortgage Math Breakdown

Before we get into TMHC’s Stock Power Ratings, I wanted to go over how much mortgage rates matter to prospective buyers.

A mortgage rate is the cost to borrow money from a lender to buy a home.

The lower the mortgage rate, the lower a homebuyer will pay for a home.

If you buy a $100,000 home with a 30-year fixed 6% mortgage rate, you will pay $6,000, or $16.66 per month, in interest.

That same loan with a 4% interest means you pay $4,000, or $11.11 per month, in interest.

You can see how even a small decrease in the mortgage rate leads to thousands in savings! And Taylor Morrison stock should enjoy this trend.

Taylor Morrison Stock Power Ratings

Scottsdale, Arizona-based Taylor Morrison builds homes and communities in rapidly-growing areas of the United States, including:

- Tampa, Florida.

- Austin, Texas.

- Charlotte, North Carolina.

- Phoenix, Arizona.

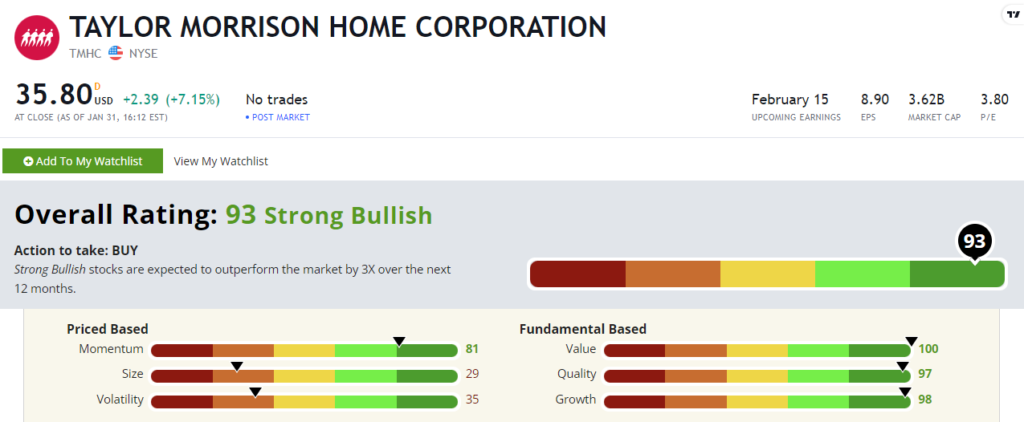

THMC scores 93 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

Taylor Morrison Stock: Green Fundamentals + Market-Breaking Momentum

TMHC closed out a third quarter in 2022 that should excite anyone thinking about investing in its stock.

High points include:

- Net income of $310 million — an 84% year-over-year increase.

- Home closing revenue reached $2 billion — a 12% increase over the same period a year ago.

As you can see, TMHC has strong bottom-line growth — scoring a 98 on that factor.

It also shines as a value stock … scoring a 100 on that factor.

Its price-to-earnings ratio is less than half the homebuilders and manufacturing industry average.

It’s the same story for TMHC’s price-to-cash flow and price-to-book value.

This tells us Taylor Morrison is a great growth stock, in addition to being an outstanding value play.

Now, let’s look at its market-breaking momentum:

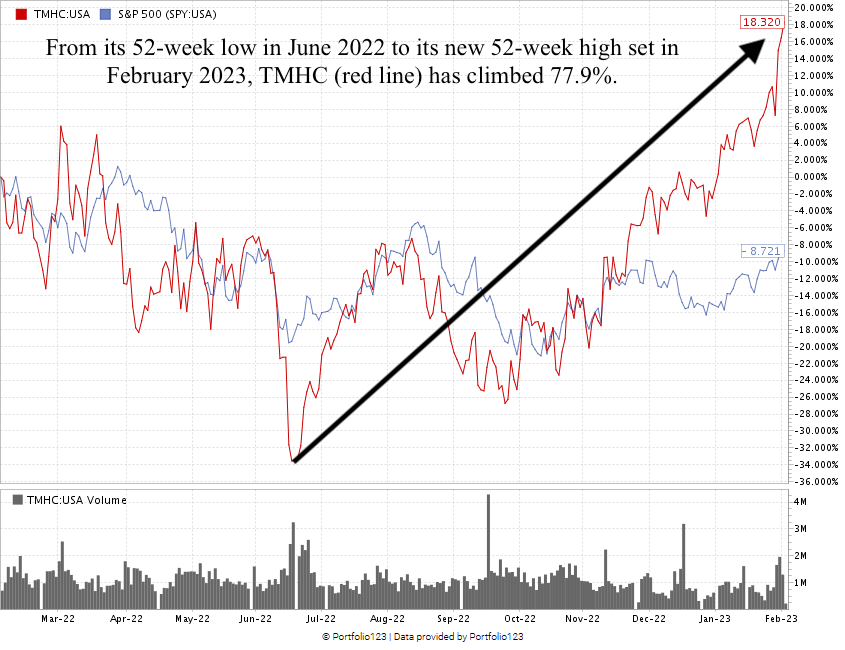

Created in February 2023.

Over the last 12 months, TMHC stock has moved 18.3% higher.

I want to focus on its movement since June 2022.

From its 52-week low set that month to its 52-week high reached in February 2023, TMHC climbed 77.9% … showing the “maximum momentum” we love to see in stocks.

I believe there are more gains in store based on its 93 overall score on our proprietary Stock Power Ratings system.

We’re “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

Mortgage interest rates are starting to come back down.

This means the potential for more homebuying is on the horizon.

As a builder of homes and communities in some of the fastest-growing areas in the U.S., Taylor Morrison stock is a strong contender for your portfolio.

Stay Tuned: A Strong Bullish Co. in a Multitrillion-Dollar Industry

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify.

Stay tuned for the next issue, where I’ll share all the details on an apparel company that’s bucking the recessionary trends and rocketing higher.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets