I used to be a picky shopper when it came to clothes.

My closet was packed with clothes from the same big brand name. I knew what I needed and I liked how those clothes fit.

I’ve grown out of that phase, mainly because it was expensive to shop that way.

But we all have our favorite brands, whether it’s shirts, pants, shoes or whatever else we choose to wear.

And my current shopping tendencies aren’t reflected in the broader global apparel industry trend, which is booming after COVID dealt a big blow:

Statista expects revenue from global apparel will increase 38.6% from 2020 to 2027. That includes a massive 13.7% jump from 2022 to 2023.

Today’s Power Stock sells men’s and women’s apparel and footwear: The Buckle Inc. (NYSE: BKE).

The Buckle operates 441 retail stores in 42 states across the U.S.

In addition to its own label of apparel, the company sells specialty brands like Willow & Root, Reclaim, Veece and Gilded Intent.

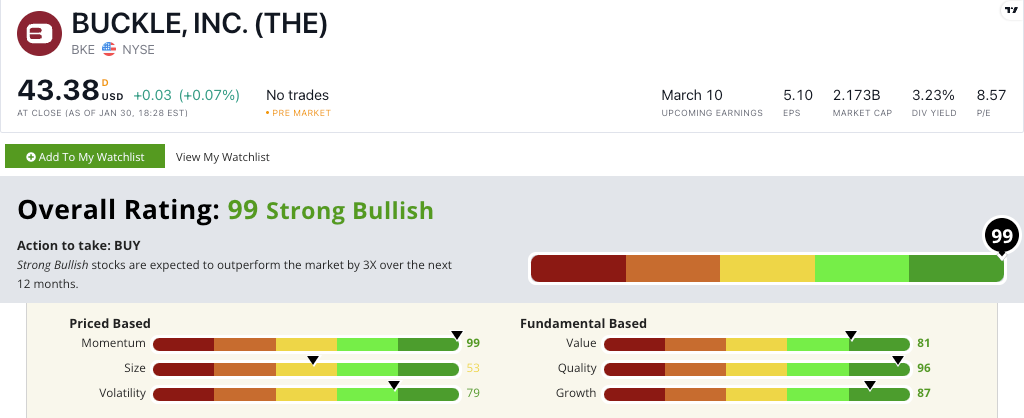

BKE scores a “Strong Bullish” 99 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

The Buckle Stock: Strong Quality, Value AND Momentum

The Buckle recently provided its December 2022 sales report.

Here are two high points:

- Reported net sales increased 7% over the same period a year ago — despite a rough holiday shopping season!

- Its comparable store net sales for the fiscal year were up 3.2% from the previous period.

These sales figures show why The Buckle stock scores an 87 on our growth factor.

It’s also an outstanding quality stock: BKE’s return on equity is 52.2%, more than three times higher than the apparel and accessory industry average.

BKE’s operating margin is 24.8%. By comparison, the industry average is 3%. This tells us company management knows how to keep profits rolling in.

The stock earns a 96 on our quality metric.

Created in February 2023.

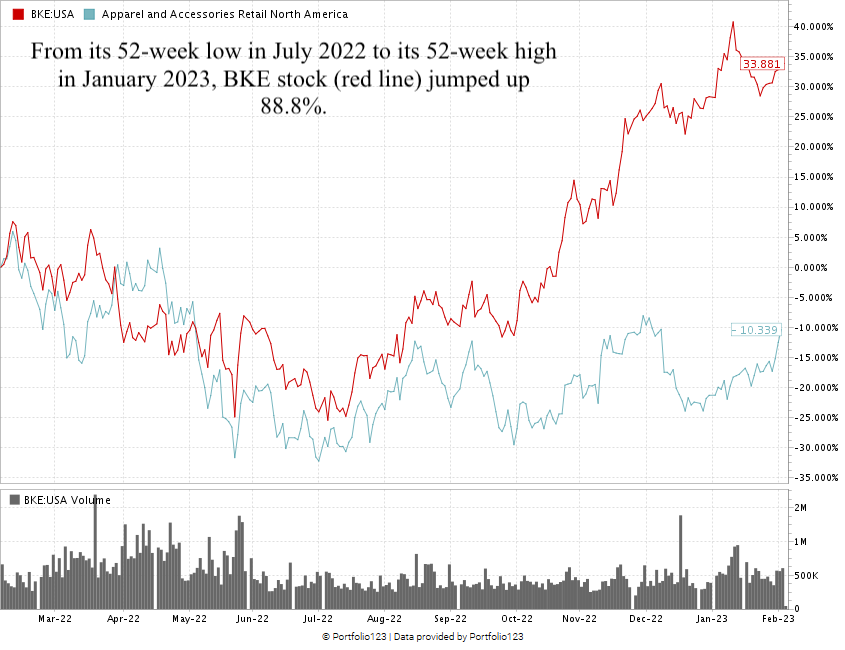

I want to focus on how BKE stock has performed in the shorter term.

From its 52-week low in July 2022, the stock ran up 88.8% to a new 52-week high in January. That’s the “maximum momentum” we love to see in stocks — and I believe it has a lot of room to run higher from here.

The Buckle stock scores a 99 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

No matter what the economy is doing, we all need clothes.

BKE sells top-quality men’s and women’s apparel and footwear.

This makes The Buckle stock a great addition to your portfolio.

Stay Tuned: 96-Rated Co. Maximizes E-Commerce for Oil & Gas

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify.

Stay tuned for the next issue, where I’ll share all the details on a business-to-business e-commerce platform that helps companies within the oil and gas industry thrive.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets