The demand for certain elements will skyrocket as the world transitions to renewable energy.

Copper is one of those elements.

Copper is ideal for the clean energy transition for several reasons:

- It has the highest electrical conductivity rating of all non-precious metals.

- It can be shaped into pipes, wires or sheets.

- Copper can remove heat more rapidly than other metals, such as aluminum.

- It is 100% recyclable and can be used repeatedly without performance loss.

This copper chart from Wood Mackenzie led me to today’s Power Stock:

By 2026, the demand for copper will start to exceed supply — meaning we need more of this commodity … now.

Today’s Power Stock mines for copper and other non-precious metals in North and South America: Teck Resources Ltd. (NYSE: TECK).

TECK’s Stock Power Ratings in October 2022.

TECK is a $17.6 billion company that mines for steelmaking coal, zinc, lead and, most important for this trend, copper.

Its operations extend to some of the most copper-rich areas of the world, including Peru and Chile.

Teck stock scores a “Strong Bullish” 90 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

TECK Stock: Outstanding Growth + Value

TECK had an outstanding second quarter of 2022 and is lining up for another solid year:

- Quarterly revenue was $5.8 billion — a 126.2% jump from the same quarter a year ago.

- Gross profit from the quarter was $3.3 billion — 2% more than the same period last year.

You can see its growth, but Teck is also a terrific value stock.

Its price-to-earnings ratio is 4, which is less than half the industry average of 10.9.

The company’s price-to-sales and price-to-book value ratios are significantly lower than the broader metal ore mining industry’s.

This tells us TECK stock is a bargain compared to its peers.

Created October 2022.

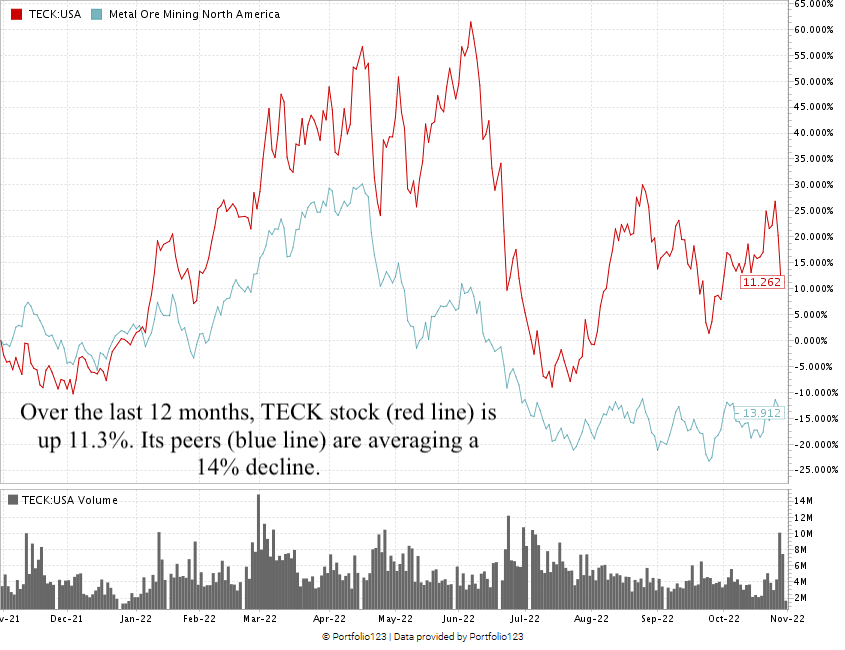

Over the last 12 months, TECK has risen 11.6%. Its industry peers are averaging a 14% decline over the same time.

From its recent low in July to now, the stock has increased 22.6%.

Teck Resources’ stock scores a 90 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The global demand for copper is like that of petroleum — we need to find new sources to meet it.

Teck’s resources across North and South America help to meet that demand.

As you can see, TECK is a smart addition to your portfolio.

The company also pays a 1.11% dividend yield to its shareholders. That comes out to $0.36 per share per year to own the stock.

Bonus: I mentioned that copper is a crucial element for the renewable energy mega trend, and we believe this is a mega trend with a long runway of growth ahead.

To see how my colleague and Money & Markets Chief Investment Strategist Adam O’Dell recommends you follow the trend within your own portfolio, click here to watch his “Infinite Energy” presentation.

Adam’s highest conviction lies with an untapped energy source that’s larger than any oil field out there. And his No. 1 stock recommendation involved in accessing this untapped source is already up more than 60% since he added it to the Green Zone Fortunes model portfolio in March.

Adam believes that’s just the start. Click here to see why and find out how to gain access to this recommendation and more.

Stay Tuned: Build a Healthy Portfolio With an Organic Food Stock

Stay tuned for the next issue, where I’ll share all the details on the “Strong Bullish” organic distributor that’s my suggestion to capture the growing organic food market.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.