Tesla (Nasdaq: TSLA) is the largest auto company in the world, measured by market capitalization. In fact, according to CNBC, Tesla stock’s market cap tops the nine largest automakers combined.

High valuations invariably lead to questions about whether the company is worth it. For Tesla, history holds some important answers.

Tesla, and its CEO Elon Musk, could emulate their predecessors.

Tesla-Ford-IBM Stock Comparisons

In the early 1900s, Henry Ford became one of the richest men in the world because his company made cars efficiently and inexpensively. By 1918, nearly half of all cars on American roads were Fords.

But Ford was a private company until the 1950s. That means there’s no public record of the company’s valuation.

International Business Machines Corporation (NYSE: IBM) is among the oldest publicly traded companies. The technology and consulting company was founded in 1911 and listed on the NYSE in 1916.

IBM engineers developed the computer hard drive, financial swaps and Watson artificial intelligence.

It was once so big that the government tried to break it up. By 1969, IBM controlled about 70% of the computer market. Regulators argued that IBM was a monopoly and, in 1969, filed an antitrust suit to break it up into smaller competitive companies.

The suit was eventually dismissed, but the fact that IBM grew so big could be a useful comparison for Tesla stock.

IBM created the market for mainframe computers. It then grew large by providing customers everything they needed in the market.

Tesla is creating a new market for electric cars in many ways, though there are competitors. Tesla provides customers with everything they seem to want and need in the EV market.

Considering the similarities, it can be useful to look at IBM’s stock price.

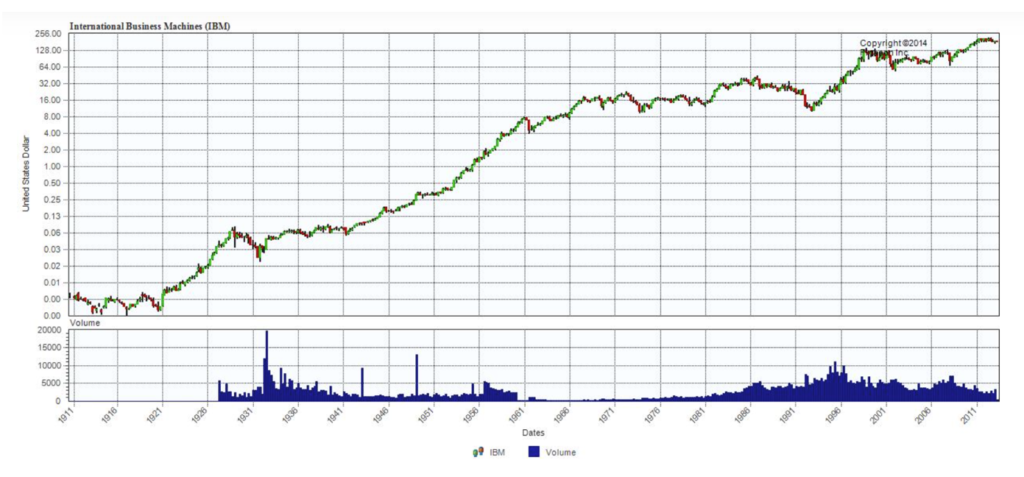

A Century of IBM Stock

Source: Global Financial Data.

Tesla Rise Could Mirror IBM’s

This chart shows the stock was trading at about $1, adjusted for splits, in 1956. IBM’s revenue accelerated after that, growing more than 30% a year and doubling by 1959 as the computer revolution took off.

By the time the government filed its suit, IBM’s revenue had compounded at a rate of more than 15% a year — for a decade. The stock price gained about 1,500% after growing at about 23% a year.

IBM was a spectacular investment as it created and grew the mainframe computer market. By traditional metrics, the stock was consistently overvalued.

Tesla is creating a new market, and that could make it one of the greatest investments of the 2020s.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.