The past few months have been unusual. From a consumer demand perspective, the closest analogy might be World War II.

The U.S. war effort required the sacrifices of service members and civilians. In order to transport troops to theaters of war, the States rationed gasoline at home. Moving personnel from seaports to battlefronts led to the rationing of rubber for tires.

Rationing limited driving back home, as did the fact that car manufacturers were using factories to make tanks, trucks and planes instead of automobiles.

The list of wartime demands goes on. This time, things are different in the sense that we have shutdowns instead of rationing.

But the vaccine could unleash economic conditions similar to those associated with demobilization in 1945.

After the war ended, consumers wanted to replace worn-out tires and buy new automobiles. Many had significant savings. Millions of deployed military members had saved their small salaries. Millions back home had worked long hours and had limited items to buy in the wartime economy.

Right now, there is a surplus of savings as the K-shaped recovery unfolds.

Consumers in the downward-sloping part of the K are struggling, while those in upward sloping part of the K-shaped economy have billions in the bank.

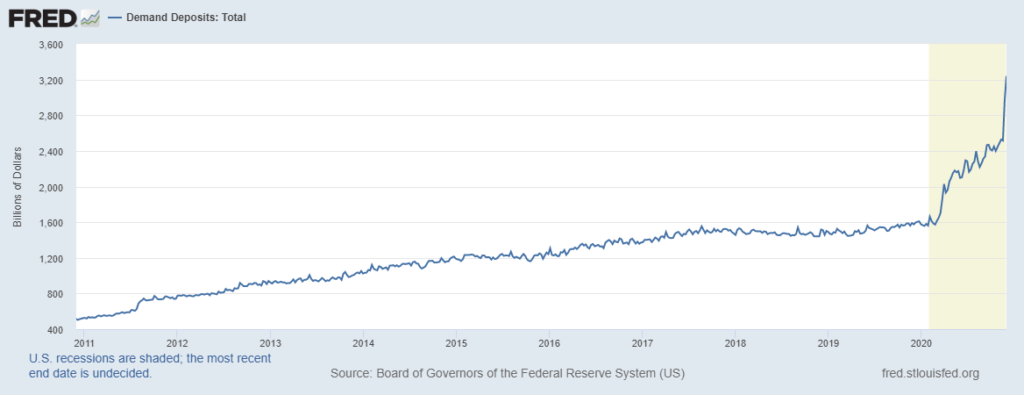

Total Number of Demand Deposits

Source: Federal Reserve.

K-Shaped Recovery: Savings Could Spur Spending Surge

Bank demand deposits doubled to $3.2 trillion since February. Demand deposits include balances in checking and savings accounts.

Some of this money represents savings for emergencies. Some accumulated because many businesses are closed, and consumers have fewer spending options.

After World War II, the government gradually removed wartime restrictions. That led to a sustained boom in consumer spending, which resulted in years of economic growth.

As vaccinations reduce the risk of COVID-19, we should see a burst of consumer spending. Demand deposits could drop back towards $1.6 trillion, their level for much of 2018 and 2019.

More than $1 trillion could be spent in stores and on travel. Money could also end up in stocks. Either way, pent up demand and more than $1 trillion in excess savings is likely to lead to a boom.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.