At the end of last year, Tesla stock (Nasdaq: TSLA) was riding high — leading the market as a member of the “Magnificent Seven.”

Throughout 2023, these seven Big Tech stocks delivered an average return of 71% … versus an average return of just 6% for the remaining 493 stocks in the S&P 500 index.

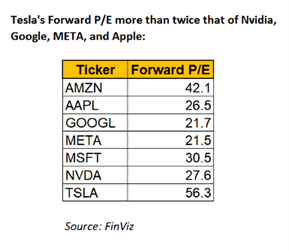

And even among the Magnificent Seven, none commanded a higher premium (in terms of forward price to earnings) than TSLA:

Now — just a few short months later — it’s become the worst-performing stock in the S&P 500.

TSLA is down 30% year-to-date and more than 60% from its all-time high of $407 per share back in 2021.

And many analysts (myself included) believe it still has further to fall.

It would be easy to blame TSLA’s misfortune on the antics of its eccentric CEO, Elon Musk.

But like I explained in a past issue of Banyan Edge, this abrupt reversal reflects a much deeper change…

The “EV Revolution” has stalled out.

Anatomy of an EV Collapse + Tesla Stock’s Rating

Prior to 2022’s bear market, electric vehicle (EV) makers reached the same kinds of high valuations we’re now seeing in today’s AI stocks.

Hugely bullish projections propped these valuations up — with EV sales expected to grow as much as 70% year-over-year by some industry professionals.

Sure enough, EV sales growth has been phenomenal.

Yet numbers are still well short of those astronomical projections (by half, in fact).

As a result, smaller EV automakers have continued to sink even as the broad market recovered.

Onetime EV breakout Nikola Corp (Nasdaq: NKLA) is down nearly 60% over the last year…

Shares of Lucid Group (Nasdaq: LCID) fell 63% in the same time…

And Fisker (NYSE: FSR) investors have lost 92% just since January of 2024!

For the remaining die-hard EV investors, there are now few practical alternatives to TSLA.

(On that note: Check out what stock our managing editor, Chad Stone, discovered using my proprietary Green Zone Power Ratings system.)

Tesla stock wasn’t a bad alternative, either.

Love him or hate him, Elon Musk has succeeded in bringing EVs to the masses unlike any other.

He took over a company that produced boutique electric Roadsters and evolved it to offer vehicles like the Model 3 and the Model X with its iconic gullwing doors.

These are the kinds of cars people love to own and drive (my colleague Charles Mizrahi drives one). As a result, the Model 3 broke into the top 10 list of America’s top-selling cars back in 2021. And sales have been outstanding ever since.

At the end of last year, Tesla was on track for record vehicle deliveries — even though it fell short of Musk’s ambitious annual target of 2 million vehicles.

But as you saw above, TSLA’s valuation was still entirely too high for what the stock has to offer. And shares are still overpriced.

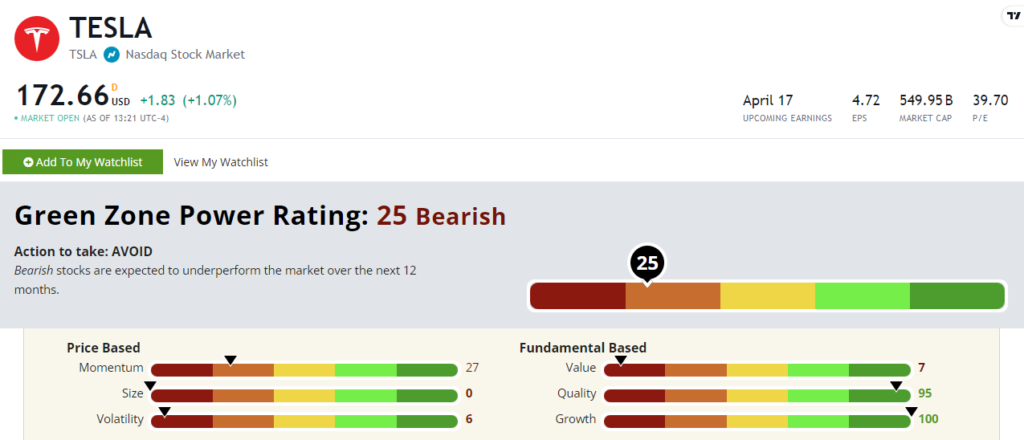

Let’s take a quick look at its Green Zone Power Ratings to see why:

TSLA’s score is quite interesting here.

As you can see, it rates extremely high for both Quality and Growth. That reflects the company’s success and its steady growth over the last few years. But its scores for Value and Size are both disastrous.

TSLA’s erratic performance over the last few years gives it a Volatility rating of 6 out of 100, and even Momentum is working against it.

In short, there might be a good business here. But not one you’d want to buy (or even own) at today’s prices.

Tech’s Next Breakout Mega Trend

Fortunately, just as one multiyear mega trend cools down, several more are rapidly emerging to drive stocks higher.

Last year’s AI boom already propelled the Magnificent Seven into the stratosphere. As I’ve written about recently, biotech stocks are also on the rise thanks to revolutionary new medications like the weight loss/diabetes drug Ozempic.

And we’re also seeing the convergence of multiple mega trends…

Like harnessing the power of AI to develop breakthrough gene therapy solutions…

Or using AI-powered systems to optimize power usage and minimize waste.

It’s already clear that AI is the biggest technological breakthrough since the internet. It’s probably even more significant.

Now, the only question is how and where AI will have the most impact first.

Over just a few years, the internet revolutionized everything from financial transactions (with PayPal) to hotel reservations (with Airbnb). It even transformed the way we socialize (using Facebook).

Investing in just one of those companies would’ve delivered massive profits for early investors.

Later this week, I’m releasing a special video feature on the “Tech Titan” who made a fortune from investing early in all three.

He’s one of history’s most successful tech investors — a man who’s been on the cutting edge for two decades now.

And you might be surprised by which mega trend he’s diving into right now.

Stay tuned…

To good profits,

Adam O’Dell

Chief Investment Strategist