Natural gas futures prices are up 35% in the last month. This obscure market is now the subject of speculation as headlines indicate the price could go higher.

Cold weather across the country increased demand for natural gas used for heating homes and generating electricity.

News indicates demand could get even tighter. Bloomberg reported that “Texas is restricting the flow of natural gas across state lines in an extraordinary move that some are calling a violation of the U.S. Constitution’s commerce clause.

Texas Governor Greg Abbott on Wednesday told a media briefing that he was banning gas from leaving the state through Feb. 21 to ensure in-state power generators had ample supplies. Less than 24 hours later, Texas’s top energy regulator told gas producers to offer supplies for sale in-state before shipping it elsewhere, citing the governor’s mandate.”

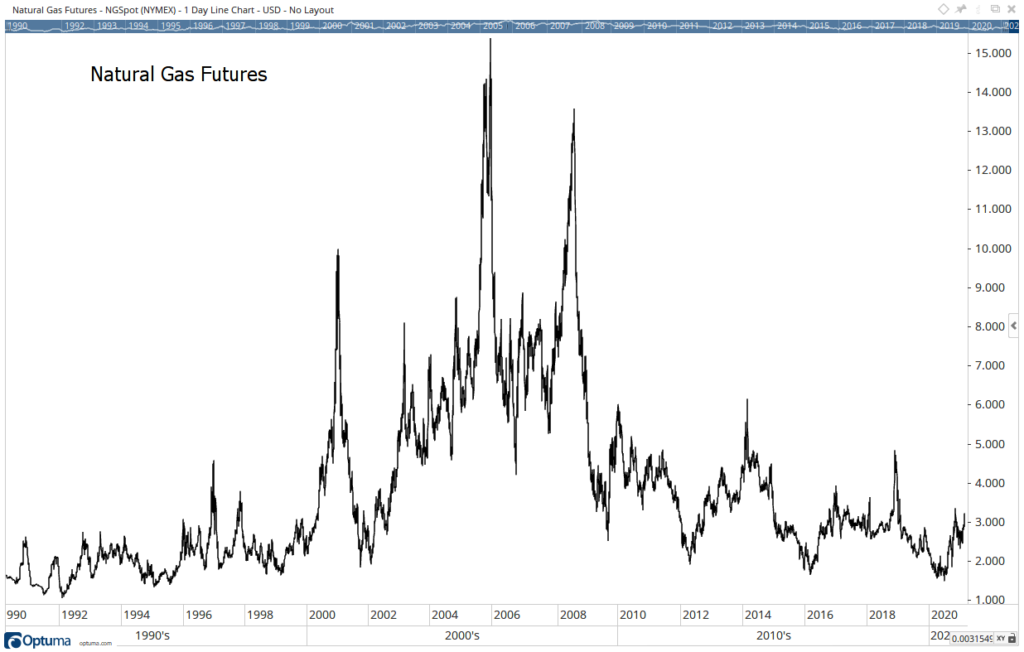

While the courts will decide whether or not Texas can restrict exports, traders are reacting to the news by pushing the price up. But the price of natural gas remains well below previous peaks.

Natural Gas Futures

Natural Gas Is a Volatile Market

The natural gas futures market is just one place where the commodity trades. There is also a spot market where the gas is bought and sold in real time.

In that market, volatility is higher and equally unpredictable. Spot prices fell from $1,250 on Wednesday to $4 on Thursday. Power companies will pay unusually high prices — when forced to — in the spot market.

Wintertime spikes occur almost every year. While this year’s news of rolling blackouts in Texas is dramatic, the market for natural gas has been relatively calm.

Based on history, natural gas prices are not a reliable predictor of inflation. The price trend is not predictive of anything since higher prices are often quickly followed by lower prices.

There are reasons to worry about inflation. There are also plenty of reasons to worry about Texas. Unfortunately for traders, these worries do not result in tradable trends.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.