You may know the name Keith Gill.

The former financial analyst turned to social media to create one of the most insane stock market rallies amid the COVID pandemic in 2020.

One video on YouTube from Gill — known by his online persona “Roaring Kitty” — pushed stocks like GameStop Corp. (NYSE: GME) and AMC Entertainment Holdings Inc. (NYSE: AMC) to huge gains in a matter of months.

It also costs hedge funds betting against those stocks billions in short-selling losses.

These massive rallies created the term “meme stock” — which has now entered the stock market lexicon.

Gill, alongside a cohort of retail investors from social media sites like Reddit, bought up these meme stocks, pushing prices higher. The problem was that these stocks did not have sound enough businesses to sustain their huge run-ups.

I found a stock in the same sector as one of the most popular meme stocks.

Only this one is different…

It’s All About Fundamentals

GME and AMC aren’t necessarily bad stocks. But their fundamentals (think, quality, value and growth) don’t support big upside stock moves.

It’s one reason these “meme stocks” fell so hard after that initial rally during the pandemic.

These stocks pushed higher again in May 2024, thanks to Gill touting bullish calls on the same stocks again. But this time, the rally fizzled out after just a few days.

It got me thinking about other stocks in GME and AMC‘s sectors. They can’t all be as fundamentally weak, right?

I focused on Texas-based Cinemark Holdings Inc. (NYSE: CNK), which operates 502 movie theaters in 42 states and 13 countries.

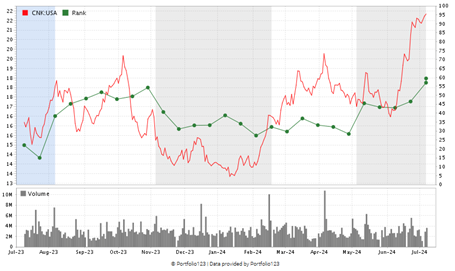

Unlike its competitor AMC, Cinemark’s stock has sustained its rally this year:

Since the start of 2024, CNK stock (green line in the chart above) has jumped more than 56% higher, while the S&P U.S. BMI Media & Entertainment Index (orange line) is up 31% and the S&P 500 (red line) has advanced 17%.

For reference, AMC is down 10% over the same time — even after its most recent meme-stock rally.

One of the big differences between CNK and AMC is profitability. Currently, CNK trades with a price-to-earnings ratio of 15, while AMC has no earnings at all.

Here’s a deeper comparison of fundamentals between CNK and AMC:

CNK has a strong 96.3% return on assets compared to AMC, which has no ROA. Cinemark has a positive net margin, while AMC has more than twice the outstanding debt.

These figures show why CNK has been able to sustain a positive stock rally, and AMC has not.

How Cinemark Stock Got Here

The COVID pandemic put a serious crimp on the entertainment industry.

Before 2020, domestic box office revenues soared above $10 billion annually. In 2020, that revenue tanked to just above $2 billion.

Last year, however, saw the highest box office revenue since before the pandemic:

In 2023, domestic ticket sales topped $8.9 billion — a nearly 350% jump from 2020’s low.

That’s been a massive lift to movie theater operators like CNK.

We can turn to Adam O’Dell’s Green Zone Power Ratings system to see what this box office surge has done to CNK’s stock:

CNK Close to “Bullish” Territory

CNK’s 56.5% jump in 2024, coupled with stronger fundamentals, pushed the stock out of the “Bearish” zone and into “Neutral.”

That means we see the stock performing in line with the broader market over the next 12 months.

However, CNK has steadily gained ground since May and is inching closer to turning “Bullish.” And that’s when the true outperformance could really kick in.

Bottom line: Movie theaters are making a comeback from the throes of the COVID pandemic.

But as a smart investor, you should be picky and not jump on the industry stock that is garnering all the media attention — for all the wrong reasons in this case.

That’s why Adam’s Green Zone Power Ratings system is great. It helps you separate the wheat from the chaff.

These numbers tell me that CNK isn’t quite ripe for the picking … yet.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets