Tomorrow at 2 p.m. Eastern Standard Time, the U.S. Federal Reserve will make the most important announcement of 2024.

That’s when the Fed will announce its first rate cut in four years.

It might not sound like a huge deal — until you start thinking back over everything we’ve been through…

In the last four years alone, we’ve seen a global pandemic … not one but two contentious presidential elections … the highest inflation in a generation … and the fastest rate-hiking cycle in decades…

As the oft-repeated saying goes: “There are decades where nothing happens, and there are weeks where decades happen.” And we’ve had quite a few of those weeks in the past few years.

Now, it seems like the coast is finally clear.

And Fed Chair Jerome Powell may have actually delivered the much-lauded “soft landing,” and now we’ve got a whole new wave of opportunities on the horizon.

But there’s still one critical question left to answer…

Anatomy of a Turnaround

As recently as two months ago, most Wall Street analysts and experts figured inflation was here to stay.

They expected inflation levels to stay relatively high, with Powell holding his ground on high rates through the end of the year.

But that all changed, almost on a dime…

It all started with May’s Consumer Price Index (CPI) print. The index’s year-over-year change came in at 3%, which was both lower than projections and May’s year-over-year reading.

The data revealed that inflation was cooling off faster than expected. By the index’s month-over-month measure, consumer prices actually fell. That was the first instance of falling prices since 2021 … and surely welcome news for every American household.

In short, inflation was finally cooling off.

And with inflation cooling off, the Fed would be cutting interest rates far sooner than anyone expected…

Then, once rates come down, a whole host of small- and mid-cap stocks would have greater access to financing and debt — making them more competitive.

I issued a small-cap trade recommendation that afternoon, and paid-up Green Zone Fortunes subscribers received a briefing on what I called “The Most Important Week of 2024” as we began shifting our strategy.

We weren’t alone, either.

Since that CPI release in June, we’ve seen a transformative shift in the stock market.

The mega-cap “Magnificent Seven” tech stocks that dominated last year’s returns are no longer outpacing the S&P 500.

Meanwhile, key indicators (like the advance-decline ratio) are showing a groundswell of interest in small-cap stocks.

Fortunately, if you’ve been keeping up with Matt Clark and me here in Money & Markets Daily (or if you’re a subscriber to services like Green Zone Fortunes, Max Profit Alert and 10X Stocks), then you’re already ahead of the curve on this new mega trend.

And now, there’s just one missing piece of the puzzle left to put into place…

Powell Calling His Shot

Wall Street’s failure to predict Powell’s rate cuts is a perfect example of why I prefer to do my own research — and why I created systems like my Green Zone Power Ratings in the first place.

Mainstream experts love to broadcast absolute certainty and then quietly rush to a new point of view as soon as the market takes a turn.

I prefer to remain cautiously optimistic while preparing my portfolios and readers for the most likely (and profitable) outcomes.

Up until this June, experts across the board were confident that Powell wouldn’t cut rates before January 2025. Now, they’re all certain that he will cut rates tomorrow.

But they still won’t agree on how big of an interest rate cut the Fed will make…

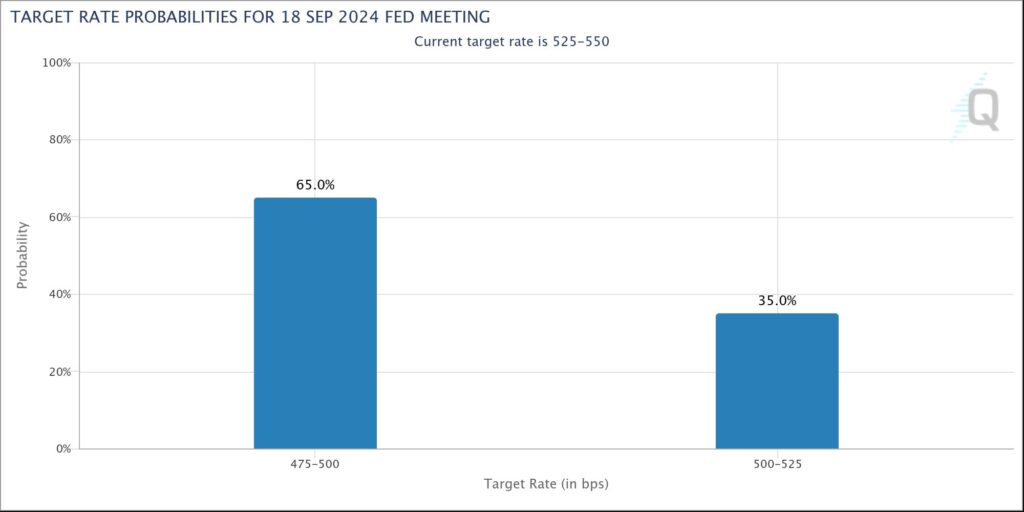

If Powell chooses the conservative approach, he’ll cut the benchmark rate by just 0.25%. The smaller cut would indicate the Fed sees the economy as healthy, but they’re still worried about stoking inflation again by cutting too much.

The Fed could also double that cut and reduce rates by 0.50%. This would indicate the central bank is more concerned with stimulating the economy and avoiding a potential recession.

The CME FedWatch indicator has been slowly shifting to the latter, with 65% of experts now arguing for a larger cut:

Either way, the most important news is that rates are coming down.

And that will have an impact on every stock in our portfolios going forward.

(If you’d like to know more about how the Fed’s rate cuts will impact YOUR bottom line, then click here to review my emergency briefing before tomorrow’s meeting. I’ve found four small stocks that are in a perfect position to run higher — no matter tomorrow’s outcome.)

Regards,

Adam O’Dell

Chief Investment Strategist, Money & Markets