Keeping up with everything going on in financial markets and the economy is tough these days. That’s where “The 5” from Money & Markets Daily comes in…

Let’s start your week off right!

Trump vs. Harris: Showdown in Philly

The U.S. presidential campaign is in its long, final stretch. And this week, all eyes are on Philadelphia.

On Tuesday, Vice President Kamala Harris and former President Donald Trump will take center stage at the National Constitution Center for their first (and likely only) debate.

Polls abound and paint different pictures, but the consensus is that there is no clear leader in the race, making this debate critical for both camps.

Rest assured, Trump and Harris will likely be asked about the economy and inflation hours before August’s Consumer Price Index (CPI) data is unveiled on Wednesday.

Fed Expected to Trim Target Rates

Forecasts call for a CPI print of 0.2% month-over-month in August — similar to the inflation numbers we saw the month before. Year-over-year CPI was 3.2% in July.

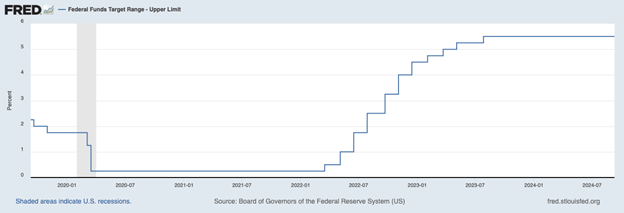

Inflation and job numbers expected this week are dropping just before the Federal Reserve meetings next week, where the central bank is widely expected to issue its first benchmark interest rate cut since 2020.

Congress has also returned to Washington this week after a lengthy break.

Among the top priorities for House and Senate leaders will be avoiding a government shutdown by eyeing measures to fund the federal government beyond the September 30 deadline.

Things are definitely ramping up with less than two months to election day. On that note, check out our poll at the bottom of today’s issue.

Now, let’s bring this back to the current state of the market…

Has the Tech Bubble Burst?

Last week marked the worst performance of 2024 for the Nasdaq and S&P 500, with the Nasdaq Composite sinking 2.5% by Friday’s close.

Since its July 2024 peak, the tech-heavy index has lost 9% after its massive bull run.

You may be wondering if the tech bubble has burst…

But our Chief Investment Strategist, Adam O’Dell, sees this as the beginning of a whole new boom.

He’s identified two catalysts that will trigger a bull market in an overlooked segment of the market amid Big Tech’s struggles. And he’ll tell you all about them later this week.

Proof That Value Isn’t a 1-Factor Strategy

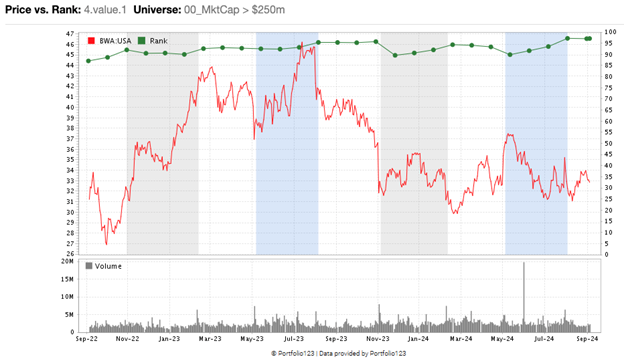

BorgWarner (NYSE: BWA) is the kind of stock value investors dream about…

It’s a 140-year-old, all-American business with $14 billion in annual revenue. BWA is also one of the 25 largest automotive suppliers in the world, making it the perfect “picks-and-shovels” play for the growing auto market.

And shares are a bargain, too — trading at a price-to-earnings ratio of 10.6 compared to an industry average of 16.3.

Sounds like a home run investment in terms of value, right?

But a value stock without momentum is like a sailing yacht without any wind.

It looks great and stays afloat just fine … but it doesn’t ever go anywhere.

That’s precisely the case for BorgWarner, whose shares haven’t budged in five years. In fact, as you can see below in our chart of the week, BWA’s Green Zone Power Rating for Value hasn’t dropped below 85/100 in the last two years, even as shares rise and fall…

Sky-High Value (Green) Can’t Save BWA’s Price Action

Seeing Trillions

2024 has been a tough year for Elon Musk…

From the disastrous rollout of his new Cybertruck to the dismal performance of Tesla (Nasdaq: TSLA) shares to his social media platform (X, once known as Twitter) being kicked out of Brazil, it seems like Musk’s luck has taken a significant turn for the worse.

“Winning?”

Media outlets were eager to run with this story over the weekend, so you’ve probably already seen this headline all over the place. We decided to take things one step further and evaluate Informa’s methodology … which seems to be nearly non-existent.

Informa’s “report” is basically a “back-of-the-napkin” calculation that projected Elon’s past wealth growth out into the future — which at this point seems increasingly unlikely.

It’s also worth noting that if Microsoft founder Bill Gates hadn’t sold any of his MSFT shares, he’d already be the world’s first trillionaire, with a net worth of $1.4 trillion.

Poll: Is the Election Changing the Way You Invest?

We like to steer clear of politics here at Money & Markets Daily.

But November’s presidential election will inevitably have a massive impact on the markets and our future.

Aside from personal politics, we’re curious about what moves you’re making (if any) to prepare your portfolio and your nest egg for November 5.

Take a moment to vote in our simple poll below. And if you want to tell us more about your approach, feel free to email us at Feedback@MoneyandMarkets.com. Are you buying American only? Are you taking some cash off the table? Maybe you’re just holding steady? We’d love to hear about it!

Otherwise, participate in our new poll below.

— Money & Markets Team