Finally, the Federal Reserve is taking inflation seriously.

Policymakers announced last week that they expect to raise interest rates at least three times next year. This is a major change from September’s meeting, when a majority of the officials didn’t expect to raise rates until at least 2023.

The Fed also announced plans to accelerate the end of the bond-buying programs that have been in place since the economy shut down last year. Stocks rallied on the news at first.

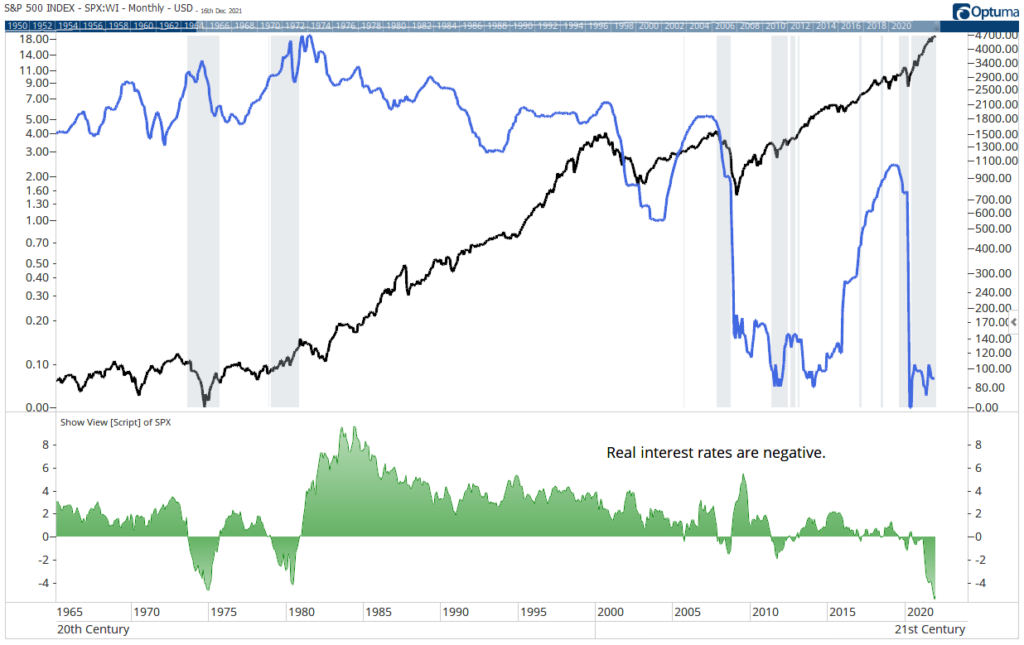

Despite the sharp changes, real interest rates are likely to be negative throughout 2022. Real interest rates are yields minus inflation. For example, the 10-year Treasury note yields about 1.4% while inflation is at 6.8%. The real rate is negative 5.4%.

With negative real rates, investors are falling behind after inflation. Because investors demand a positive return on their investment in most cases, negative real rates are rare. The chart below shows real rates with grey shading used to highlight times when the rate was negative.

Real Rates Have Been Negative

The Fed Holds the Key

The chart shows the S&P 500 Index as the black line and the Fed Funds rate as the solid blue line. The latter is a short-term interest rate set by the Fed. The level of the rate is less important for this chart than the direction of the trend.

The first time the real rate turned negative, in 1973, took investors by surprise. The S&P 500 entered a steep bear market, losing 45% of its value in 24 months.

Since then, the trend in the stock market has largely depended on the actions of the Fed. When the Fed is fighting inflation by raising rates, stocks tend to rally. If the Fed cuts rates in a negative rate environment, stocks decline.

Last week, the Fed said all the right words. As long as rates move higher next year, stocks should go up. If the Fed wavers, a bear market is inevitable.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters.