Federal Reserve officials seem to be calm based on public statements, but the central bank’s balance sheet could suggest otherwise. Recently Federal Reserve Chairman Jerome Powell noted that risks are high but under control.

He said: “The overall financial-stability picture is mixed. But on balance, you know, it’s manageable, I would say, and…it’s appropriate and important for financial conditions to remain accommodative, to support economic activity.”

In a more detailed semiannual Financial Stability Report, the Fed was more specific but still calming when discussing risk, noting: “Should risk appetite decline from elevated levels, a range of asset prices could be vulnerable to large and sudden declines, which can lead to broader stress to the financial system.” These risks are offset by a resilient system and households that have stronger balance sheets.

Reading these reports, investors might be assured. But under the surface, the Fed is adding money to the economy in a way that suggests they’re concerned risks are high.

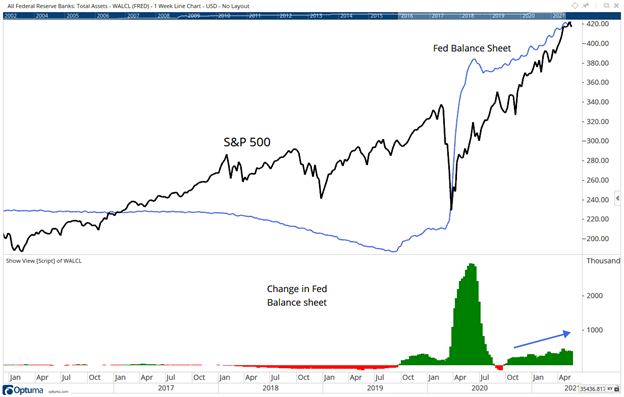

The chart below shows the Fed’s balance sheet as the blue line, the S&P 500 as the black line and the quarterly change in the Fed’s balance sheet, updated weekly.

Fed Balance Sheet Shows Quantitative Easing

Source: Optuma.

Fed’s Balance Sheet Props Up Stock Market

The balance sheet is a rough measure of quantitative easing. These are the extraordinary measures that have been used since 2008 to ensure the financial system functions in a crisis.

Fed officials tried reducing easing in 2018 and 2019. This is shown with the red line at the bottom of the chart. Stock prices struggled during that time.

As the economy weakened at the end of 2019 and the stock market started dipping, the balance sheet started growing again.

An attempt to reduce the balance sheet last summer resulted in a stock market decline. Since then, the Fed has been increasing its balance sheet even as officials say the economic recovery is on track.

It’s likely the Fed will continue adding to its balance sheet since the stock market seems dependent on that. As the Fed warned, lower asset prices could lead to strains in the financial system, and avoiding that is the Fed’s primary concern.

I don’t like working more than I have to.

That’s why I found a way to beat the market by making one simple trade per week.

Last year, this trade helped me beat the market eight times over.

It’s a great way to accelerate your gains. Click here, and I’ll show you how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.