Inflation is increasing, but the Federal Reserve isn’t worried. Officials are confident higher prices are transitory. From an investor’s perspective, we need to hope they are correct.

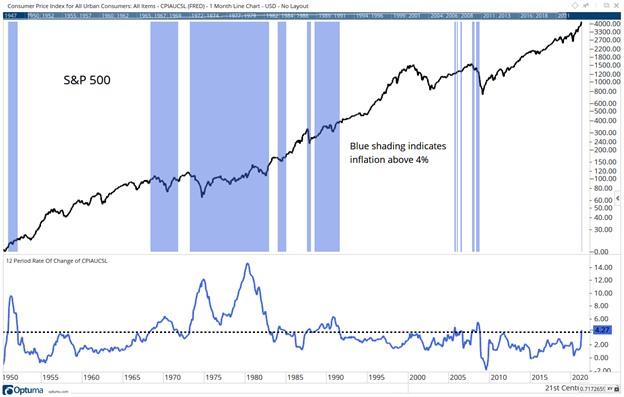

The most recent data showed inflation of 4.2% compared to a year ago. In the past, Consumer Price Index (CPI) readings above 4% have been associated with weak stock market returns. This is shown in the chart below.

4% Inflation Has Been Associated With Weak Stock Market

Source: Optuma.

Short-Term Inflation Can Have Long-Term Effects

Since 1950, the S&P 500 has delivered the majority of its returns in low inflation environments. According to The Wall Street Journal, 89% of the time, the S&P 500 has been lower three months after inflation topped 4%.

The chart highlights that in the longer term, trading ranges have often followed the initial decline. The high inflation of the 1970s and 1980s was one of the most challenging environments in history for investors.

This makes the recent spike in prices alarming. Government officials insist that higher prices are the result of reopening the economy. They ignore the fact that there is no precedent for reopening an economy after a shutdown, so there is no way to know if inflation is transitory.

Price hikes may remain in place for many items. No one, for example, expects that companies in the consumer goods sector will reduce the prices they increased in recent weeks.

On the commodities side of inflation, recent gains may not be reversed. Higher lumber prices will have a long-lasting effect on home prices since comparable home sales affect the prices of homes sold in the future.

Higher wages are also unlikely to be reversed. As large and small businesses continue to raise wages, they increase the likelihood that additional price increases are on the way.

The future looks to be inflationary. The past says that’s bad news for investors.

Is this stupid … or brilliant?

I found a way to trade the markets making the same trade every week.

We do this because any given week, this trade can knock it out of the freaking park.

I recommended 59 of these trades last year. We saw five trades go up 100% or more — each in a week or less.

And a total of 18 went up 50% or more — in an average of two days each.

All told, someone could have doubled every dollar they invested last year trading this way.

I want to give you the same chance.

P.S. I’ve been telling my readers that someone could double their money in a year with this. By the end of 2020, I proved that to be true. My “One Trade” strategy has never had a losing year across 12 years of back testing. And last year’s live results were even better. Click here to see how it all works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.