A year ago, my wife and I made two crucial decisions:

- Reduce the number of cars in our household from two to one.

- Buy a new car that will last.

The first decision was easy … we sold the two vehicles we had.

The second … not so much.

Living in South Florida, there are tons of electric vehicles (EVs) and hybrids on the road, so we contemplated getting one ourselves.

However, the cost and the lack of charging stations quickly made this option a no-go.

Instead, we went with a model we had previously purchased — a Dodge Charger. It was nice to return to something familiar.

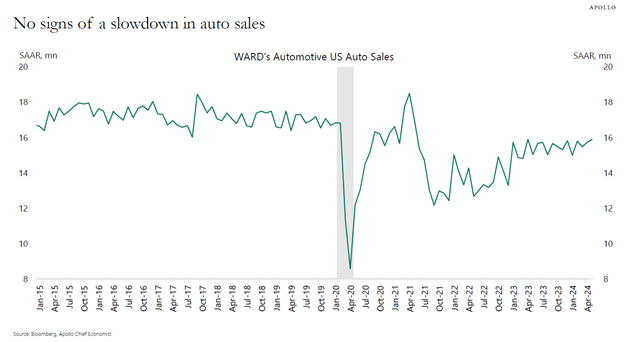

We weren’t alone in the car-buying process, as U.S. auto sales picked up last year.

In looking at auto sales data, I spotted a trend that is not-so-great news for a popular automaker.

Today, I’ll show you that trend and dive deeper into what it means for that manufacturer’s stock.

Auto Sales Are Up, EV Market Share Is Down

The first quarter of 2024 saw a boom in auto sales despite higher interest rates on auto loans.

For the first three months of the year, new vehicle sales in the U.S. jumped 5.1%.

While that sounds like great news for most automakers, the data reveals a less rosy story for one segment.

The market share of EV sales dropped in the first quarter.

According to Kelley Blue Book and Cox Automotive, EV share of total new-vehicle sales was 7.3% in the first three months — a drop from 8.3% in the previous quarter.

Total EV sales were up 2.6% on a year-over-year basis but fell 15% quarter over quarter.

What’s even more telling is the world’s largest EV maker, Tesla Inc. (Nasdaq: TSLA), has seen its U.S. EV market share drop from 75% in 2022 to just 52% as of the end of March.

With Tesla in the news this week, it’s a good time to see how TSLA stock has fared over the years in Adam O’Dell’s Green Zone Power Ratings system … and what it tells us now.

TSLA Stock’s Ratings Journey

Tesla is in the news this week as shareholders prepare to vote on CEO Elon Musk’s $56 billion pay package on Thursday.

The Delaware Chancery Court previously ruled the pay deal “unconstitutional,” but shareholders hope to correct flaws in the arrangement made six years ago … when the deal was originally approved.

Another reason for the vote is to get Musk’s focus back on Tesla and not on any of the five other companies he either owns or has a huge stake in.

If you follow Green Zone Power Ratings, you’ve had a heads-up on Tesla’s stock prospects for a while now…

TSLA “Bearish” In Green Zone Power Ratings

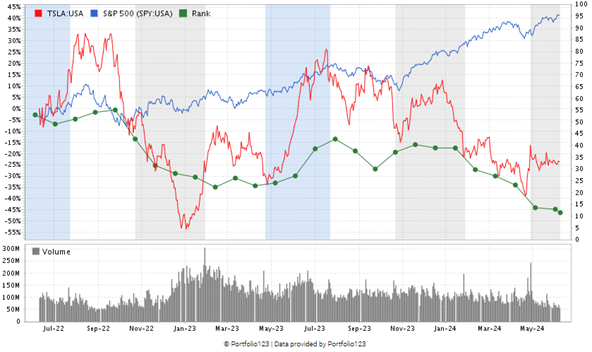

TSLA moved from “Neutral” to “Bearish” on October 24, 2022 … and has remained there ever since.

A “Bearish” or “High-Risk” outlook on a stock means we expect that stock to underperform the broader market over the next 12 months.

And TSLA certainly lived up to that…

Despite some massive price swings higher at times, TSLA stock (the green line in the chart above) has dropped more than 17% in value since hitting that “Bearish” mark in October 2022.

The S&P 500 (the red line), on the other hand, has surged up more than 42% over the same time.

If you owned TSLA stock and sold it when our system flashed a “Bearish” signal, you would have saved not only money but also a lot of headaches.

Bottom line: Tesla remains the largest seller of EVs in the world, but the market has hit a rough patch. Dwindling demand is hurting Tesla’s bottom line.

In addition, companies like Ford, Hyundai, Mercedes, General Motors, Volkswagen and others are chipping away at that market share.

Smaller companies like Rivian and Lucid are also cutting into Tesla’s sales.

While you might want to buy a Tesla for the road, our Green Zone Power Ratings system says this stock is hands-off for your portfolio.

Go ahead and try looking up a few other stocks yourself. Just go here, type in a company name or ticker and get that stock’s rating breakdown in a snap!

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets